Hack:

Adopt natural system principles to keep economies profitable at their limits

A good goal for growth would be to end at a stable peak of vitality providing a sound capital endowment for life on earth. That would be better than ending at a peak of exhaustion, like other "tower of Babel" societies of the past such as Rome and the Mayans.

This surprising approach to economic change is based on discoveries in complex systems physics. They help you make observations for explaining why uncontrolled natural systems all begin with explosions of new organization and "fossil" energy use, and then need to change form in response to changing their own environment. Part of what people have not noticed about our economic system is that it has always had "a secret life of its own", as an uncontrolled natural system. Growth systems in nature are spontaneous construction processes, not equations. As systems they work by a "bootstrap" method for “using the system to build the system”.

Our conceptual challenge can be illustrated with the usual "Petri dish" idea of growth limits. For yeast cells doubling in number every hour, the space on a Petri dish would be only half occupied an hour before it is exhausted. The main difference between that and an economy is that yeast cells stop growing then. In a real economy that expanded to limits, the strong competitors then keep growing, and do so by taking resources from others and so creating growing conflict as a symptom of limits. There is a specific reason why that very visible effect has not been noticed. People have been thinking of the economy as a conceptual model, rather than as the behavior of an environment full of individually motivated and learning parts. A conceptual model doesn't change when conditions do. In contrast, what individuals are learning about their inter-relationships can changes dramatically, often with no warning at all.

How natural systems survive their initial "growth in a Petri dish" without running into crippling conflict is responding in time, by "maturing". One easily recognizes the natural maturation response at the end of growth in how plants or animals first grow with a burst of development and then mature, but also in how small businesses and most anyone's career also does. Maturing involves the growth process changing its focus, from internal development to external relationships. Such systems first build things for expanding themselves and then to secure their environments and develop relationships. That allows them to sustain their peak performance as they approach limits. Otherwise they'd waste their efforts on ineffective strategies, creating costly conflicts and exhausting their resources leading to decline.

Among other surprising things about this approach is that the economics for it originated with the observations of J.M. Keynes. He found that according to his growth model, financial investments would need to work more like endowments than for multiplying capital, or businesses could not remain profitable at such time as growth of the whole ran into natural diminishing marginal returns. In Chapter 16 of The General Theory he indicated he thought that condition, of growth producing more costs than profits for the whole, would not be at all difficult to achieve. Today we certainly see the looming costs of unsustainable development actually overtaking the long term profits, but those symptoms don’t fit the old model. They are treated as “externalities”, just “left over data” with no place to fit because the models omit that kind of variable.

So this proposal is to sketch out "where to start" and "how to proceed" toward an intentional economic transition to following "nature's plan" and learn to mature. We'd work from where we are to perfect the economy's design for endless creativity, to make it sustainable and for its wealth to last. The plan doesn’t define an outcome, but a learning process for moving in that direction, by learning about and from our environment.

The first step would be to get some support and initiate two learning processes. Each would need the production of educational materials and assistance for developing learning networks. One network would be aimed at the expert community, of business, professional and government planners and managers. They'd need to discover how to adapt the systems they manage to follow natural system principles. The other network would be designed to serve other communities and interests. That includes people needing to understand what the changes occurring mean to them, and to learn to observe how their own environments work and understand their own changing opportunities. Serving those needs would contribute to the widespread efforts of self-help communities solving their own problems.

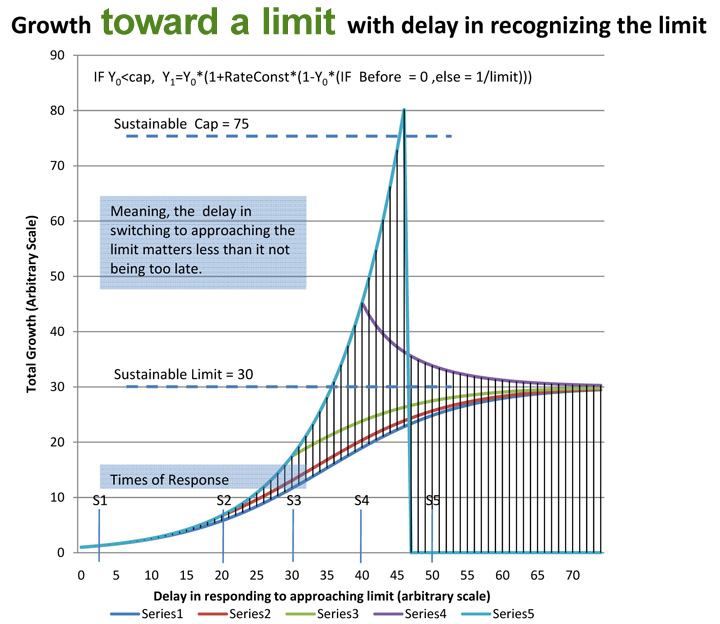

The "core curriculum" is learning to observe changing organization, large and small scale, in your own environment, and discover why it always begins and ends with complex animated processes (¸¸.·´ ¯ `·.¸¸) . For example, one can notice for large and small storms alike, there is usually a "calm before the storm" and then things erupt with their full force. If you find useful leverage for changing them, this approach also helps you see what else your intervention would affect. You gage the timing and expectations in relation to any system's natural rates of learning, historically ~3.5%/yr for economies (see "Timed Response" image).

The necessity for changing our uses of money comes from money being a token for physically delivered goods and services. When delivering those goods and services is pressing the earth's physical limits, there are just two ways to stop money from growing to relieve it. Financial failures reduce the growth of the whole economy's physical demands. When people spend their financial profits on good works it also does, with the added advantage when spent as for endowments instead of to compound profits, of doing a lot of good. It's a natural relief valve for the economy's growing physical demands that can be used to keep the economy profitable at limits to growth.

Keynes really tried to explain it repeatedly, in conversation, in his Treaties on Money and in The General Theory. His effort to raise the subject did not get far because relieving economic bubbles of excess demand that way contradicts the main purpose of most money managers. The only economist I know of who understood what it meant was Ken Boulding, who also raised the issue over and over and didn't get very far. It seems we now have little option but to adapt some form of it, given the consistent 40 years of failure of all good efforts to change the data on accelerating resource depletion and need for expensive mitigations coming in.

You might reasonably respond to this with the profound thought "The impossible will still be impossible!",… or something. You might then also study the realities a bit are realize it will only require tipping a balance of recognition to set off a cascade of endorsements for this kind of approach. The pressures mounting for something to break are becoming very intense. People who understand it might well find it easy to prefer not to do business with people who prefer to deny it, too.

What would happen is small networks of both institutional and private innovators would emerge, and probably work together quietly just getting a grip on the problem. The initial implementation would likely come at a moment of tremendous economic strain, like we’re approaching.

The effect would be experienced as a tremendous relief, as it became clear that the mountains of unearned income would not vanish in a financial collapse (as usual), but would be steadily turned back into earned income and profits again. On realizing that shift the financial markets would discover the windowless dead end they had just been facing would more or less suddenly vanish, as they realized there would actually be a future after all.

___

It would also represent a change in form for our economic system, while still being the very same economy with the same people and rights, and reliance on creative innovation funded by investors. By giving profits an end purpose, of caring for things rather than just for multiplying profits, it woud give the whole economy a very different purpose. So, it can also be thought of as a change of "ism's".

It's to change the use of our ability to control things, to care for them. So we'd need to change our systematic habit of using the profits from controlling things to multiply our control, to instead care for them. Choosing to not make the change would turn us into one of those societies of good people that work together for truly evil purposes, that no individual would want to have anything to do with.

Dispassionately, one would have to say that devoting ourselves to cooperatively exhausting everything on earth useful to people would be as truly an evil thing as there is, a violation of everything we would want to stand for. But it's the natural goal and purpose inherent in maximizing capital investment as a way of life. It also fits the evidence for how dozens of historic vanished human societies achieved remrakable greatness and mysteriously vanished. With "efficiency of growth" being the core principle of institutional "sustainability" today, it's also clearly what today's human society with all its marvelous achievements is now proceeding to do, and to work energyetically together to accomplish.

Changing from organizing our economy around expansion (using profit for multiplying capital) to caring for what we built and our world (using profit to improve the quality and uses of capital) a change from "capitalism" to "fidelity", remaining true to ones purposes rather than just investing in what's addictive. If financial investments need to eventually all be used to endow other things it would replace using the profits of capital to multiply capital. The main source of financial capital would then be the savings from creative labor, still invested to maximize returns, but for serving as a reserve and endowment for greater values such as economic sustainability and healing the earth, rather than just for self-inflation.

I tend to find that successful new directions of change are ones that have already begun, and only need to be recognized, and built upon with complementary additions. The need for fundamental global change has never been felt more strongly or widely, for example. It’s partly because lots of people seem to see the pressures will keep building till something breaks. The idea of having investor earnings returned to them to spend as endowments rather than reinvested, causing a soft landing for growth, seems almost completely missing from the "alternative" literature. So this proposal seems to be "a long shot". It "doesn't fit the rules". It's also being presented to intellectual communities who are experts at following the rules that this proposal mostly doesn’t fit. So it’s likely to not to be understood.

People also sometimes think for themselves, though. The recognition that nature is a physical system with organic parts, wrapped around a planet, seems to have been crystallized in the imagination again and again recently, only to be pushed aside again and again too. Today we also see signs of that imagination what we need accumulating, along with an awareness of just how important that vision is. People are extremely well informed about events, and it seems virtually everyone intuitively senses the converging crises confronting mankind from every direction. People can also plainly see how different social and professional groups define reality in completely different ways, while also all clearly living in the very same natural world too. All that might possibly break in the right direction.

The proposal is largely an individual creative synthesis from innumerable sources, with contributions and moral support from teachers, books, correspondents, family and friends.

My main influences on creative economic thinking have been Ken Boulding and my father, Clement Henshaw (who taught physics as recognizing natural principles from observation) and the "alternative" social networks interested in change and appropriate technology. Other pivotal thinkers for me (in no special order) were Jane Jacobs, J.M. Keynes, Robert Rosen, Walter Elsasser, Stanley Jevons, Jay Gould, Howard Odum, Margaret Mead, Louis Kahn, Bucky Fuller, Christopher Alexander, D'arcy Thompson, Lester Brown, Colin Renfrew, Rudolph Geiger, Lester Brown, Gerald Midgley, Paul Colinvaux, Joe Tainter, Tim Allen, Ricardo Hausmann and correspondents Stan Salthe, John Blackmore, Robt. Ulanowitz, Charlie Hall, John Fullerton and a great many others.

A good paper, thanks. You may be interested in biomimicry (cf. for instance http://www.paristechreview.com/2012/04/23/biomimicry/)

- Log in to post comments

Requests for details are quite welcome. See the link to "Questions from Bill Rees" for some. The proposal opens up a vast subject, and seems important to first understand as a concept, for then thinking through the details when applying it in a variety of circumstances. Jessie

- Log in to post comments

You need to register in order to submit a comment.