Hack:

The New Paradigm of Long Term Enlightened Capitalism

This hack is a model designed on the facts: where we were, where have we taken the wrong turn and where do we go next, maybe towards a new model of enlightened capitalism, as a rupture in the world of ideas - the Big Bang Capitalism 2.0.

In these days of continuous search for financial wisdom, when CDS and default are the words of the day and the main global issue is how to escape from the claws of bad investment options and do not get caught in the trap of twists, swaps or other financial mechanisms we need to underline the facts that made today’s enlightened side of the economy. For this to happen we need to stress the ruptures that made the general framework for the actual economy to exist and the components that need to be inserted to create the new economy with the greater purpose of creating long term capitalism or Big Bang Capitalism 2.0 and in the end just extract one common sense idea.

To create a solution for our problem we need to stress the ruptures that made the general framework for the actual economy to exist and the components that need to be inserted to create the new economy with the greater purpose of creating long term capitalism or Big Bang Capitalism 2.0 and in the end just extract one common sense idea.

General framework

The evolution of learning

In ancient times, hard labor of subsistence was gradually transformed, by the invention of tools, this being the beginning of technology. By the development of new sources of energy – first was the steam engine and, then, electricity and the internal combustion engine – have appeared machines which substantially improved productivity. In the last 60 years the technological advance exploded in all domains, based on the invention of the transistor. Once with the development of the digital technology, we had the revolution of electronics, communications, transportation, medicine and other forms of manufacturing, underlined by an exponential growth of the ability to gather and disseminate information. A necessary bind of these revolutionary forces has been the promotion of universal education. The innovation that made education available to masses was the invention of the dynamic print by Gutenberg in 1438 and the evolution of printing which followed through the growth of the literary background, this way becoming the foundation of the educated population. The impact of this innovation is noticeable in the old saying: “We learn to read so we can read to learn.”.

As the literature developed education which brought the appearance of technology, so there was a comparable evolution in the way how our businesses are led. Individuals live in communities from the beginnings, firstly hunters, gatherers, fishermen, agricultural society and, today, industrial society. From outside, humanity hoped to discover the best ways to take decisions regarding communities – ways of governing disputes, control of the destructive behavior and to achieve goals which advance common welfare of members of the society. The effectiveness of a given governance approach was determined on the will of survival and prosperity of the society. In the beginning, the groups of individuals were small, simple and located in one place. Their governance process was simple. Through time, these groups have become large, complex, vast organizations. Tribal and feudal fiefs have evolved to nation states. Small, local properties have evolved into mega-corporations. The decision-making process has grown to reflect more and more complex government problems.

Among primary innovations in this journey from simplicity to complexity in capitalism there were the social revolutions of the 18th and 19th centuries, especially the American Revolution and the French one and the period of illumination that fallowed them. Primary for those times, while the society was changing, these became more stratified, with small, ruling classes which accumulated wealth generated by the subdued masses. The powerful dictated until they were removed by internal riot or external defeat. Although the basic nature of the society changed; it was a simple case of through which monarchy changed with dictatorship and vice versa. Some changes were competent and willingly, after which nations benefited from, too, but, most common, there was much incompetence, corruption, oppression and rebellion.

The innovative capitalist system resulted from the action of individuals, not from the evolution of legal principles. When individuals gained power, they have imposed by forced oppression, creating revolutions. Social revolutions which followed were fed by the hunger for individual freedom and the wish for the moral imperative of how people should to behave between them. From this revolutions appeared the modern concept of democracy – a rule from the people, of the people and for the people – a concept exemplified through the Constitution of the United States of America and cleared by Abraham Lincoln’s speech at the battle of Gettysburg.

The company

Among the most important rules of capitalism that evolved during time are those that addresses to the form of governance of business organizations. We take the corporative form as a given good these days, but the company/corporation is a relatively new form of organization, as it fallows.

The non-business companies are forms belonging to ancient times, initial being used for organizing towns, guilds and colonies of Rome, and in the early middle ages, these were used for universities, religious orders and other voluntary organizations that performed civic services, being, thus, subject for licensing and government surveillance. The Muscovy Company in 1555, the Spanish Company in 1577, the East Indies Company in 1601 were the first businesses with the shape of an incorporated cluster (early economic organization – precursory to the today’s multinational companies), all being created under the regime of Queen Elizabeth I of Great Britain. The London Company, that shortly renamed as Virginia London Company appeared in 1606 (Beatty, 2000). Before the appearance of the corporation/company, businesses were organized in common properties or in partnerships.

The Supreme Court of the United States of America, under the ruling of supreme judge John Marshall, has created the necessary legislative framework for the existence of corporations/companies as we know them this day, at the beginning of the 19th century. Marshall, himself, has defined the corporate status in “Dartmouth College vs. Woodward” in the fallowing terms:

“…A corporation is an artificial being, invisible, intangible and existing only in the contemplation of the law. Being the mere creature of law, it possesses only three qualities which the charter of its creation confers upon it, either expressly or as incidental to its very existence… (the most) important are immortality and, if the expression may be allowed, individuality; properties by which a perpetual succession of many persons are considered as the same, and may act as a single individual.”(Johnston, 1997)

To summarize, the corporation/company is a creation of the law and has legal interpretation independent of its owners. Three functions made the corporation attractive: eternal life, limited responsibility and the division of ownership that allows the transfer of ownership rights without creating ruptures in the organizational structure. In the last years, the taxonomy became more and more problematic, especially at the moment of the occurrence of the economic crisis, because of the plurality of types of companies that were created (international regulations call these companies: C. Corporations), here appears the major difference between the structures of corporations at international level: limited responsibility companies (L.L.C. – limited leverage company) benefit from a corporative form, but incomes are charged at owners level. This fact contrasts with traditional corporations, where the corporation, itself, pays income taxes and not the owners. After the appearance of the legal framework, the corporation became a preferred form of organizing for big companies. In 1919, corporations represented 31.5% from total global businesses, hiring 86% of the existent workforce and producing 87.7% of the total global income. (U.S. Government, 1919).

The trust

Another form of organizing was experienced at the middle of the 20th century by J.P. Morgan, financier, assumed the role of unofficial guide and law creator in the absence of federal regulations. Paul Johnson, in an exceptional book, “History of the American People” wrote that J.P. Morgan:

“…The tendency of economic activity in a free society was to produce primeval chaos, in which men fought savagely for supremacy and countless sins were committed. Freedom was needed for economic society to function efficiently, but the resulting chaos generated inefficiency as well as sin, He reasoned that some degree of order was needed, and that order could best be brought about by forms of economic concentration that imposed a degree of order without inhibiting freedom to the point where efficiency was again endangered. This valuable concentration was achieved by the corporation and the trust”(Johnston, 1997)

The story of the appearance of trusts is a complicated one. During the Civil War, U.S.A. has followed the high tariffs policy to protect its developing industries. Protectionism through high taxes was maintained by state independent corporations, which joined together to grow their political influence on U.S.A.’s government. Learning to cooperate, a number of industries have started to form trusts; sugar, tobacco, railways, bovine and oil are only some examples. Trusts reduced competition and have encouraged monopoly, as an addition to the given situation. Then the justice courts interfered and by the panic from 1893, the antitrust laws have appeared. This effort in organizing of the economic activities wasn’t legal anymore or, as time has shown, efficient.

Carpe Diem (Cease the moment)

“Painless poverty is better than embittered wealth“ (Ancient Greek saying)

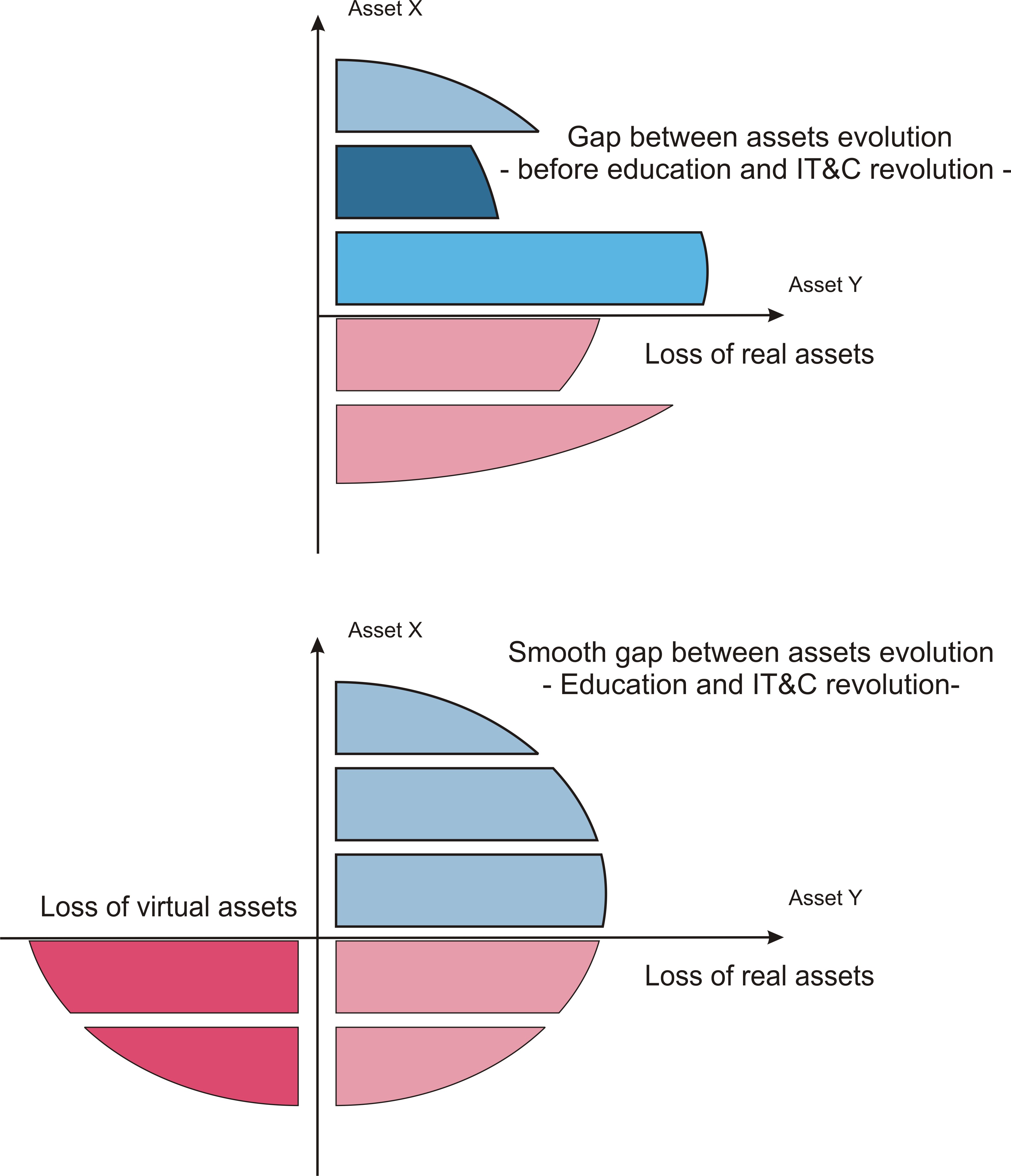

Why the gap between historical changes in the development of long term capitalism is starting to decrease? Because the ruptures gap in capitalism’s evolution decreased from the fact that the access to information is easier with the development of education and IT&C.

The general benefit from private ownership of means of production is changing. The new information atomicity could not reveal any more basic information about the proprietary destination of the future outcomes, deepening on the information asymmetry of the market. Before financial innovation people couldn’t just know what other market participants knew, but there were a common knowledge about the limits of their profit or loss. It would have not been possible to lose more than own, at least without knowing that. Almost universally ignored, risks become related to capitalism, but only like zoo freakiness, it was there, but if people kept their businesses out of the danger zone, nothing bad could have happened.

A pervasive axiom of the self-evidence goal of capitalism held the focus on capitalism evolution, launched by its enemies. According to it, capitalism was a system which operated only in the interests of the capitalist, seeding the wealth gap as it is known in present days.

The subprime crisis from 2007-2008 could have been seen as a new paradigm of outcomes equation toward equilibrium, even what the crisis has brought was anything but equilibrium. The meaning of capitalism is not only to preserve those very basic freedoms which lie beneath its foundations, but to reduce poverty, if not abolish at all, therefore its future evolution is strong related on the solutions’ reliability quested by the economic crisis which are not making them richer, but poorer. Should the financial crisis of 2007-2008 have been prevented, had the appraisal of the visible hand of the state been lower. The sovereign debt crisis and the European contagion menace, is not a capitalism crisis, nevertheless it could harm its principles at the same magnitude. Loses made people once again poorer, giving market participants a hard time understanding the long term capitalism future evolution of better outcomes. Greece’s creditors imposed loses of 70% and are nothing else than hidden redistribution, the main economic engine of socialism. Taking into account the 39:1 value of price-to-asset ratio on Wall Street and the huge loses of leverage victims of few times more than they even owned, 70% loses could be taken as very bad, but not even close disastrous. More than this, professor Robert Schiller (2012) has even presented a magnificent alternative to such aggressive attack of loses of sovereign debt crisis, Trills for T-bills. John Maynard Keynes underpinned the same statement in his General Theory, when he imagined possible solutions to prevent stock market losses. After accused of deregulated market policies, governments did it again: they allowed citizens to spend more than they produced, facing once again the specter of default. Controlling other people’s money, governments gave appraisal to Adam Smith, proving once again that managing other money than yours cannot be an action which claims to much responsibility. In other words, people were careless with money they were not entitled to spend, hence the crisis. Should they have had money invested in their own country’s GDP, had they certainly been more responsible on spending under a different incentive of their future wealth. These wealth evolutions are developed along with capitalism evolution. After all, Nazi power and communism have conquered a devastated Europe by war and Great Depression. Despite civilization presumptive progress, humankind is permanently facing war, and, as a new badly habit, once at a couple of years, economic crisis. Conversely of what market participants are expecting from one year to another, long term capitalism is only facing deeper challenges and newer extreme measures to get things back on tracks.

Where did we take the wrong turn?

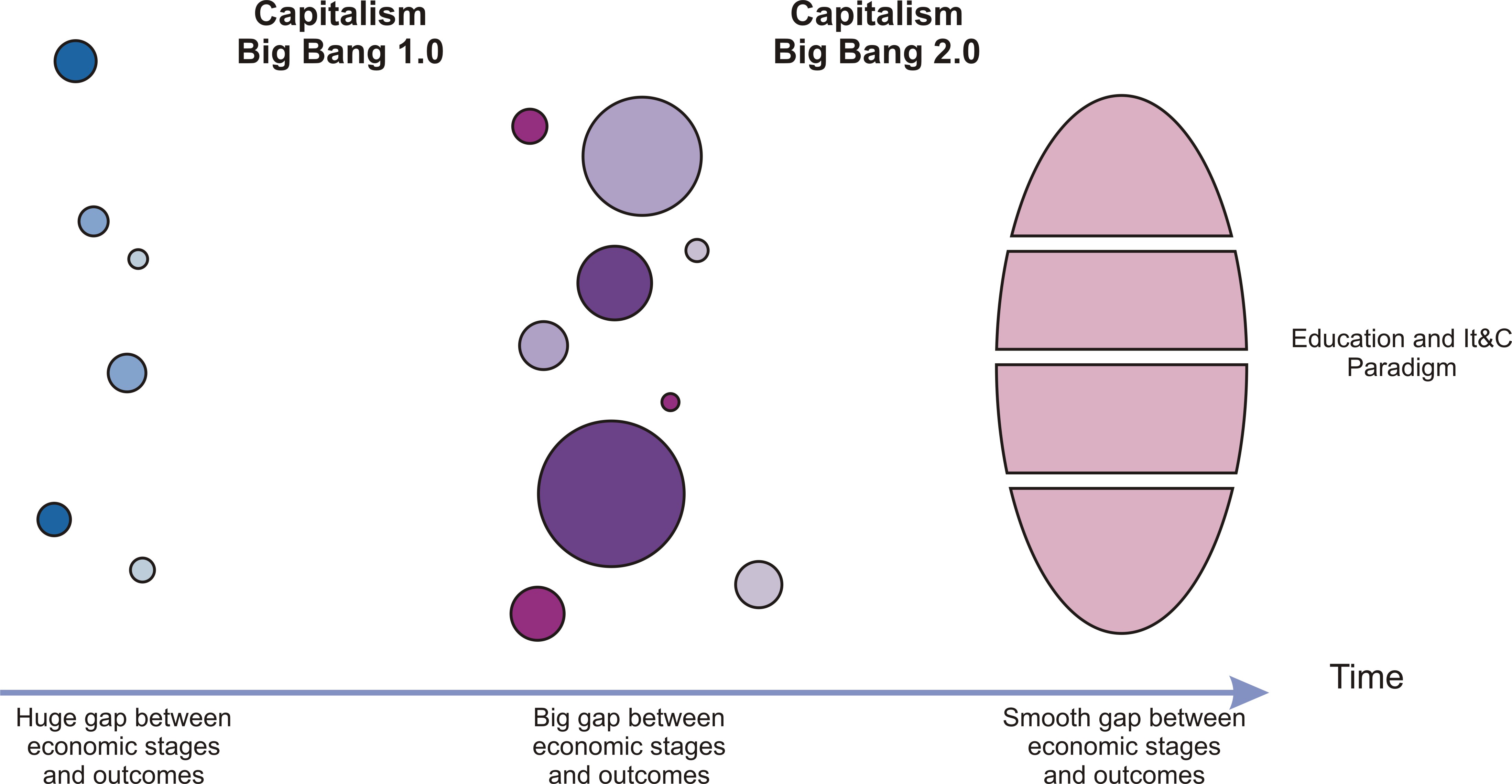

Long term capitalism requires a new paradigm. This means that the hard core of capitalism should be kept, whereas the external layers should come under economists’ attention to improve. (figure 2 - Capitalism Big Bang 1.0 & Capitalism Big Bang 2.0)

The limits of improving long term capitalism are given by economic knowledge and market experience, though science is founded on a priori principles and deduction, against a posteriori principles of personal experience. Nevertheless, capitalism is not a science, but a way of life, therefore we admit permission granted for experience. Limited solutions are good as long as for they are a little better than previous ones, hence the reason for they are accepted in their use. As an example, it took a long time to gain the knowledge about Universe principles and what it really happens in space. First, in ancient time of Roman conquest of Egypt, Ptolemy thought that Earth was in the Middle of the Universe. Then, Aristofan of Samos published a brand new theory, about the sun in the middle of the Universe, so, a better theory, even far by the scientific truth. Things got better with Nicolas Copernicus and Johannes Kepler thousands years later. Nevertheless, the most important paradigm was Ptolemy’s, even the less accurate. It granted the first important step to a useful solution, even not perfect: it was infinitely better to think at Earth like a planet in a system of planets, instead of believing that the world is kept on the shoulders of a giant, or on the back of a turtle, which provoked earthquakes when it moved. The idea of a planetary system was kept and constantly improved, hence the hope that long term capitalism stands its chances to make our lives better through a new paradigm.

A new paradigm of long term capitalism is one layered by education and IT&C. Older layers like geographical location and natural resources are about to be dismissed. To achieve long term capitalism from a new paradigm perspective means timing in appropriate adjustments.

It's an interesting research and presentation about long term capitalism. However, for me, enlightened economy can't involve capitalism which takes raw resources that belong to all humans and sell to mankind for a hefty price while using legal maneuver to avoid the contribution to mankind as taxes. So, enlightened economy has to be more to socialism or social communism as China might prove.

- Log in to post comments

I totally agree with you that nowadays we deal with persons or corporations that elude paying taxes (be them on the way used to find new raw materials, on minimum wage or on profits), but if we understand enlightened economy as the new generation of socialism or communism, we'll evolve on the long run to the impossibility of economic calculus, fact that is often met in communist economies. I think that a middle path between left and right is the answer, let's call it a corporate-social capitalism, based on the active partnership between the private sector and the public sector. Thank you for your comment and your active support on this topic (hack).

- Log in to post comments

You need to register in order to submit a comment.