Story:

Incubating intrapreneurs to revitalize customer business

InsuranceNext epitomizes the spirit of intrapreneurship in large organizations and rewires talent with an objective of revitalizing customer business. It harnesses the power of imagination and collaboration by crowdsourcing disruptive ideas and heralds the game-changing moments of the future of insurance industry. Together, passionate minds at work bring future alive.

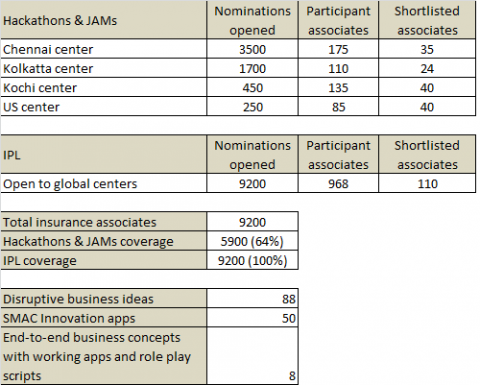

Cognizant (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process services. Headquartered in Teaneck, New Jersey (U.S.) with over 50 delivery centers worldwide and approximately 171,000 employees as of December 31, 2013, Cognizant is a member of the NASDAQ-100, the S&P 500, the Forbes Global 2000, and the Fortune 500 and is ranked among the top performing and fastest growing companies in the world. Cognizant recently completed two decades of service. We belong to Cognizant’s Insurance Practice which is one of the mature Practices within the organization with over 9, 200 employees and serve as strategic partner to 7 of the top 10 global insurers.

All of us are aware that every business is becoming a digital business with the emergence of disruptive technologies like Social, Mobile, Analytics and Cloud (SMAC). There was this sense of urgency amongst our insurance customers to catch up with the emerging trends in order to remain relevant in the competitive landscape and to serve their consumers better who were quick to adopt these technologies. We saw this as a major opportunity to change the playing field in order to help their customers rethink, reinvent and rewire their businesses as the trusted partner.

While we continued to focus on market share with the traditional Application Development and Management stream, by having the SMAC strategy in place, we established the mindshare work stream seeking to transform the nature of customer engagements by proactively helping them through enhanced thought leadership and innovation.

With that as a context, we at Cognizant Insurance Practice realized that the ideas originating from few bright minds in the four walls of an executive office would not be sufficient to revitalize customer business.

Insurers are usually considered conservative compared to other industries when it comes to new technology adoption. They are not to blame squarely. Being part of a highly regulated industry, insurers must ensure that they are extremely cautious in their approach to new technology adoption by not compromising with the regulatory and legal obligations. This posed a huge barrier to institutionalize the changes in a rapid fashion and pushed them to the back foot compared to their peer industries. Insurers were also facing the risk of being left behind and becoming irrelevant as a brand in the minds of their end users who were consuming the new technologies at a faster pace.

Having a fair understanding of the global and the insurance landscape, we at Cognizant took it upon ourselves to reimagine the future of insurance industry. We had to quickly establish our credentials as the thought leaders who can enable the insurance customers to run better and run different challenging the status quo, maximizing their fullest potential. But we were just making foray into the emerging technologies ourselves.

Reflecting on the journey, our earlier attempts at targeting specific use cases to demonstrate the capabilities of emerging technologies failed to impress upon the customers as the power that is vested in the convergence of these technologies to disrupt their business remained untapped. Reinventing our approach by applying convergent thinking to come up with the possibilities of the future that relates to the business imperatives seemed the way forward. Cognizant is born global and a client-centric organization. Our associates (we prefer addressing our employees as associates) have always been passionate and deep rooted in solving complex problems faced by the customers. Traditionally, the onshore associates who are closer to customers have a solid understanding about customer’s business landscape and pain points. Predominantly, the offshore associates focus on delivering technology solutions. The biggest challenge on hand was to come up with a distinctive approach that can bring these passionate minds together to coalesce business and technology that has the potential to transform the customer’s business in near-future.

A lot of questions were looming large. We have been in similar situations in the past and come out shining through the fog. Amidst all the challenges, we knew that if we have the right strategy in place to unleash the potential of our associates by kindling their passion, we would be on a roll.

Way back in Q2 2012, we formed the Insurance Future of Work team, a four member team to develop our point of view on leveraging SMAC technologies for insurers.

Try out the tested methods

Going by the fact that it is always better to try the tested methods, we piggybacked on running innovation campaigns in the individual accounts i.e. project delivery teams to pool ideas from associates as part of the managed innovation process on how to leverage the SMAC technologies for insurers. The managed innovation framework advocated by the Cognizant Innovation Group had already paid huge dividends for us in providing a structured approach to innovation.

We floated campaigns like, “How insurers might benefit from mobility initiatives?” or “How insurers might adopt social business?” and generated ideas from a cross section of the crowd representing large accounts and captured them in the idea management system. We started publishing them as thought papers (Sample few -> Thought Paper 1 | Thought Paper 2 | Thought Paper 3).

Learn to fail fast

While we were able to generate ideas in silos and implement them, we did observe major gaps.

#1 – The ideas mostly constituted incremental innovation like enabling existing web based functionality as a mobile app or social app and were not powerful enough to disrupt the customer business models

#2 – Concerning SMAC, 80% of the ideas remained as ideas on idea management system either due to lack of feasibility or relevance or funding and only 20% passed the filter criteria to move on to the next stage. Out of the chosen 20%, only 10% were fitting into the strategic objectives of the customers. Out of the 10%, only 2 - 3% of them got implemented successfully in the near term.

#3 – Majority of participation were from the critical mass at offshore. The onsite associates who were actually closer to customer business and who could prove extremely valuable in providing relevant inputs on customer’s strategic initiatives were not engaging as much.

#4 – Even with respect to offshore, there was designated few from the account teams primarily from technology background who participated in the initiatives to learn a new technology and develop the apps but there was not much participation from the rest of the community, mainly the domain experts were not involved.

#5 – Though multiple ideas were generated with larger focus on quantity, we could only create point solutions with those ideas. It was getting extremely difficult to establish correlations amongst the ideas and put together a cohesive story that can impact customer business.

#6 – We realized that the context we set for innovation in the campaigns was flawed as it focused on a singular area like mobility or social and did not provide a holistic view on how emerging technologies can converge to build a digital insurance enterprise and generate better business value across the value chain and improve the efficiency of individual stakeholders.

The tested methods were failing and the existing platforms were not helpful to accomplish what we aspired for. The good news was that we failed fast and were willing to learn from the failures fast.

Keep experimenting

#Hackathon

Around Q3 2012, we went on to conduct hackathons, build 24*7 events where associates formed teams with diverse stakeholders like business consultants, developers and built working prototypes and functional apps using the new technology enablers. We found that by collaborating with business folks, hackathons helped associates to passionately code and pump oxygen into a prototype to breathe business. We chose themes that revolve around key insurance business processes and conducted these events across the global branches at Cognizant where associates exhibited excellent enthusiasm.

We still faced difficulties in tying the different apps implemented in hackathons as an end-to-end business theme.

#JAM

Around the same time, we started to conduct JAM sessions where diverse stakeholders from business, technology and design world got together to throw their perspectives on how we can transform the key customer business processes using technology enablers. We discovered that by applying design thinking and empathizing with the end user from varied perspectives, we could conceive an end-to-end business theme around the key business processes.

The eureka moment

These events opened our eyes to discover a next generation way of engaging our associates to conceptualize and build end-to-end business themes. The biggest revelation being that we should largely engage the millennial workforce as they were looking at things differently. These digital natives for whom the smart devices have become the networking hub had an inherent intrapreneurial spirit. By being the largest consumers of SMAC technologies, they had it in them to explore and apply the cutting-edge technologies to disrupt customer business. Tapping this talent effectively was the need of the hour.

The managed innovation approach was working wonders when it came to incremental innovation. Nevertheless, we recognized that we had to devise an impactful strategy that can propel disruptive innovation by channelizing the millennial talent. We felt it’s time to seed a vision.

Seeding the vision

During July 2012, our think-tank comprising of the key Leaders of Insurance Practice and the Insurance Future of Work team reviewed the proceedings and sensed the need to chart a strong vision and clearly communicate the objectives across the board. After few hours of structured brainstorming, we envisioned a platform that confluences the following –

- Identify the key customer business processes across the varied lines of business that can be digitized and re-wired

- Leverage the emerging technology and trends – Social, Mobile, Analytics, Cloud and the Internet of Things as an enabler to benefit business

- Engage the customers, partners and associates differently – Make the interactions personalized, contextualized, connected and insightful

- Present our point of view through a combination of storytelling and Try-it-yourself concepts that can generate enough interest for downstream opportunities

- Unleash and aggregate the human potential – design environments to inspire associates to amplify their imagination and contribute towards disruptive innovation through collaboration

Rather than developing the comprehensive suite of apps completely and then testing their applicability or potential value to the business, we adopted lean startup mindset to prototype the ideas and gather feedback early in the life cycle. We eschewed the traditional powerpoint presentations and conference room meetings for customer presentations and adopted a role play approach to let the customers experience the value demonstrated.

Garnering support from stakeholders

The most challenging of all was to fund the initiative as we had to invest heavily towards erecting a physical experiential zone with environments that could simulate a home, office, car etc. to empathize with a stakeholder far better and deliver apps that can cater appropriately. Luckily, our executive leadership team had huge faith in our vision and provided us the necessary approvals and support.

Over the course of time, from a four member team, we expanded to a cross-skilled ten member core team. One of our team members took the primary responsibility to coordinate and oversee the user-centric design of physical environments conducive to amplify imagination. One sub-group within our team concentrated on conceptualizing an end-to-end business theme and refining the approach towards delivering the content as a first-hand experience. Another sub-group developed the apps using emerging technologies.

Our vision became a reality. The physical zone with the state-of-the-art infrastructure and necessary gadgets came into existence. We branded our initiative as InsuranceNext epitomizing the spirit of next generation team building the next generation solutions for insurers.

The Launchpad

On July 9th 2013, we, the rebranded InsuranceNext team piloted our initial business theme to demonstrate what the future beholds. We conceptualized as to how a day in the life of an insurance advisor would get transformed in future by deploying smart technologies and thereby aid in maximizing productivity, reduce cycle time for new business acquisition and enrich end user experience. With the help of the series of gadgets infused with the apps developed by us leveraging new technologies, the customer delegates could feel the future by enacting roles of different actors in the value chain in the simulated environments at the physical zone. They were enthralled with the experience, in turn testifying our vision.

But this was just the tip of the iceberg. How do we scale and sustain this initiative to cover wider horizons of varied lines of business and associated processes, tailor it to customer needs or expectations, tap other ambit of technologies and deliver the experience globally transcending the boundaries of a physical zone? Referring back to our vision, we knew that we had the right infrastructure and approach in place and now it’s time to unleash and aggregate our associate potential.

Executing the mission

We started evangelizing InsuranceNext brand with the crowd. Any new initiative including innovation needs good marketing. We decided to borrow ideas from the buzzing trends that catch up fast with the associates. What better option could it be than the sport of cricket for the Indian mass? On July 29th 2013, we floated our call for disruptive innovation as InsuranceNext Premium League (IPL), needless to say inspired by Indian Premier League.

InsuranceNext Premier League is a championship tournament for Insurance Practice associates that aim at spotting the thought leaders of the Practice who can think futuristic and create valuable assets for InsuranceNext zone.

We knew that disruption can be made possible only by bringing together diverse mix of team comprising of technical architects to business consultants, designers to developers. We decided to harness the power of collaboration. Every portfolio, more commonly known as business unit within the Practice had to field 11 players and elect a franchise owner and nominate a captain to compete in fortnightly challenges that revolved around an end-to-end insurance business theme. The top teams based on point standings would have a face-off during Grand Finale in a bid to win the coveted Championship title. Thus by gamifying the initiative, we added a little more glitter and fun and garnered huge participation.

- Amplify imagination and script the future of insurance industry

- Collaborate with a intrapreneurial community - diverse mix from the world of business, technology, design to build futuristic concepts

- Access to mentors to seek subject matter expertise and help with refining the ideas

- Get hands dirty to learn and explore emerging technologies

- Gain good exposure to end-to-end business processes

- Realize the business outcomes generated by your technology contributions

- Access to state-of-the-art lab infrastructure equipped by latest devices and gadgets

- Execute innovative proof of concepts along with a community and see your ideas come alive

- Empathize with the end user point of view while developing the apps

- Test the power of your ideas and apps with early feedback from customers

- Participate in anchoring customer mindshare / thought leadership presentations

- Ability to showcase apps to customers and receive first-hand feedback

- Pursue passionate activities apart from regular deliverables

- Earn respect from peers and visibility to leaders

- Be part of a game-changing moment in the Practice history

- Each team has to field 11 players in the squad (primarily the associates working for a business unit comprising of many project delivery teams aka accounts within Insurance Practice, both onsite and offshore) represented by a franchise owner

- The franchise owner has to be in the capacity of business unit leader cum executive sponsor

- Each team should name a captain to lead the teams in the efforts throughout the challenges

- Each team can have a coach (excluding the playing 11) in the capacity of a mentor to guide and fine tune deliverable

- Each team is recommended to field 4 foreign players (belonging to specialized Insurance Practice groups) comprising of business consultants (Cognizant Business Consulting Group), technical architects (Insurance Technology Council Groups), product consultants (Insurance H3 Group) and so forth

- Each team can collaborate with external partner groups (outside of Insurance Practice) including but not limited to Global Technology Office – the organizational group that functions as research and development center for technology, Emerging Business Accelerators – the organizational group that incubates new businesses around emerging technologies, Enterprise Application Services – the organizational group that enables business enterprise architecture integrations and reuse their common assets as applicable

- After an initial qualifier round, 10 teams would qualify to compete in fortnightly challenge rounds

- Top 4 teams based on point standings at the end of challenge rounds will have a face-off for the championship title in a Grand finale

Tournament Announcement: July 29th, 2013

- How well thought out the idea is (in terms of clarity, profoundness, user experience)

- Is it leveraging SMAC and emerging technologies

- What is the business applicability in the next 5 years

- Does it present a novelty factor / uniqueness

- What is the level of progression from previous round towards building user experience (as applicable)

30 accounts participated and we received a whopping number of 88 business ideas fielding 968 players. Remember these are not just app ideas but disruptive concepts that presented the potential to flip the fortunes of the insurers in future. Not just that, for the first time, we saw center of excellence groups external to insurance (4 foreign players outside of Insurance Practice allowed as per IPL rule) and onsite teams heavily participate with great gusto. 10 ideas were shortlisted and the 110 players fielded by the selected franchises were raring to create some of the best innovations of all times.

While one of the teams submitted an idea on how the internet of things would aid in smart risk assessment for property insurers covering both personal and commercial lines of business, the other team provided their point of view on how the auto insurers could leverage the telematics technology to monitor driving patters to influence premium reduction and enable safe driving.

Innovation in action

The teams participated with so much vigor and spirit that it seemed most of them were working 48*7, investing 24 hours extra apart from their regular project deliverables. It was sheer passion that was evident and the ability to learn through collaboration and the excitement to create something out of the box pushed the associates to perform beyond their limits. Participation of onshore teams was facilitated through video conference. We did a live update of all the rounds in enterprise social channels for the community to follow the updates and derive further inspiration. The finale event was video streamed to the participant community globally spread out.

Feedback from eminent judges

"This is the mother of all other innovations" – Group Chief Executive (Tech & Ops)

"This platform is an excellent blend of technology and business" – CIO & Head of Innovation

"This is a platform which all other Practices should take notice and follow" – CTO & Head of Global Technology Office

"Thank you for giving me the opportunity to participate as a judge in IPL. I was very impressed with the quality and efforts demonstrated in every solution area" – Head of Enterprise Application Services

"InsuranceNext is the silicon valley of Cognizant! Guess we have already achieved the ROI for all our investments" – Head of Insurance Practice

All the ideas presented excellent business potential. In fact the winning ideas of the tournament were decided to be patented by the Practice. (The reason why we couldn’t disclose all of them here with sufficient detailing)

The winning team quoted, “It is a great moment for us. We are delighted to hear Chandra’s (Executive Vice-Chairman) comments. The team was highly motivated right from Round-1 and we feel happy on the outcome. On the final round today, all teams did well and apart from the fantastic show that we managed to put up, the runner-up team were equally amazing in integrating smart devices which impressed all of us”

This was a competition which brought out new ideas and innovation, demonstrated the true value of team work and dedication and above all testified the power of passion and belief.

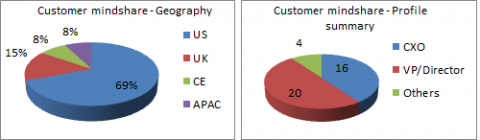

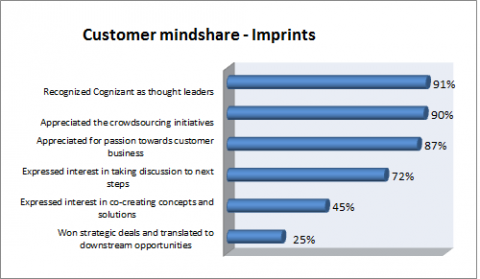

The Real Success

What testified the real success was when we took these ideas delivered by the communities of passion to the customers to deliver mindshare. By mindshare, here we mean how effectively we showcase our thought leadership to customers so that we can occupy a fair share in their minds and thereby recall us as their trusted partner while facing business challenges. We have hosted around 40 customer visits since inception showcasing varied futuristic concepts and apps as a storyline enactment and it would be an understatement to mention that we have never been this successful in showcasing our thought leadership to the customers. The best part being that the innovation has come from the people on ground and the mindshare presentations are delivered by the people on ground. We are able to take the minimal viable products to the customers and receive their feedback and validate our thoughts.

This is ultimate testimony to innovation as we are able to cover all spectrums of the line of business and processes, cover associates spread across the geographies and cross-pollinate ideas and sustain the momentum on a continual basis. Few of the customers voluntarily expressed interest and requested for the facilitation of exclusive JAM sessions enabling their stakeholders to participate with our teams in order to co-create value. These sessions have helped us strengthen our understanding of customer’s business and establish our credentials as strategic partners.

Road ahead

Day by day the passion is growing bigger and stronger. We are all geared up to roll out IPL as an event on an annual basis and confident that the outcomes of subsequent editions would surpass the maiden edition. Of late, we have started delivering the experience at customer locations beyond the physical boundaries of an offshore zone. By conducting a series of workshops and enrolling the associates at onsite right from the millennial crowd to the client delivery directors, we have enabled them to customize these concepts according to the customer business situation and their consumer demographics. We are confident of tailoring and shipping this experience to every customer’s doorsteps across the globe to demonstrate our thought leadership which is now running deep-rooted in the culture of the Practice and running in the veins of every associate than restricted to confined few.

Rewire the talent

Challenge – Large organizations have the risk of becoming complacent in their day-to-day operations and might lose sight of the opportunities presented by entrepreneurial culture to produce disruptive innovations. Incubating intrapreneurial spirit within large organizations that are globally wide spread is a mammoth task. Providing opportunities for every associate to collaborate with a diverse community, letting associates pursue their passion apart from their regular tasks, attempting things out-of-the-box by amplifying imagination is difficult to accomplish in hierarchical organizations that have well-defined managerial structure and protocols.

Solution – Cognizant has been advocating the principles to reinvent the workforce considering the expectations of the new age workers. Insurance Practice leadership has always believed in empowering its associates and operates in an open, flexible and inclusive way of working. Our managed innovation programs already helped us make every associate believe that they are an innovator. Rewiring the talent by empowering and supporting them by designing environments conducive to innovation, facilitating the necessary infrastructure for igniting their minds to think futuristic and providing them adequate recognition did the trick.

Building an innovation ecosystem

Challenge – Building an innovation ecosystem to gain support from the business unit leaders, gathering support from partner groups representing business and technology world and demonstrating value for every stakeholder presented huge challenges.

Solution – By kindling the competitive spirit through gamification initiatives, we influenced the business unit leaders to vie for coveted honors. Apart from the 110 players who were selected in the IPL initiative, every associate in the business unit contributed their bit in researching trends, refining ideas, voting the best ideas, cheering their peers, designing prototypes, providing feedback on the user experience of the apps, scripting the role play etc.

During the initial rounds of the contest, business unit leaders who typically manage a business unit within Insurance Practice and liaison with customers realized that the powerful concepts conceived by the collaborative community had the potential to disrupt their customer business and maximize efficiencies in near future. It opened newer avenues for them to engage with their customers and earn their goodwill and trust. The rule to field foreign players from specialized groups within Insurance Practice in the playing 11 and the rule to engage with partner groups that represent the organizational center of excellence groups that envisions and develops generic frameworks, solutions or capabilities to leverage their assets and best practices helped in building an effective ecosystem.

Most of the technology capabilities developed by the partner groups could not reach the insurance customer’s purview because they lacked the backing of a strong business case or demonstration of business value. By partnering with the insurance associates and participating in the IPL event, their capabilities got quickly integrated with the business workflow substantiating the benefits in a language appreciated by the customer. Most of the business consultants who were part of the specialized groups within Insurance Practice like Cognizant Business Consulting Group volunteered to participate as their ideas were coming alive in action and presented to customers paving way to rapid feedback.

The icing on the cake which was an unexpected outcome was when one business unit that developed a disruptive concept was able to pitch in that concept not just to their customers but customers representing other business units as well presenting a potential of building a platform as a service in near future that can cater to multiple customer organizations and generate non-linear revenue for Cognizant. Rather than claiming that we built an innovative ecosystem, it would be apt to mention that a value-based ecosystem evolved with varied stakeholders realizing what is in it for them and volunteered to subscribe.

Treading the road less traveled

Challenge – Traditionally, we were used to certain processes and methodologies followed in our approach to innovation, approach to app development and the way in which we deliver customer presentations. In a large organization like ours, it is extremely difficult to get the buy-in of multiple stakeholders and pivot the approaches that are time-tested. Treading the road less traveled is one of the biggest challenges that we faced as the potential to fail is huge and the failures could cost heavily to us considering our proven track record.

Solution – Our time-tested methods were anyways not producing the desired outcome and we decided to experiment with the newer methodologies by gaining inspiration from startups. Mindful of our responsibilities, we just ensured a few things in place. Put together a strong vision and clearly articulate it to all the stakeholders involved. Present our newer approach to ideation, app development and delivering customer mindshare backed with solid research and solicit feedback from executive leadership team. Obtain buy-in and support from the executive sponsors by clarifying our vision and approach.

Instead of idea management campaigns on specific themes, we leveraged collaboration and gamification (classic example being the IPL event) to deliver futuristic concepts around end-to-end business themes through effective crowdsourcing. Performing rapid iterations of app development applying lean startup principles and adopting a role play approach for delivering customer presentations to gather early feedback directly from the customer helped us validate our point of view.

Scaling the model

Challenge – Most initiatives start with a lot of promise but ultimately wither in due course of time either because of the challenges faced in scaling the model or sustaining the momentum. Ours is going to be no exception.

Solution – As already highlighted, the business unit owners started supporting the customer mindshare delivered for other business units as applicable. This helped us leverage the associates within the business units to refine and customize the concepts on an ongoing basis. The partner groups helped us build and tailor most of the technological capabilities and integrate with the concepts by enrolling their associates. Same was the case with the business consultancy group that pitched in to offer help from the domain perspective. As per the two-in-a-box model followed by Cognizant, every business unit leader at offshore has an onsite counterpart designated in the role of client delivery directors. They helped us conduct the workshops at customer locations widening the reach and took responsibility for customizations specific to the customers in their respective business units.

Employee gains

The associates (employees) in the project delivery track were able to pursue their passion for learning and development apart from their regular deliverables. The technology enthusiasts got to enhance their knowledge on the emerging technologies. The business enthusiasts got to collaborate with the technology enthusiasts and in turn with the designers to blend business and technology to come up with futuristic concepts, thereby each of them enhancing their knowledge levels to understand the holistic picture and deliver value to the customers. They were able to gain access to mentors and coaches, they were able to connect with a passionate community, see their ideas come alive, present their thought leadership to customers and feel valued for their contributions.

Some of the associates representing both business and technology communities decided to switch their career tracks to focus on product development strengthening our product delivery capabilities and in turn pursue their aspirations.

The initiative helped the participant associates acquire skills in both technology and business front enhancing their knowledge levels like never before.

Customer gains

Customers from varied geographies were highly enthralled with our mindshare and some of the feedback testified the impacts we had created on their minds and the value we had generated to revitalize their business –

"This is the first time we see innovation in action. We would like to engage with you as a strategic partner" - VP, Group benefits, One of the largest group benefits provider in US

"This is a business driven session with technology as an enabler with fine customizations that would provide us great value" - AVP, Commercial lines, One of the leading global commercial insurers in UK

"We are thoroughly impressed with your thought leadership. We would like to engage with you" - Digital strategy Head, One of the global leaders in financial protection in APAC

"We would like to engage with you in the product implementation" - Head of distribution, One of the leading life insurers in APAC

"You guys are extremely strategic in your approach" - CIO, One of the largest P&C insurance providers in US

Organizational gains

The mindshare that we delivered through the InsuranceNext platform positioned us as a strong thought leader and we could win a lot of strategic engagements of the customers as trusted partners.

The partner groups were able to monetize their solution capabilities by identifying and integrating them with appropriate business cases. Product organizations benefited by leveraging this platform to test minimalistic features of their solutions before making concrete investments. They were also able to gather feedback from the customer and refine the solutions early in the life cycle. By seeding a sense of ownership in associates and engaging them, as an organization we could realize higher employee satisfaction, better customer retention, better employee engagement, between synergy among the varied stakeholders in the associate community, enhanced associate productivity and explore newer opportunities.

Believe in the vision

We learnt the importance of charting out a strong and clear vision, communicate the same to all parties involved and obtain the buy-in from the executive leadership team and other stakeholders. Above all, believe in the vision, especially while treading the road less traveled. Exhibit perseverance during the initial hurdles, keep challenging the assumptions and embrace changes in an agile fashion.

Empower the team

If we get the core of employee engagement aspects right by empowering the team and entrust them with challenging assignments to tap their creativity and imagination, enable them to collaborate with a passionate community and value them for their contributions, it translates to a win-win situation for the employees and the organization. The customers could reap the benefits of the intrapreneurial DNA that we had seeded on the ground amongst our associates to make them a differentiator in their marketplace.

Tap the millennial talent

Every organization should look at tapping the millennial talent as this population breaks the stereotypes by bringing in fresh perspectives. We experienced in our journey that they are tech-savvy, multi-taskers and natural collaborators craving to do things differently. By clearly communicating the strategies and equipping them with the right environment that encourages innovation, organizations can channelize their talent and benefit hugely to gain competitive edge.

Failure is good

We realized that failure is not that bad, in fact failure is good if we can fail faster. When our tested methodologies failed, we learnt quickly from those to pivot our strategies. Right through every step we traversed, there were lessons learnt and we continued to incorporate those lessons in the subsequent endeavors. We would rather claim it to be incremental success rather than a failure. From hackathons to JAMs, we made a bigger stride to float IPL initiative and gained huge returns. From custom presentations to storytelling, we made a bigger leap to deliver first-hand experience with role plays.

Inject voice of customer early

Alongside the journey, we discovered that our mindshare vehicle could be the testing ground for the actual products we develop. By letting the customers experience the future and validating our hypothesis, we could gather customer feedback early in the life cycle on the minimum viable products we showcased at the InsuranceNext platform and embraced that validated learning to decide whether the concept can be built as a comprehensive product or a solution to serve the right target audience.

The biggest lesson being that, "Together we can make a huge difference"

Thanks to Cognizant's Executive Leadership team for helping us refine and fund this initiative. Without their support, we would have got nowhere. Special thanks to Chandra Sekaran (Executive Vice Chairman), Rajeev Mehta (CEO - IT Services), Sukumar Rajagopal (CIO), Sumithra Gomatam (President - Industry Solutions) for their patronage towards this initiative.

Thanks to Insurance Practice Leadership team - Muthu Kumaran (SVP), Dinesh Maroo (AVP), Rajesh Shastri (AVP) and other eminent leaders with whom I, Shyam Sundar Nagarajan, had the privilege to put together this vision as a team.

Thanks to my core team - Suresh Kumar Tata, Roopa Navin, Akila Narayanan and rest of the members to have helped us orchestrate the collaborative efforts and translate the vision on the ground.

Thanks to Ramdas Nyayapati (D), Karthikeyan Sivasubramanian and Kannan Srinivasan for helping us organize the innovation events across geographies. Thanks to Pradeep Shilige (SVP), Sowrirajan Santhanakrishnan (VP), Sukumar Rajagopal (CIO) and Raj Bala (CTO) for honoring us by judging the IPL event along with our Practice Head, Muthu Kumaran (SVP).

Special thanks to Chandra Sekaran (Executive Vice Chairman) for his gracious presence to inaugurate the grand finale event and encouraging the associate community with his words of wisdom.

Thanks to Portfolio / Business Unit Leaders, Client Delivery Directors, our parent group Insurance H3 and the Product Venture Leaders, Cognizant Business Consulting Insurance (CBCI), Insurance Technology Consulting Group (ITCG), Cognizant Innovation Group, external Partner Groups that includes Global Technology Office (GTO), Emerging Business Accelerator (EBA), Enterprise Application Services (EAS) and other support groups that includes Networking, Admin teams for their relentless support.

Thanks to Customer community who have participated with extreme enthusiasm and provided us valuable feedback.

Most importantly, thanks to the whole associate community of the Insurance Practice for making this initiative their own and multiplying the effects by collaborating and innovating with the truest intrapreneurial spirit.

It is great to be part of this initiative. The support from the insurance practice has been outstanding. We all took a leap of faith and the same has paid up.

- Log in to post comments

InsuranceNext is an outstanding innovation platform which has brought many innovative insurance ideas to the table and paved way for a great mind share with our customers. Credit to the entire insurancenext team for establishing this platform.

- Log in to post comments

Shyam - Thrilled to see our initiative being nominated here. It has been a great privilege and fantastic learning experience to have played a part in this initiative. It is an understatement to claim that this is one of the best initiatives where we saw the whole Insurance Practice come together and contribute towards disruptive innovation. The trust shown by the Cognizant Leadership team in empowering the millennials and leveraging the wisdom of the crowd, the collaborative and mammoth efforts invested by everyone coming together as a team from diverse groups, the passion exhibited by associates in learning emerging technologies and the business value that we could generate and demonstrate to the customers through this initiative is unparalleled.

- Log in to post comments

It is great to see how this initiative is making a difference in the employee engagement that we have within the practice. It is great to see so many minds eager to contribute and challenge the boundaries.

- Log in to post comments

Shyam-I completely agree with your views on how cognizant has empowered millenials and has created an ecosystem of innovation.I personally am a by-product of this initiative.I was part of one of the client team's in Windsor connecticut,When the wheels of hackathon reached the shores of US, the way the event was organized, the freedom we were given to innovate all these contributed to the birth of the mobile developer in me.

I still remember the one word feedback that I had written for the hackathon that was conducted- "Addictive", and that is what this initiative of ours has done,it has actually addicted thousands of associates at cognizant to be innnovative.

IPL has created new realms of innovation-"Addictive Innovation"

- Log in to post comments

Hats off to our CEO's strategy of Dual Mandate - Help our customers "Run Better" and "Run Different" both at same time. Really InsuranceNext became the real accelerator for our Insurance practice on the "Run Different" category. It has brought not only the new excitement and energy for the entire BU, but also gave a structured platform to channelize this new found momentum. Really blessed to be part of this wonderful initiative and to get the opportunity to work with such wonderful team which conceptualized, brought it to life, implemented in a big way. It is truely a team effort. Thanks to the entire leadership team who empowered us and gave us the freedom to experiment to bring the best of best. This probably is the first-of-the kind initiative which now other Business Units are looking to replicate. All this is evident from the countless accolades came from several of our clients and our senior leaders.

- Log in to post comments

Innovation at a large scale is possible only by passionate teams and leaders who devise interesting ways of engaging minds. This is truly phenomenal and wonderful to witness. All the best and really proud of your journey

- Log in to post comments

Shyam - Insurance Next is a great platform for associates to collaborate , experiment , test , fail fast , improvise their ideas and bring it live.

- Log in to post comments

Chandru, Thanks for the support from your side and from your team side for the InsuranceNext initiatives. Without your support we could not have achieved what we have achieved.

- Log in to post comments

Participating in marathon is a dream come true for every athlete as it is a true test of ones stamina, perseverance and capability and helps build buoyancy. I had a similar feeling when I took part in the hackathon event organized by cognizant. I still remember the hackathon eve where I asked myself a lot of questions whether I can do it, what will happen if I cant etc. But here I am as a mobile developer writing to you all. And without hackathon, this wouldn’t have been possible. Truly inspired by the peers who participated along with me in the event, led me gush my innovative thinking and drove me to be a part of the team where I am branded as a mobile developer. As I stand today, I want to thank every soul behind organizing this event and wish many such events turn up and help us innovate our inner ability

- Log in to post comments

You and team have done a fabulous job of using the body of InsuranceNext to unleash the spirit of creativity within all associates in Cognizant's Insurance Practice.

- Log in to post comments

InsuranceNext Team has created a structured scalable and sustainable platform to tap into the millenial talent for next generation ideas and solutions in the Insurance space. Events like IPL organized and successfully executed by InsNext team are a perfect outlet for associates to contribute back to practice beyond the delivery work.

- Log in to post comments

InsuranceNext is an excellent platform for empowering our associates to unleash their creative side, and it provides an excellent opportunity to validate the feasibility of these ideas. It is almost akin to a platform where start-ups meet with prospects.

Kudos to the which has come-up with this idea and executed it successful.

All the best for the future.

- Log in to post comments

InsuranceNext has set a high benchmark for itself to beat when it comes to how we demonstrate our innovation, futuristic point of views to our customers at Cognizant. Instead of traditional "show and tell", it goes one step further to "show and engage" the customers thru role play. Two of the ideas from InsuranceNext Premier League is already getting closer to be approved for next round of funding so that we can scale those ideas. Another significant achievement was more than 60 people would have done mobile programming for first time as part of IPL contest over the 10 weeks that this competition was on. That's probably best form of learning...

- Log in to post comments

Shyam , I finally see "Innovation Happening" . Great effort . Congrats to you and the team.

- Log in to post comments

InsuranceNext has created excellent platform for associates to learn (really meant this as my team utilized this platform to learn) and innovate (IPL events..). Really proud to see such a healthy platform available for Insurance practice.

- Log in to post comments

Shyam, I was witnessing some of the IPL rounds and I could see the enthusiasm and passion shown by the associates in presenting their futuristic ideas/solutions on the floor. Hats off to you and your team for building such a wonder platform to incubate innovative ideas and help associates to unleash their creative side.

- Log in to post comments

Insurance next is a great platform to innovate new solution ideas. Hackathons and IPL provides a comprehensive environment for associates to realize their ideas to workable prototypes and solutions. Many congratulations to the entire Insurance Next team.

- Log in to post comments

InsuranceNext has created an environment/platform through which we are able to envisage what next in Insurance. It also creates an opportunity to showcase our entrepreneur skills. Congrats and all the very best to the team that made this happen.

- Log in to post comments

Well I think that is a great strategy in order to revitalize the customer business. Regards, Maryann Farrugia on LinkedIn.

- Log in to post comments

You need to register in order to submit a comment.