Hack:

Achieving a Healthy Balance Between Offense and Defense in 21st Century Capitalism

If capitalism in the 21st century is to deliver long term sustainabie value it must achieve a healthy balance between offense and defense. This will require a notable correction to the current imbalance in order to create a natural harmony between these two antagonistic yet complimentary principles.

To gain an understanding of what modern capitalism represents one must observe corporate behaviour which represents the essence of capitalism. A commonly held view of economic theory is that the western capitalist model is primarily driven by the motivating factors of greed and fear, the former is the motivation to extend ourselves in search of even greater rewards, while the latter is the motivation to protect that which has already been achieved lest it should be taken from us. Progress no doubt requires both, while prudence and common sense would suggest that long term sustainability requires a healthy blending of the two. This search for a middle path has been the subject of much debate down through the centuries. The recent financial crisis and the resulting global economic downturn has highlighted the unhealthy nature of greed when left unchecked, resulting in the prevailing capitalist paradigm and the blinkered focus on short term financial rewards. This in turn has given rise to a growing belief that "Capitalism" if it is to survive in the 21st century, will need to adapt and evolve in order to satisfy the imperative to deliver long term sustainable value.

- On overly narrow focus on pure financial metrics while ignoring important non financial issues

- A focus on short term interests at the expense of broader long term stakeholder interests

- The lack of Board level appreciation of the necessity of having a formal systematic corporate defense program in place within their organization to help ensure that their stakeholder interests are adequately safeguarded

- The lack of a seat at the C-Suite table for a "defense" champion to challenge, scrutinize and add a degree of balance to the formulation of corporate strategy and policies

- The resulting lack of transparency and responsibility for corporate defense, where accountability is fragmented and diluted at the executive management level

- The lack of coherent co-ordination of defense related activities at a functional level leading to the development of silo type structures which means that they are not in alignment with one another but rather operate in isolation resulting in both ineffectiveness and inefficiency

The challenge facing capitalism is wide-ranging however restoring a natural equilibrium between offense and defense in the corporate mindset will go a long way towards improving the situation going forward. This can perhaps be best achieved by a degree of tweaking and joining of the existing dots rather than a complete overhaul of the entire system.

The practical impact of implementing the CDM framework includes:

- Helping to positively change the prevailing capitalist paradigm which encourages the pursuit of short term goals at the expense of long term sustainability.

- Helping to make it easier for external parties (e.g. regulators, rating agencies, external auditors etc) to review and assess whether an organization has taken all reasonable steps to adequately safeguard its stakeholder interests.

- Helping to make the Board and Executive Management more responsible and accountable for their oversight duties in relation to safeguarding stakeholder interests, by ensuring corporate defense has a more prominent role in corporate strategy.

- Helping to ensure that defense activities are operating appropriately from the boardroom to the shop-floor via formal systematic corporate defense programs.

- Helping to create a more comprehensive and robust corporate defense infrasructure that better safeguards stakeholder interests.

- Helping to optimize stakeholder value by increasing effectiveness through improved performance, and increasing efficiency through higher productivity and reduced costs.

- Helping to increase stakeholder comfort that their interests are being adequately safeguarded.

In an ideal world all of the following steps should occur:

- The broader stakeholder community to demand formal corporate defense programs in order to adequately safeguard their interests

- Regulators to declare a formal corporate defense program as a mandatory compliance requirement

- The following entities to incorporate an organization's level of corporate defense maturity into their assessment and evaluation of the organization

- Regulators

- Market Analysts and Rating Agencies

- Entities planning a merger or acquisition (M&A)

- Shareholders

- Investors and Venture Capitalists

- Banks and other Lending Institutions

- Insurance Providers

- External Auditors

- Business schools to offer courses in corporate defense and to include corporate defense as a module within their MBA programs

- Corporate defense related professional bodies to collaborate and co-operate to help facilitate this inter-disciplinary integration

- The Board to accept the requirement for corporate defense as a necessary component of corporate strategy and to approve the requirement for a formal corporate defense program

- Executive Management to establish the corporate defense framework and a seat at the C-suite table to be allocated to a corporate defense champion (not unlike the US Defense Secretary)

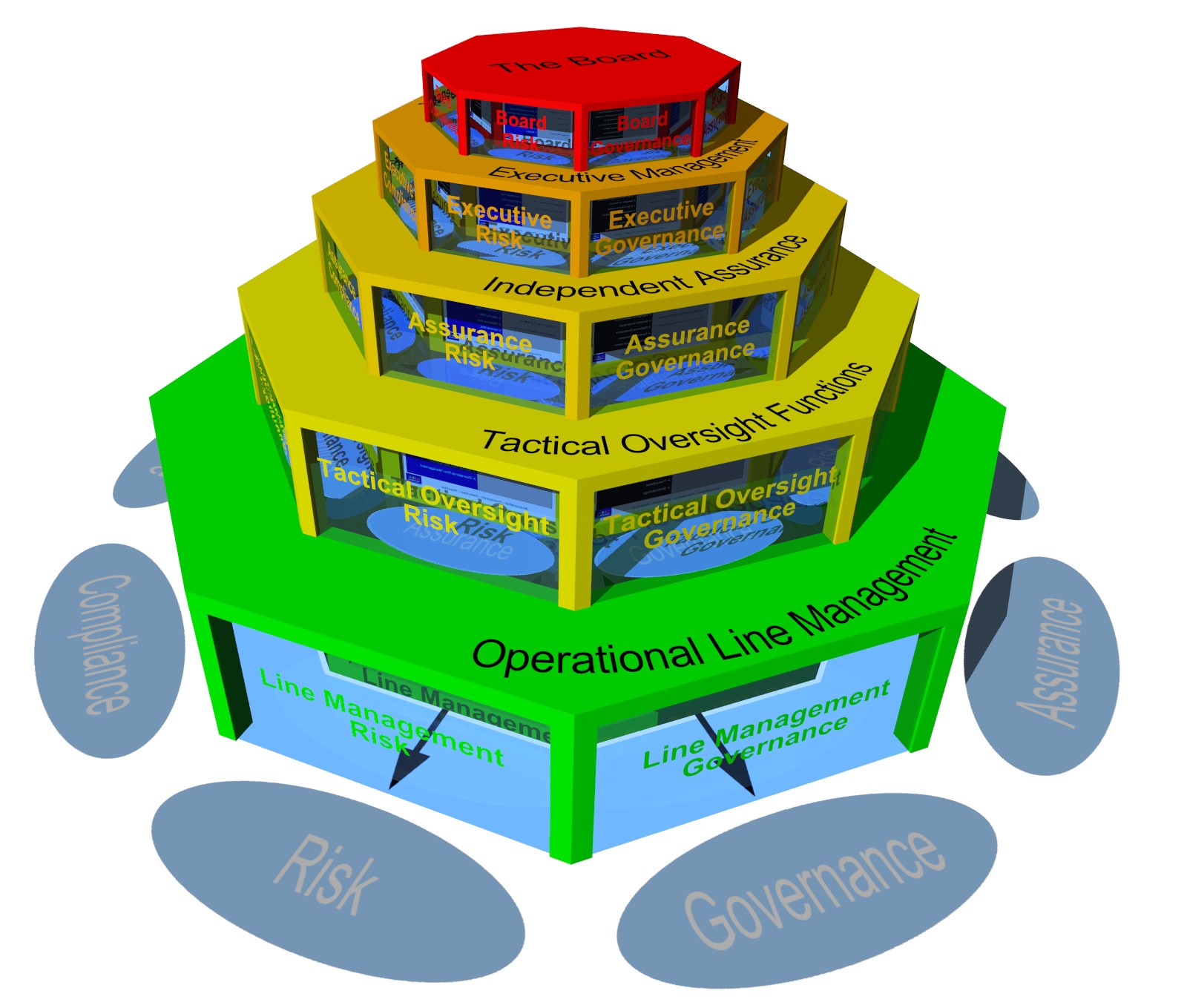

- The corporate defense program needs to be rolled out at strategic, tactical, and operational levels, and corporate defense responsibilities and accountabilities to be incorporated into the performance review (and bonus calculation) process on an enterprise-wide basis

- CEO succession planning to require a placement within corporate defense to help ensure a more well rounded understanding of the workings of the organization

- The concept of corporate defense to be viewed as a positive aspect of the organization's corporate culture so that corporate defense fundamentals become embedded into day to day activities at all levels within the organization until it forms part of the organization's DNA

Author: Sean Lyons

Better balancing competing interests between short term earnings and long term sustainability at the board level makes perfect sense and is a barometer of corporate citizenship status. Sadly, the lack of balance in American corporate boardrooms remains too skewed in favor of those entrenched in protecting interests extraneous to the nuts and bolts involved in corporate sustainability. While conceptualization of this problem is gaining recognition on Main Street, leadership in terms of directly addressing remediation is sorely lacking at a time when it is most needed to spur economic recovery from the excessive focus on short rather than long term and fair stewardship of (and between) multiple interests.

- Log in to post comments

You need to register in order to submit a comment.