Hack:

Virtual Ocean Strategy(VOS) driven CapitalismPlus – Reimagining Capitalism as a 5 Dimensional Market System with a 5M Mindset and 3V Heartbeat!

The Invisible Hand’s Purpose Seed, manifesting itself as a 5D Market system with a 5M (Meta Events, Means, Metrics, Method & Mediation) mindset, yielding Triune Shared Value (Shareholder+ Societal + Purpose Driven Motivation/emotion/cultural value)

While "Capitalism” is practiced differently, in different parts of the world, most economists, by and large agree, that Capitalism, in its current form, is not only, being perceived, to be favoring the top 1% of the population , but also, is being insufficiently designed to handle (and withstand) another financial meltdown, of scale and magnitude, as that of 2008-10 time frame. While perceptions sometimes could be misleading, our root cause analysis suggests that some of these perceptions stem from both the strategic and structural foundations of capitalism itself, and so, we decided to dive deeper.

First, let’s start with the strategic lens – and the key root causes, include, but not limited to are -

- Capitalism, in its current form, is primarily practiced as a single dimensional market system with a tangible equity capital mindset, without paying too much of credence to the other intangible forms of capitals (purpose, human, Intermediate Goods and Product capital), as explained in detail in latter sections).

- Capitalism, in its current form, has no standardized causal chain mechanisms established between the tangible market capital value and the intangible market capitals (also called as the intangible “expectation building abilities”), that drive the overall market capital values.

- Capitalism, in its current form, by and large, is practiced as a “trading value” type mechanism, as opposed to creating value fresh, with a purpose driven motivational mechanism that not only increases the size of the value pie, but also, helps all the sections of the society to equitably enjoy value.In other words, capitalism in its current form is a system that trades values, purely based on market’s “shareholder value driven expectation building abilities”, and not based on, a profound sound principle!

The implication from the strategic lens is that capital markets, either over reacts to those “expectation building abilities” in the form of higher stock prices, or in some cases, under react (or some might suggest punish) with lower prices – purely based on the way, it interprets the causal relationship between the market value and the “expectation building abilities”. As it turns out, this causality interpretation gap seems to be the single most important factor, driving company executives and investors, to get into this game of trading value, as opposed to creating them fresh, says Roger Martin.

Similarly, when we look at it from the structural lens, it became all the more evident that Capitalism, in its current form has

- Insufficient, in-built resistance mechanisms, to effectively manage the expected (e.g. capital inflow risks, highly leveraged trade/lending risks, banks’ inflated balanced sheets, fancy financial instruments etc) & unexpected events (natural disaster, terrorism etc) that primarily led to the financial meltdowns of 2008-10 time frame.

- Ineffective mediating policies from government and other political policy making institutions (and other regulating agencies), in managing these events.

- Ineffective, inside-out, purpose driven motivational mechanisms to enable all citizens to equitably enjoy the value from the positive value accelerators of capitalism.

- Ineffective inside-out, purpose driven motivational mechanisms to enable all citizens to equitably bear value (impact?) from the negative value decelerators of Capitalism.

- Lack of an agreed upon “sense of purpose” on the part of the “invisible hand” to sustain it for the long haul, which raises an interesting point - what ought to be the motto of the “invisible hand” in shaping the 21st century Capitalism?

Speaking of the motto of the invisible hand, it is our view that the, invisible hand has to figure out a way, to master the art and science of balancing 21st Century’s #1 economic dilemma of productivity & inequality, in 3 unique steps (delinearize, decouple &democratize), as we have attempted within our larger Virtual Ocean Strategy (VOS) driven VizPlanet platform. Turns out, we had handled it in the form of 25 tweet cluster and so, let me summarize it here, before diving deeper into the Capitalism's structure part.

1. With resources happen to be the weakest link of our planet earth, a key implication is, there are simply not enough resources available, to support 10B population, 30+ years from now.

2. Turns out, most resource constraint solutions today, are discipline focused myopic solutions, that end up negating the impact of each other only.

3. A classic example of discipline focused myopic solution being: The increased productivity(tech discipline),causing the inequality(economics discipline).

4. Turns out, tech productivity, ends up growing the economic value pie, by growing wealth of top1%,at the expense of the income of 99%,thus causing inequality.

5. While regulatory solutions like wealth tax&employment insurance can mitigate the inequality gap in the near term, they’re not sustainable at all.

6. With tech productivity happens to grow the wealth of top 1%, at the expense of the income of 99%, is’nt it time to reframe disciplines, using their roots, from where they came from in the first place? http://thenexteinstein.com/idea/display/reframe-every-discipline-using-e...

7. So, here’s VOS’ one such discipline neutral hypothesis: The #1 21C economic challenge is, solving the dilemma b/w productivity & inequality, sustainably.

8. VOS’ answer is 3 fold: Dilinearize economy as circular, with zero waste, decouple its size from constraints&democratize elite infinite human capital across masses.

9. Step1:Delinearize the linear economy as circular with 5 value stations(or capitals) and restore/multiplex value, with zero leakage driven 5R+5M patterns.

10. Step2:Decouple economy’s size from its constraints, by adding the infinite human capital to the restored/multiplexed value&make value pie size infinity, as well.

11. Step3:Democratize the restored/multiplexed value, among masses, by creatively combining the phy&virt resources using VOS’ #VizPlanet platform.

12. Explanation: VOS’ value travels thru 4 value stations(purpose,human,intermediate P&S and P&S Capital),b4 becoming Fin Capital as explained in later sections.

13. While Fin Capital is restored as human Cap, the rest (P&S capitals) are mostly consumed linear, with a big waste &so, time to make it 100% circular?

14. When economy is imagined as circular, its size is proportional to % of resources, that are restored back into the economic cycle, by minimizing waste.

15. Simply put,VOS’ economic value is proportional to HOW MUCH(S dim)&HOW MANY TIMES(T dim),P&Ss and resources are restored back into its economic cycle.

16. When resources are restored as products, #VOS’s restoration cycle follows a 5R pattern (Refresh, Refurbish, Recycle, Repurpose, Revive)

17. When resources are restored as services,VOS follows a 5M pattern(Pure play Muxing,Time slice Muxing, Freq Muxing, Wavy Muxing & Multiplication).

18. Despite how much&how many times, resources are restored, after certain iterations, restoration/multiplexing capabilities(productivity) have their limits.

19. Simply put, as long as, restoration/multiplexing happens at a household level(given any time),P&S usage, still going to be linearly constrained.

20. Put otherwise, as long as P&Ss are restored/multiplexed only in TIME dimension, it’s still going to grow value, with an ADDITION based productivity only.

21. What if, we restore P&Ss in both T&S dimensions, with AI/robotics/telemetry/VRE interfaces& multiplex/restore/democratize value exponentially?

22. Won’t such restored/multiplexed productivity value of P&Ss (in both T&S dims), democratize value among masses, with a MULT effect&reduce inequality?

23. However, such restorative/multiplexed productivity,today,is achieved,only by the elite 1%, because of their superior skills(&so accumulates their wealth ),causing the inequality.

24. This is where,#VizPlanet,has a compelling answer to this dilemma, as it not only restores/multiplexes value, but also, democratizes the restored/multiplexed value of the elite, among masses.

25. Final summary synthesis: A discipline neutral #VizPlanet platform,that restores/multiplexes/democratizes the elite infinite human capital among masses, is the answer for 21C’s productivity/inequality dilemma http://thenexteinstein.com/idea/display/reframe-every-discipline-using-e...

Yet another implication from the structural lens is that Capitalism in its current form, may not be able to withstand another financial meltdown, of the scale and magnitude, as that of 2008-10 time frame - unless we augment it with a fundamentally patient and socially accountable, next generation approach, by addressing these root causes, in both strategy and structure dimensions.

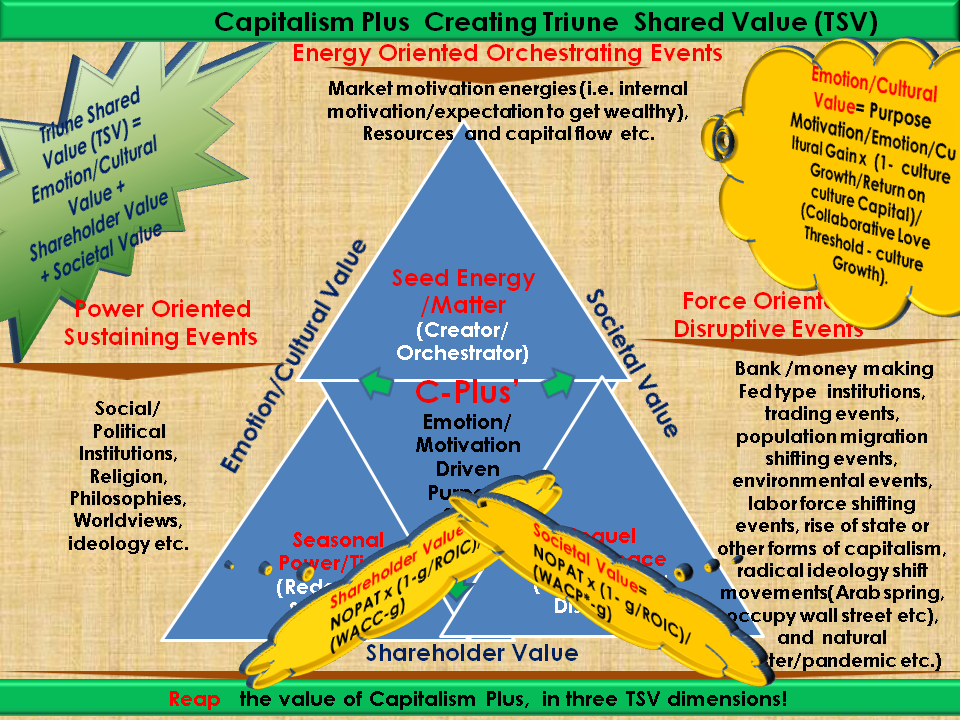

As we further analyze at these strategic and structural complications (and the implications), with a 21st century sustainability lens, it become all the more clear that the need of the hour is a profoundly principled, fundamentally patient and socially accountable capitalism, to meet the ever changing business needs of the social media driven, digitally connected, resource constrained, 21st century world - as echoed by Gary Hamel in his MIX challenge! Rightfully so, we have developed a next generation approach called Capitalism Plus, wherein, every citizens are, not only, encouraged to participate in the Capitalism journey, by planting their “purpose driven motivational energy seed”, using nature’s profound seedal chain principle, but also, must nurture it, so that it can germinate into a five dimensional value market system (Purpose Market, Labor/Human Market, Intermediate Goods Market, Product Market and Equity Market) with a fundamentally patient ,5M seasonality mindset (Meta market events, Means, Method, Metrics and Mediation) – yielding a socially accountable Triune Shared Value Portfolio(Shareholder, Societal and emotional/cultural value)!

The thing that really differentiates CPLUS from other approaches, is that - it is the only approach that is sourced from a common MOTIVATIONAL ENERGY BASED PURPOSE SEED, governed by nature’s profound “SEEDAL CHAIN PRINCIPLE”, from where, the 5 dimensional market systems are being birthed, to yield its three dimensional, value portfolio harvest (i.e. one inside out emotional/cultural energy value balancing the reaming two outside-in shareholder and societal values), which makes it sustainable for the long haul. In other words, CPLUS is the only five dimensional market system that is sourced from an “inside-out” purpose driven motivational/emotional energy source called PURPOSE SEED, delivering values in Share holder, societal and emotional/cultural value dimensions!

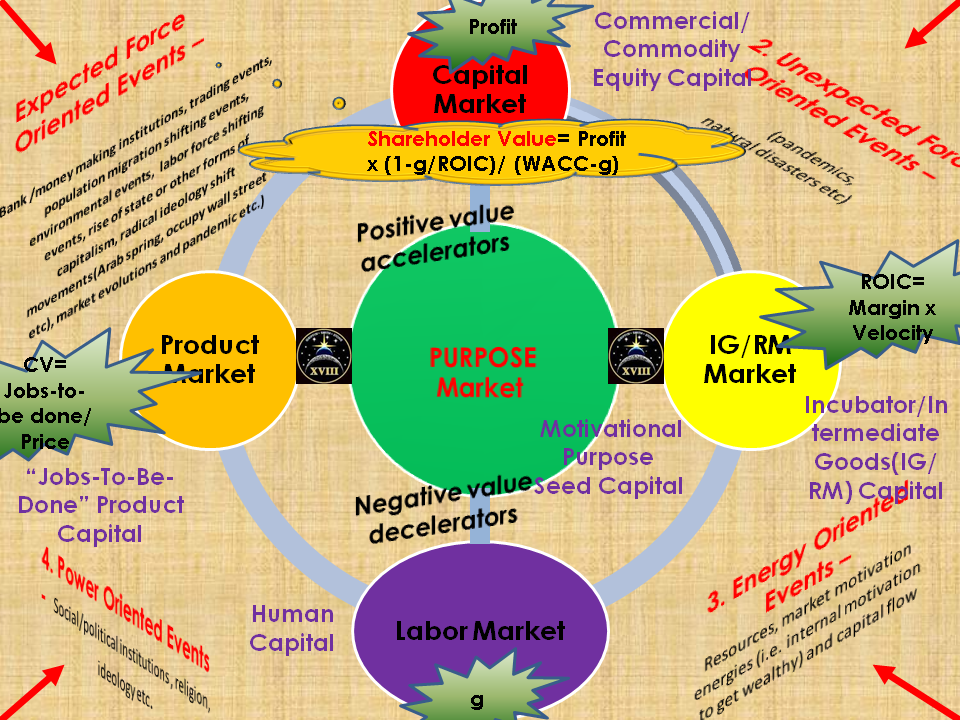

How do all the moving parts come together under Capitalism Plus?

As outlined in the picture, It all starts with the Motivational Purpose energy seed, transforming itself into an inside-out emotional/motivational energy capital called purpose capital, that gets traded within the central purpose market, which then gets exchanged in the form of Intellectual/Emotional/Cultural Capital(IC+EC+CC) within the labor market, as a human capital. This is when the human capital resources, start generating creative ideas and solutions needed for the intermediate goods (IG) capital, that is traded within the IG market. While IG market is all about promoting the intermediate incubator value to the external world, Product market, on the other hand, trades the finished Product Capital (i.e. jobs to be done), which then ultimately, gets traded in the form of investment capital within Capital Market – all linked together by a causal chain relationship among them and anchored by the central purpose market in the middle, delivering value in three forms (Share holder, societal and emotional/cultural energy value).

In other words, Capitalism plus, in its essence is a purpose driven, three dimensional value balancing market system (i.e. the “inside-out” motivational/emotional energy value balancing the remaining two “outside-in” stakeholder and societal value energies) using a 5 dimensional market system, with a collaborative 5M (Meta events, Means, Mechanism, Methods and Metrics) mindset.

Some of the execution configuration options include, but not limited to are: tightly coupled weight factor rating, loosely coupled weight factor rating, reverse fixed weight factor allocation (i.e. pre-determined weight factor during IPO), reverse variable weight factor allocation (dynamic weight factor on a day to day basis based on social media/analyst rating) and Transparent Internal company metrics driven weight allocation model – as explained in detail in the solution section.

For better visual display, please feel free to check out the slide share version of our Capitalism Plus hack as well.

Our quest for the next generation capitalism approach came down to answering the key question -

“Is Capitalism, in its current form, sustainable when it comes to meeting the challenges of the 21st century?

In other words, it all comes down to answering the following five corollaries -

- Is it anchored and revolving around a profound purpose driven seedal chain principle?

- Is the Meta market events (expected and unexpected) and resources managed effectively with a fundamentally patient mindset? Are the resources plentiful and robust? Is there enough mitigating resistance/replenishment/recharge mechanisms built into the system to manage the expected and unexpected events?

- Is today’s single dimensional financial market mindset, is good enough to balance value in a socially accountable way, among all the value accelerating and decelerating entities within the value cycle (i.e. Purpose, Labor, Intermediate Goods, Finished Goods, Equity Capital) in a fair and balanced manner?

-

Is positive and negative value accelerating loops balanced with a socially accountable heartbeat?

- Is positive values substantial, visible and the system ensures that those values are equitably enjoyed?

- Is negative value accelerating loops are minimized, managed and equitably borne?

- Are the policies from the mediating political/government institutions and regulating agencies effective in managing and maintaining these conditions? In other words, how do we break away from the single dimensional shareholder value minded exotic financial instrumentalism that has marked the past 25-50 years of capitalism and push towards systemic change. While the politics could end up being off the scale, scaling solutions will require us to embrace, perhaps new forms of politics? Are we prepared for it? If the answer is yes and we equally have the will to change the political construct, how do we position capitalism to succeed within that larger political construct?

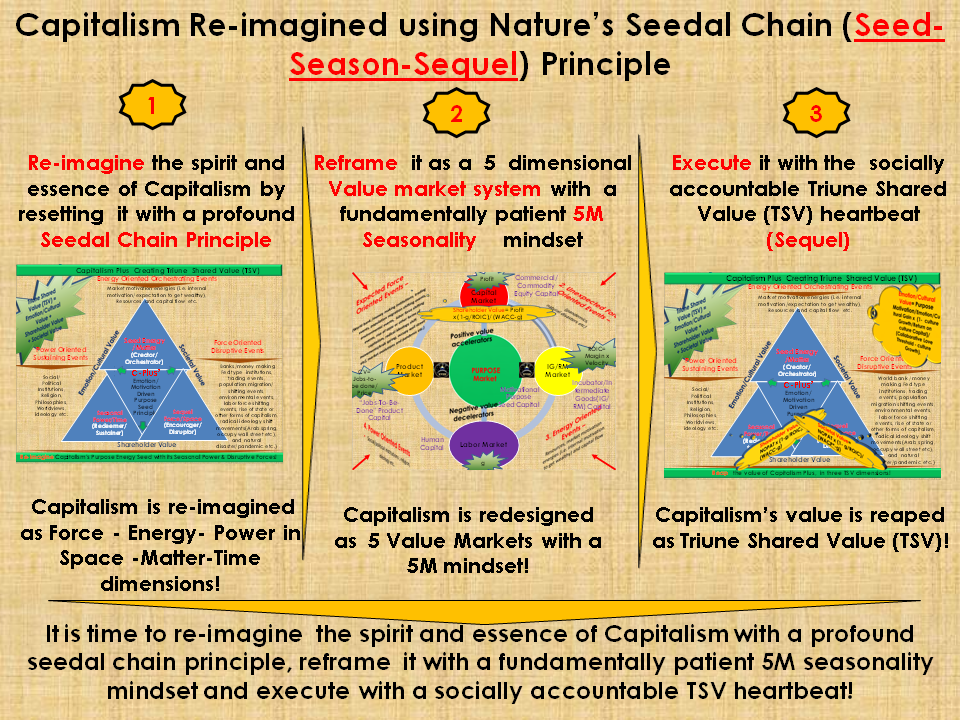

Step 1: Redefining the spirit and essence of Capitalism by resetting it with a profound Seedal Chain Principle

As it turns out, the best way to answer this five part question, is to re-imagine capitalism as a purpose driven Capitalism Plus, in five dimensions, as outlined below -

-

First and foremost, it is all about re-imagining/regrouping the Meta market’s expected and unexpected events in Force, Energy and Power dimensions (or space-matter-time dimensions in a larger universal context) using nature’s energy management principle, to help design the right type of resistance mechanism for the right type of event. In other words, one of the lessons learned from the 2008 financial meltdown crisis, among many, is that the capital markets, in the larger context, did not have the right type of in-built resistance/replenishment/recharge type automatically triggered mitigating mechanism for the right type of event. In other words,

-

Energy oriented events to be handled with matter dimension based proactive efficient replenishment mindset

- Market motivation energies (i.e. internal motivation to get prosperous etc) and tangible and intangible capital resources including the natural resources etc, need to be handled by an in-built recharge mechanisms to replenish them.

-

Forceoriented events to be handled with Space/distance dimension based proactive resistance mindset i.e. (note : Force=Energy/distance)

- Expected events or manmade events like bank/trade risk migration, environment sustainability risks, state and health of labor force, rise of state capitalism, radical movement, evolution and pandemic etc need to be handled with sufficient elastic cushion space to re type resistance mechanism to bounce back from the impact.

- Unexpected event or Messiah made unexpected events (pandemics, natural etc) also need to have a similar elasticity, but then must have plan B type alternate path of execution to bounce back quickly.

-

Power oriented events, to be handled with time dimension based proactive effective channeling mindset. (note : Power=Energy/Time)

- Policies from Social/political institutions, religion, ideology etc. need to have a timely lever to channel/control its dosages and its impact on the system.

-

Energy oriented events to be handled with matter dimension based proactive efficient replenishment mindset

- Reimagining the means - i.e. from the current shareholder value focused multiples method at the ticker level and GDPat the country levelto a three dimensional Triune Shared value(TSV) mindset i.e. Stakeholder value +Societal Value+ Emotional/Cultural value

- Reimagining the method i.e. from single dimensional capital market system to a five market system with a causal chain among them.

- Reimagining the metrics with three dimensional TSV value formulas that are manifested in 5 different intermediate forms within each of the five market systems.

- Reimagining Mediation as self regulated mechanism using “inside-out” emotional/cultural motivational energy driven ethical mindset, with minimal government involvement.

Step 2: Redesign it as a 5 dimensional Value market system with a fundamentally patient 5M Seasonality Mindset

Let’s face it - the true value of any market system, is primarily driven by its equity prices, which in its essence is the summation of its “future cash flow value” and its linkage to “future expectation building abilities” discounted by today’s cost of capital. While there are quite a few valuation models (e.g. McKinsey’s Zen of corporate Finance formula, multiples method, DCF, NPV, IRR) available, to accurately quantify the cash flow value of the individual assets and its cumulated value, there are not many proven models available, to accurately establish the causal chain relationship between the “tangible cash flow driven capital value” and intangible “expectation building abilities” - and so, stock markets, often follow the tread mill effect of trading on misinformed causal chains and mismatched expectations.

Part of the reason for that behavior is that, the so called “causal chains” within the “expectation building abilities” are often hidden within the “intangible” value creating capitals of the economy (i.e. Purpose, human, Intermediate Goods and Product capital, per our Cplus design) and so, they are not well understood by the capital markets, within its right context, especially when it comes to the causal chain relationship among them. “Causal chain relationship among the expectation building abilities” in this context, all comes down to answering the following question –

- What events cause or trigger the motivational purpose energy (or vision or a dream) to go through the 3 intermediate value creating steps in the forms of capital of CPLUS (i.e. human, Intermediate Goods, Products) and how, before transforming itself into an equity capital?

All said than done, the challenging part of answering this question is that those three value creating steps (or causes) that happen within the four walls of the company, are not usually visible to the larger capital market, where the corporation's stock is traded. This is the primary reason, Capital markets, by and large, trade on the “Expectation building abilities”, that are derived from the earning guidance, product portfolio pipeline for the next 5 years, share repurchase program schedules/dividend payout, management changes and other big ticket capital expenditures - provided by company executives on an ongoing basis.

Trading Value vs. Creating Value – Another big challenge of Capitalism, in its current form

The implication is that equity markets, either over react to those “expectation building abilities” in the form of higher stock prices, or in some cases, under react (or some might suggest punish) with lower prices – purely based on the way, it interprets the causal relationship between the cash flow value and the “expectation building abilities”. As it turns out, this causality interpretation gap seems to be the single most important factor, driving many company executives and investors, within the current form of capitalism to get into this game of trading value, as opposed to creating them fresh, says Roger Martin.

What do we mean? From investor’s standpoint – while quantifying cash flow is important in making the near term investment decisions, interpreting the causal relationship accurately, is key for them to bet on a stock for the long haul. Similarly, from company’s leadership standpoint – while quantifying cash flow value is critical for making effective near term operating decisions (i.e. achieving Q-To-Q results), framing the causal relationship among their value capitals and its “expectation building abilities” accurately, in the form of earning guidance statements, is very important to manage the expectations of their investor community and to stay focused on their long term strategic choices.

As it turns out, this causality gap between “expectation building abilities” (i.e. value that are buried within the intangible capitals like purpose, labor, IG, product capitals) and “cash flow based fully realized equity capital value” seems to another big hurdle faced by the capital markets today, apart from the insufficient resistance/replenishment/recharge mechanism that were identified as part of the Meta market events section.

And so, if we had to dissect the components of value life cycle of a firm -

- Invisible value of discovering the unmet “Jobs to be done” value + Invisible idea/vision seed value +invisible incubator value + commercialization value(when there is no alternative product available) + commoditization value (when alternate products are available with heavy competition)

If we look at this equation, interestingly enough, they map 1:1 to the five markets within the Capitalism Plus’s five market structure. Yet another interesting insight here is that- it also reiterates our earlier point that stock prices are often decided based on the commercialization and commoditization value components (i.e. equity market ), partly because, market does not have visibility to the unrealized invisible values of the early capital life cycles(i.e. remaining for capitals), the primary driver behind those expectation building abilities.

Five market system comes to life within Capitalism Plus framework

The question is how these five types of capitals within the five dimensional market system fit together? It all starts with the Purpose seed, transforming itself into an inside-out emotional/motivational energy capital called purpose capital, that is traded within the central purpose market, which then is exchanged in the form of Intellectual/Emotional/Cultural Capital(C+EC+CC) within the labor market as a human capital. This is when the human capital resources, start generating the creative ideas and solutions needed for the intermediate goods (IG) capital, that is traded within the IG market. While IG market is all about promoting the intermediate incubator value to the external world, Product market, on the other hand, trades the finished Product Capital (i.e. jobs to be done), which then ultimately gets traded in the form of investment capital within Capital – all linked together by a causal chain relationship and anchored by the central purpose market in the middle, delivering value in three forms (Share holder, societal and emotional/cultural value) – as outlined in the picture below.

Interestingly enough – this five types of capitals map 1:1 to five markets - suggesting the need for four additional virtual markets on top of the equity capital exchange ( i.e. primarily cash flow value driven)– and link them all together with causality - as outlined in the picture above and explained in detail in our firm’s Purpose driven strategic planning framework (http://www.managementexchange.com/story/strategic-planning-purpose-driven-way-using-nature%E2%80%99s-seedal-chain-principle)

- Purpose equity capital exchange model ,based on the formula -> Purpose value= Profit x (1-g/ROIC)/ (WACP-g)

- Human capital equity exchange, based on human capital growth, per one of my recent hack at MIX site (http://www.managementexchange.com/hack/reforming-performance-management-systems-%E2%80%93-virtual-purpose-equity-vizpity%C2%A9-exchange-way)

- Intermediate Goods Market or Value chain equity exchange based on the formula ->ROIC= Margin x Velocity

- Product Market or customer “Job to be done” exchange, based on the formula -> Consumer/customer value=Jobs-to-be done/Price

- Financial capital market which is today’s’ version of capitalism based on the formula ->Share holder value= Profit x (1-g/ROIC)/ (WACC-g)

Providing this type of valuation visibility in these five dimensions, not only will help us to accurately establish the causal relationships, but also, help us to increase the size of the value pie, with our profoundly principled, fundamentally patient and socially accountable approach.

With that said, I hear someone asking - how what does these five markets work together from the “day in the life” standpoint? Here are few possible implementation configurations

- Tightly coupled “weight factor rating” model, where four Intangible Markets (Purpose, Human, Intermediate Goods and Product market) are configured as a public opinion/rating based markets, with direct linkage to the tangible Capital Market. In other words, traders are expected (mandatory) to submit a “weight factor percentage allocation” of their buy price, among the five markets, say (15%-25%-15%-15%-25%) respectively, which would give a clear indication of the motivation behind their trade (i.e. which market among this 5D market is motivating them to invest on this stock). For example, traders who believe in the management and talent of the company will assign more weight to human market, whereas, traders who believe in the purpose/vision of the company will assign more weight for purpose market and so on and so forth.

- Loosely coupled “weight factor rating” model, where four Intangible Market (Purpose, Human, Intermediate Goods and Product market) are configured as a public opinion/rating based markets, with honorary linkage to the tangible Capital Market. In other words, traders are encouraged to submit a “weight factor percentage allocation” of their buy price, among the five markets, say (15%-25%-15%-15%-25%) respectively, which would give a clear indication of the motivation behind the trade (i.e. which market among this 5D market is motivating them to invest on this stock). For example, traders who believe in the management and talent of the company will assign more weight to human market, whereas, traders who believe in the purpose/vision of the company will assign more weight for purpose market and so on and so forth.

- Reverse weight/value allocation model, where we allocate weight to the four intangible market based on a pre-established weight factor distribution, say, (10-30-10-10-50), as decided by the company during the IPO.

- Reverse weight/value allocation model, where we allocate the weight to the four intangible market based on a pre-established weight factor distribution, say, (10-30-10-10-50), as decided by the public opinion/rating on a day to day basis.

- Transparent Internal company metrics driven weight allocation model linked to capital market value (multiples method and/or McKinsey’s Zen valuation formula) using our firm's CPM type system.

Please note that these options all need to be detailed out before it can become a working solution.

Step 3: Execute it with the socially accountable Triune Shared Value (TSV) portfolio heartbeat (Sequel)

While it all sounds great to link these five capitals with a causal chain within the context of this 5 dimensional market structure, one might ask, how do we make sure that they are executed with a socially accountable heartbeat?

Right off the bat, let us reiterate our earlier point that Capitalism plus, in its essence is a purpose driven, three dimensional triune shared value balancing market system (i.e. the “inside-out” motivational/emotional energy value balancing the remaining two “outside-in” stakeholder and societal value energies) using a 5 dimensional market system, with a collaborative 5M (Meta events, Means Mechanism, Methods and Metrics) mindset.

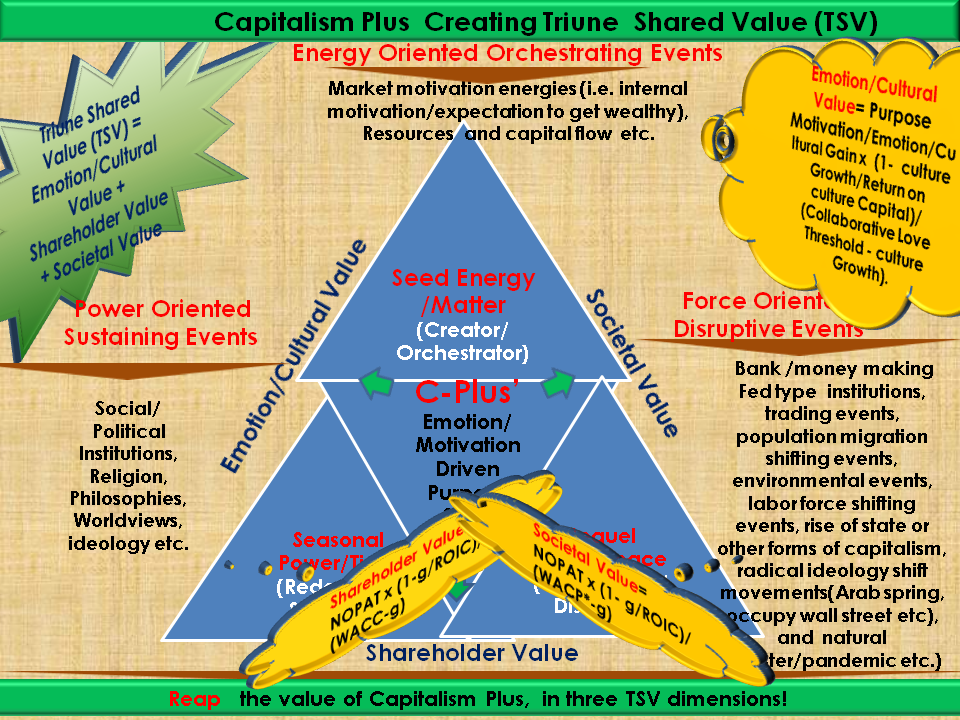

The question is what is this Triune Shared Value?

First things first – let us establish some context before answering our TSV question. If at all one thing we have learned from the CSR programs within large corporations, it is the fact that “pressure politics” driven charity programs have not yielded its intended results, and the primary reason being is, that corporations have not yet figured out a perfect way, to successfully link CSR programs to their Competitive Advantage, says, Professor Michael Porter. Having personally witnessed, how CSR programs are being run within few large corporations, we tend to agree with the Professor, and rightfully so, he is in the process of rebranding the decade old CSR concept, with an integrated approach of linking shareholder value with societal value, using his own flagship concept of Competitive advantage (CA), as CA is the only motivational energy that is capable of compelling corporations and societies to work together to create such shared value. By now, I am sure, most of you would have guessed, what we are talking about – Yes, the buzz word for his new approach is called, Creating Shared Value (CSV).

Outside-in vs. Inside-out energies

With that said, as we started further analyzing the origins of the two outcomes within this CSV (i.e. shareholder value and societal value), it became apparent to us that they both happen to be sourced and manifested as “outside-in “energy motivational sources (shareholder and societal) respectively. As it turns out, outside-in sourced outcomes, in general are not sustainable (per the law of nature), unless they are balanced by one or more of the inside-out energy sources and this is where our purpose capital traded within the purpose market of our 5D market structure fits the bill.

With that said, as we further started analyzing CSV with this emotional energy driven cultural/emotional value lens, we saw a Triune Shared Value (TSV) concept emerging, which by the way, happens to be sourced from our firm’s Virtual Ocean Strategy framework – which makes us to hypothesize – TSV, perhaps is the next wave of CSV?

- CSR = Shareholder value+ Societal value (With no direct linkage to CA)

- CSV = Shareholder value+ Societal value (With direct linkage to CA as defined by Michael Porter)

- TSV = Emotional energy driven cultural value, primarily derived from the purpose capital within Capitalism Plus’s 5 dimensional market structure+ Shareholder value+ Societal value (With direct linkage to SCA)

Leveraging Michael Porter’s CSV definition – we see the following TSV definition emerging – as TSV after all, in its spirit and essence is very similar to CSV, with some minor tweaks -or simply put, TSV is nothing but CSV in steroids!

- TSV is a Purpose Capital driven Motivational/Emotional/Cultural energy value driven policies and practices that enhance and sustain the collaborative competitiveness of a company while simultaneously advancing economic and social conditions in the communities in which it operates - as outlined in the picture below.

With that said, we hear someone bringing up another argument – while it all sounds great to talk about CSV and TSV – but, what counts, at the end of the day is just share holder value – as most valuation formulas are all based on just three key financial ratios of growth, ROIC and cost of capital – as highlighted in one of our earlier articles. While there is a merit in that argument, more and more research is confirming with empirical data, that there is a direct correlation existing among emotional energy driven cultural/emotional value, societal value and shareholder values. The question is how we quantify those correlations, using a financial formula, very much like how share holder value is being quantified using a financial formula.

TSV components expressed as hypothesized financial formulas

Interestingly enough, we had proposed one such correlation in the form of a hypothesis called purpose-profit balanced societal value formula, with a new metric called WACP - which is nothing but a Weighted average of WACC (weighted average cost of capital) and WACP(weighted average cost of purpose in one of our earlier articles (http://strategywithapurpose.blogspot.com/2010/11/purpose-profit-balanced-sustainable.html). Interestingly enough, our hypothesis was recently being validated by Wharton Business School Professor Henisz with his empirical data based findings, as highlighted in his article (http://knowledge.wharton.upenn.edu/article.cfm?articleid=2814#.TieL9eTHQt4.email) - which means our hypothesis was spot on!

- NOPAT x (1-g/ROIC)/ (WACP-g)

Similarly, we had also proposed another Purpose Capital driven cultural/emotional value correlation in the form of a hypothesis called Purpose Capital driven cultural value formula – as Purpose Capital driven cultural value, like share holder value, is just discounting our future heavenly experiences (which happens to be faith & hope driven in most denominations/religions), based on today’s cost of emotional capital (which happens to be love in most denominations/religions), that is expressed using our own version of Zen of Purpose Capital Formula, listed below. In other words, we not only need to grow with a purpose capital mindset, but also, must learn to exercise our purpose capital energies of faith & hope, in a prudent manner, and start applying those energies within the capitalistic society, above and beyond the minimum threshold of collaborative love (or cost of Purpose Capital driven cultural/emotional capital called love), for us to increase our Purpose Capital driven cultural/emotional value.

- Purpose driven cultural/emotional energy value= Purpose Capital driven cultural gain x (1- Purpose Capital driven cultural growth/Return on purpose driven cultural capital)/ (collaborative love threshold-purpose driven cultural growth).

Now that we have a set of hypothesized formulas for societal and purpose capital driven cultural/emotional value components, we see a holistic TSV value equation evolving. Granted, lot more research, with empirical data needs to be done before publishing these formulas as working formulas, however, Professor Heinz’s recent work is the step in the right direction and we are happy to see that his research has validated the underpinnings of our purpose driven societal value formula.

Virtual Ocean Strategy (VOS) to Triune Shared Value (TSV) mapping

With that said, yet another interesting aspect of TSV is that, it happens to be perfectly sourced from our firm’s VOS frameworks on a 1:1 fashion, as we had alluded earlier and shown in the VOS-TSV mapping picture on the top of the page and further reiterated in the following mapping as well.

- VOS’ Purpose Driven Leadership (PDL) Framework -> TSV’s Purpose Capital driven emotion/cultural value

- VOS’ Portfolio-Thread View based Strategic Planning Framework -> TSV’s Shareholder Value

- VOS’ Purpose Innovation Portfolio (PIP)Framework (PIP) -> Societal Value

As we further look at this 1:1 mapping, it is interesting to see that VOS’s SCA equation is the one that happen to bind the VOS and TSV components on a 1:1 fashion. Speaking of our own version o SCA equation, we would like to reframe it as Sustainable Completive and Collaborative Advantage (SCCA) to highlight the sub component called collaborative cultural value advantage, within our SCA equation, that facilitates such type of binding as well.

- SCCA = market or experience advantage + capability or competency advantage + collaborative cultural value advantage

While the first two components of SCCA are sufficiently being explained in our earlier articles using EPP© and CPP© frameworks , we would like to highlight Collaborative Advantage , the third component within our SCCA equation, as further explained in our Purpose Innovation Portfolio( PIP©) framework. Purpose Innovation is a revolutionary, boundaryless innovation concept that helps us to increase the size of the value pie, by tearing down the artificial trading boundaries among corporations, within both related and unrelated industries, using a powerful causal chain (externality, H&W, sustainability etc) which by the way, happens to perfectly align with our earlier implication of supporting bolder ideas of accommodating the needs of 10B billion people of planet by 2050. And so, in our humble opinion, Purpose Innovation is the next wave to unleash these sustainable growth opportunities within CapitalismPlus, especially within the pull side of the value chain, as covered in one of our earlier articles (http://strategywithapurpose.blogspot.com/2011/01/purpose-innovation-answer-for.html).

One might ask - while it sounds great in theory, what are its pragmatic implications?

- Among many, one key practical implication is Capitalism Plus, by its design, inherently will encourage and reward those companies with bold and profoundly principled, fundamentally patient and socially accountable ideas and proposals (e.g. VizPlanet platform), that would work for 10 billion people (as opposed to the current 6 billion), with a triune shared value (TSV) mindset, using multiple forms of capital—purpose, human, IG, product, and equity.

- In other words, Capitalism plus, in its essence is a purpose driven, three dimensional value balancing market system (i.e. the “inside-out” motivational/emotional energy value balancing the remaining two “outside-in” stakeholder and societal value energies) using a 5 dimensional market system, with a collaborative 5M (Meta events, Means, Mechanism, Methods and Metrics) mindset.

- Simply Put, Capitalism Plus, encourages every citizens to participate in the Free market Capitalism driven prosperity journey by

-

- Planting their “purpose driven motivational energy seed” ideas, using nature’s profound seedal chain principle,

- Germinate itself into a five dimensional value market system (Purpose Market, Labor/Human Market, Intermediate Goods Market, Product Market and Equity Market) with a fundamentally patient ,5M seasonality mindset (Meta market events, Means, Method, Metrics and Mediation)

- Yielding a socially accountable Triune Shared Value Portfolio (Shareholder, Societal and emotional/cultural value)!

- Get a buy in from policy makers for a prototype; more specifically explore the possibility of getting an alignment with the leaders from the President’s recently launched OFR group, to proactively avoid another financial meltdown. We recommend augmenting OFR with our Capitalism Plus driven big data analytics and causal chain maps, at the system level, by visually representing the cause and effect relationships within all the entities of macro and micro economies using our 5 dimensional market design, with a 5M mindset. As a next step, we also suggest to undertake a proactive planning effort and simulate the overall capitalism plus design, in real time with various “what if scenarios” with key risk and valuation indicators, using big data driven Business Activity Monitoring (BAM) techniques. BAM provides the capability to alert risk and valuation indicators proactively, so that policy makers and decision makers can accelerate their decision making and avert another financial meltdown of 2008 magnitude!

- Take a baby steps and try to implement a small scale exchange that are made up of start-up firms, as they will be motivated to participate given the fact bulk of their value is in the intangible capitals.

- Extend that approach to the partner firms of the entrepreneur (suppliers etc) firms who may be willing to participate.

- Slowly build the momentum for boundaryless approach for more participants

- Influence Washington and see if the concept can be taken nation wide

- Take the concept global.

Prof. Clay Christensen, Horace Dediu and Robert Wheeler,Dr.Steve Willis

As suggested by some MIX readers, I am reposting the comment I had posted on the HBR site, wherein, Polly Labarre had clarified the essence of the Capitalism Challenge under the heading – Whose Capitalism is Anyway (http://blogs.hbr.org/cs/2012/04/whose_capitalism_is_it_anyway.html).

Please find below the text of that comment - and I hope it benefits the MIX readers and evaluators as well.

+++++ Polly, A great follow-up article, clarifying the essence of the Capitalism Challenge. More than anything else, the way you have re-framed the shift happening within Capitalism is phenomenal. For my own understanding, I've paraphrased it as follows (and perhaps for the benefit of others as well) –

• Pursuit of profit value is SHIFTING to Triune Shared Value (shareholder, societal and motivational)

• Economic center of gravity is SHIFTING from west to the east

• Competition mindset is SHIFTING to Collaboration mindset

Within the context of this amplified definition, what I really liked the most is the way you and Chris have aligned your three suggestive prescriptions as an answer to each of these three shifts as mapped below.

• Pursuit of profit value is SHIFTING to Triune Shared Value (shareholder, societal and motivational) -> Do what you believe is right

• Economic center of gravity is SHIFTING from west to the east -> Build a life boat

• Competition mindset is SHIFTING to Collaboration mindset -> Internalize the externalities

If I may, here is my one suggestion for whatever it is worth - instead of trying to treat all the shifts as forces, I suggest that we re-imagine/regroup these tenets/events as three dimensional energies i.e. Force, Energy and Power dimensions (or space-matter-time dimensions in a larger universal context) using nature’s energy management principle, to help design the right type of resistance mechanism for the right type of tenet/event.

• Energy type tenets/events need to be handled by replenishment mechanisms

• Force type tenets/events need to be handled by resistive mechanisms

• Power type tenets/events need to be handled by channeling mechanisms

In other words, one of the key lessons learned from the 2008 financial meltdown/crisis( among many), is that the capital markets, in the larger context, did not have the right type of in-built resistance/replenishment/recharge type mechanisms, automatically triggered to mitigate the right type of events. Simply put,

• Energy oriented events to be handled with matter dimension driven proactive efficient replenishment heartbeat strategies i.e. Market motivation energies like "Pursuit of profit value shifting to Triune Shared Value (shareholder, societal and motivational)", need to be handled by an in-built recharge mechanisms like “Do what you believe (and only that)” strategy to replenish those energy impact from those shifts.

• Force oriented tenets/events to be handled with space/distance dimension driven proactive resistive body space strategies i.e. (note: Force=Energy/distance) i.e. events like "economic center of gravity (or. environment or body space gravity) shifting from west to the east", needs to be handled with sufficient elastic cushion space type resistance mechanisms (e.g. building a life boat) to bounce back from the impact of these force type shifts

. • Power oriented tenets/events, to be handled with time dimension driven proactive effective seasonal channeling mindset strategies. (note: Power=Energy/Time) i.e. "Competition mindset shifting to Collaboration mindset" needs to be handled by the time lever (e.g. Internalize the Externalities) to channel/control/encourage it from the impact of the power type shifts.

On the whole, you and Chris have beautifully redefined Capitalism with these three tenets (with three prescriptions) in perfect harmony with the way, I had re-imagined it with a profound Seedal Chain Principle, as outlined by my Capitalism Plus hack, a week ago (http://www.managementexchange.... )

I guess there are only few ways one can skin the cat!

Regards, Charles

- Log in to post comments

@Charles Prabakar

This is a rich post and it requires thorough reading. You tackle a topic of high complexity. A great manifestation of your abilities and deep thinking. The flow and soundness are great and exceed my expectations.

One point that strikes my mind and it has always been playing darts in my head. I quote your top line

~ The Invisible Hand’s Purpose Seed Manifesting itself as a 5D Market system with a 5M (Meta Events, Means,

Metrics, Method, Mediation) Mindset, yielding Triune Shared Value

When I see such a model I expect some cross interaction leading to a non-linear complexities due to feedback effect. Your diagram shows these possibilities. I expect some new phenomena would emerge.

I admire your courage to tackle such a hugely important topic. I wish readers would give it due attention as the material is intertwining by mixing so many disciplines in one pot. I assure readers it is well time spent.

I congratulate you for writing such a free-flow material dealing with a tough subject

- Log in to post comments

Thanks Dr.Ali Anani for an insightful comment. I agree that Capitalism is a complex subject, and so, by no means, I can do justice, by trying to cover a new generation approach of capitalism within a hack like this.

With that said, as I read through your comment – the thing that caught my attention the most was the way, you had synthesized the findings of my approach “it is a feedback loop generating new possibilities and new phenomena”.

I couldn’t agree more! As it turns out - if at all, there is one common agreement among most economists, all the way from Adam Smith up to the modern day economists like Friedman – they all share the view that, any new thinking in economy (and capitalism) is all about identifying those newer possibilities, as you have alluded.

One such possibility, as I had briefly alluded within my hack is to find an optimal answer for the century old question – "Which view (supply side or demand side) is better to fix/stimulate a down economy or financial meltdown/depression?".

While supply siders like Friedman might argue that the lack of money supply is the key driver that disrupts the feedback loop (i.e. causing depression), on the other hand, demand siders like Keysean might argue that lack of investment is the key driver that disrupts the feedback loop, causing financial meltdowns (depressions).

However, as you know better than I do, that it is a chicken and egg type of a debate, as no one can back up the reasoning behind their position with a 100% objectivity/certainty all the time, and so the debate i.e. “ Which is better- supply side or demand side to fix/stimulate a down economy”, still continues.

The key reasons for this never ending dilemma, in my opinion, includes, but not limited to are –

- Inherent difficulty in clearly predicting the magical next move(s) of the invisible hand, with a 100% certainty.

- Economy or Capitalism has not been accurately defined with a comprehensive framework with the possibilities/phenomena type mindset suiting the 21st century needs.

- External Meta events have not been properly grouped and understood within its context – as explained later

While analytics and simulation techniques have helped us to make some great progress in recent years when it comes to the first reason, lot more work still needs to be done, as I had alluded in my big data analytics driven real time economy simulation approach in the next steps section of the hack.

When it comes to second reason, that is exactly we have done with our CapitlaimPlus framework, wherein we have defined the “Invisible hand” as the “possibility of Purpose Seed Collaboration, manifesting itself as a 5D Market system with a 5M (Meta Events, Means, Metrics, Method, Mediation) Mindset, Yielding Triune Shared Value, that is governed by nature’s seedal chain principle”, very much like how Friedman called Invisible Hand "the possibility of cooperation without coercion”.

What do I mean? Defining the possibilities with a right model/framework and then accurately predicting the moves of the invisible hand within that framework, perhaps is the best way to answer the question i.e. " which view (supply side or demand side) is good for fixing/stimulating the down economy/depression or meltdown"?

In other words, while there is a “place and time” for each of the views (supply and demand side) within the seasonal cycle of economy – the real trick is discerning the right inflection point within that cycle, (depending upon how the Meta Events are operating at that point in season) and then deciding which view is better, within the context of Seed-Season-Sequel principle.

In other words, as alluded in our reason #3, it all comes down to classifying the external Meta events in three categories (Energy, Force and Power) within the context of the following hypothesis -

- The decision of using supply side or demand side view driven Energy replenishment events/strategies (i.e. money supply stimulus or capital stimulus respectively) must be chosen depending upon what types of Meta events are dominating within the economic seasonal cycle feedback loop (and causing the depression or financial meltdown) within that seasonal inflection point.

In other words, If force type disrupting events are dominating the season (Force=Energy/space), then “supply side view”, perhaps is the way to go, whereas, if power type sustaining events dominate the season (Power=Energy/time), then demand side view perhaps is the right answer here.

Please note that it is just a hypothesis at this point, and so, lot more work needs to be done with a historical data to prove our hypothesis.

However, our intuition says that - instead of debating which view (supply side or demand side) is the right solution to fix a depression, I would rather reframe the debate and suggest to spend our brain power on analyzing what types of events are dominating/shaping the economic seasonal cycle feedback loop - and then let the answer to that question, decide which view (supply or demand side) is better to fix/stimulate the down economy/depression/meltdown within a season.

In a way, this type of reframing might also provide an opportunity for both the right and left ideology groups to come to the table and work together and find a common solution as well - and let that be my last word!

Regards,

Charles

- Log in to post comments

You need to register in order to submit a comment.