Hack:

Replace "Maximizing Shareholder Value" with Optimizing Commercial Competitiveness

Let's adapt current knowledge of practices for corporate govenance to teach pension plans and other stewardship investors what values-driven business leaders need and want from investors who sponsor them in building and leading values-driven enteprise.

Public companies today are trapped inside the tyranny of transient ownership of trading positions by large stewardship investors, like penson plans, and their professional money managers. This leads to the modern day mantra that the purpose of the corporation is to "maximize shareholder value", which is a euphemism for always driving the share price up.

This trap is failing business, stewardship and the economy and society generally.

To spring this trap, we need to engineer new architectures for making a more direct connection between large, purposeful, perpetual stewardship investors and values-driven business leaders.

To do this, we need to teach stewardship investors what business leaders need from them as investor-sponsors of values-driven enterprise.

There are multiple ways in which capital is formed for investment in the economy today. I find it brings clarity to talk about them as technologies, in the root sense of 'techne', as in "skill or knowledge for constructing artifacts, as the work of human hands". Capital is an artifact that we make. It is not something that just happens naturally. The way of making it is a technology, just like any other technology for making things that do not occur naturally. As with all technologies, there is always more than one.

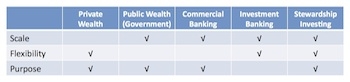

In the materials section there is a table that presents five capital formation technologies: Private Wealth, Public Wealth, Commercial Banking, Investment Banking and Stewardship Investing. Each of these technologies has its own unique protocols for aggregating savings to form capital and for deploying the capital as so aggregated to sponsor new value creation. As with all technologies, each has its own unique strengths, and its own unique limitations.

Corporate finance, which gives rise to issues of corporate governance, are part of the unique architecture of securitization, which is the unique technique for capital aggregation and deployment as practiced by investment banking.

Corporate finance, corporate governance and investment banking all evolved in the 19th Century, at a time when prosperity within the Euro-American economy was defined by industrial expansion into a Western Frontier that was so vast as to be, for all practical purposes, unlimited. This creates the fundamental, defining expectation that underlies all corporate finance and investment banking: that enterprise, as industry, can expand exponentially, and unendingly. This means that capital, once invested in an enterprise, needs to remain invested in that enterprise, to fuel exponential growth, to infinity. This creates a problem for the capital providers. They need, at some point, to get their money back. In the parlance of investment banking, enterprise needs longevity, while investors need liquidity. The solution to this problem is the "relay race" of the Exchange. Large scale enterprise is broken down into bite-sized securities -- company shares -- that can be bought and sold between investors, without removing capital from the incorporated enterprise. Enterprise can go on expanding exponentially, always reinvesting profits to keep up with growth. Investors can buy, hold and sell shares as appropriate to the changes in their personal cash positions over time, and from time to time.

The take-away from this story is that the investment banking system of corporate capital formation through securities trading is built on the premise of transient ownership. Although the legal theory is that shareholders own the corporation, the practical realities are that investors only own the trading positions they hold in listed securities. Their interest is in buying for a price, holding for a time, and selling at a higher price. The markets, that is, the Exchanges, must provide liquidity, which means the corporation must deliver a price. The price can go up or down. A certain sale at an uncertain price is the fundamental value proposition of the Exchanges. But up is better, and the markets will punish the leaders of a securitized corporation if they do not drive the share price up.

Accountability, in this system, is to the next new buyer. That buyer must be supported in the expectation that share price will continue to rise, exponentially, to infinity, or at least until that buyer needs to trade its position with the next new buyer. And so it goes.

Fast forward to the late 20th Century, shading into the 21st Century, where we have a number of root, or radical, changes in the architecture of the global economy.

One is that exponential growth has proven to be unsustainable. Things change, and when they change, we have to adapt. Nothing lasts forever. So, the most fundamental, bedrock expectation on which the whole edifice of investment banking is built is proving to be untenable.

Another is that stewardship investing as a technology for capital aggregation has evolved in competition with investment banking. Vast quantities of personal savings are now entrusted to pension plans, university endowments, charitable foundations and other similar institutions investing other people's money as stewards of a chartered trust to achieve the purposes of their governing charters of trust for successive generations of entitled or intended beneficiaries, in perpetuity. As investors, these stewardship institutions are large, purposeful and perpetual. Not at all like individuals. They have longevity. They do not need liquidity.

They do need to deploy the capital entrusted to their care, and they do need to realize minimum required returns on the investment of that capital. What do they do?

They pour their entrusted funds into the investment banking system. They need longevity. They buy liquidity. In the process, they transform the relay race of individual share ownership for a time into a game of musical chairs. Where individuals buy, for the most, part, when they come into the money, and sell mostly because they need to take that money back, to spend it on something else, stewardship investors never need the money back. Not the principal, anyway. Their principal must always be invested, making more money to support their chartered purpose. When they sell, it is to take profits on a trade, profits they take from other investors, profits which they immediately reinvest in the next trade, in the process, paying profits to some other investor. Their money changes hands, but it never leaves the market to reenter the real economy (except as fees to money managers and other market operators). Instead, pricing bubbles form on the self-fulfilling prophecies of speculative trading: "buy low, sell high" becomes "buy high to sell higher".

Stewardship investors entered the eco-system of corporate finance and investment banking expecting to realize the returns they require to achieve their charters of trust by riding out short-term fluctuations in share prices to profit from exponential growth over the longer term. That is the fundamental promise of efficient markets and modern portfolio theory. It is a promise that has failed of its essential purpose.

What stewardship investors are getting from their portfolios of liquid trading positions in the eco-system of investment banking are a mismatch of costs to benefits, miscreant market manipulation, erratic returns, inadequate returns, and loss of principal from the tyranny of transient ownership of trading positions in listed securities and alternative trading vehicles.

This is not because the eco-system of investment banking is broken. It is because investment banking is the wrong eco-system for stewardship investing. Investment banking is built for liquidity. Stewardship investing is built for longevity, extending out in perpetuity.

Any systems engineer who looks at things this way will see that the problem is not with systems design or engineering, or even with the way we are using the system. The problem is, we are using the wrong system.

Once we get the problem right, the path to a proper solution becomes that much easier to see.

Instead of trying to teach pensions and other stewardship investors better ways to influence choices being made within public companies in which they hold liquid trading positions, we should be teaching these stewardship investors better ways to negotiate the terms of investment directly with values-driven business leaders.

To do that, we need help from values-driven business leaders themselves. We need to mine knowledge of the workings of corporate governance within the eco-system of investment banking to build a solid base of knowledge and experience to guide stewardship investors in their direct negotiations with values-driven business leaders for the construction and operation of new or ongoing business enterprises that they choose to sponsor in building a portfolio of investments that is designed to deliver required returns by supporting desired values.

Change starts with conversation. People have to discuss the need and the opportunity for change, before innovation can take root and grow.

Leadership from business leaders who talk about what they need and want from capital sources who support them in optimizing the commercial competitiveness of their business, and what those supportive investor sponsors will receive in return, will ignite the imaginations of stewardship investors.

The time is right for change. It only takes leadership to make change happen.

"There is none so blind, as those who will not see."

The opportunities to innovate new ways to make more direct connections between large, purposeful and perpetual stewardship investors and values-driven leadership of large scale enterprise are real and immediate.

BUT the pervasive belief that investment banking is the only way to finance large scale enterprise prevents the people who can sieze that opportunity from taking the one small step it will take to get them thinking outside the box.

How do we create the necessary willing suspension of disbelief that will engender the thinking and talking about a new a better way?

"Going private, and staying private".

Let's get business leaders to begin telling stories of what they would do with the businesses they lead, if they were given the option of taking those busienss out of the trading trap of public ownership, by partnering directly with stewardship investors to agree on the equity splits as between Investors and Owners, in the cash flows that will flow through their newly values-driven business as they change the standard of performance from "maximizing shareholder value" to optimizing their commercial competitiveness.

What would be their preferred path to earning back ownership of their business?

You need to register in order to submit a comment.