Corporate boards of the world, hearken and observe.

As this Web page loads…

...entire factories are being built on clouds. Up there in the sky, land, natural resources, roads, and canals are abundant. Fewer amounts of cash are required to operate, and a new kind of capitalists (geek-vestors) and workers (nerd-tisans) are emerging. It is a time of clash and collaboration, where only the fittest (e.g. the ones capable of letting things go) shall survive, and thrive; the premise, to create culture pride or die, as well as to promote the right economic incentives to let your organization stay in the game, and grow. Now, let us get into the how.

Around three hundred years ago, in the 1700s, the steam engine transformed the entire world. Only few noticed that such a changing wave was coming. It was sudden and drastic. It completely ruined the feudalism’s birthday party, the ruling system of that time.

Now, capitalism -son of the Industrial Revolution-, conqueror of the feudal economy and clearly the ruling system of our days, is facing a similar challenge: a series of dazzling, yet ubiquitous large scale of events that are occurring in a place called… [aha, that one!] Internet.

A New Revolution, Really?

In the late 18th century, six conditions favored the emergence of the Industrial Revolution. Could it be possible that those party crashers are now present in the 21st century? Let’s review them in order to drive into a joint conclusion:

#1 Plenty Resources: in the past, rich deposits of coal and iron, rivers, and raw materials such as wool and cotton, powered an incipient textile industry, which reinvented the manufacturing world. Marx once said that people who controlled the means of production controlled the society. Well, we now have an entirely different array of means of productions and many of them are vastly available, in some cases, for free (i.e. blogs, Wikipedia, YouTube tutorials, cloud computing, and digital manufacturing). Those resources are setting up a DIY post-scarcity economy. As Jeff Jarvis concluded in his book What Would Google Do?: “The Internet kills scarcity and creates opportunity in abundance.”

#2 Large Labor Force: an improvement in food supply along with a general increase in the rate of the natural increase of the population provided a new class of skilled and educated workers. Back then, there were about 600 million people in the world. Now, we are 6.9 billion and counting, and more than 30% of us have Internet access. The latter represents a giant labor force of… nerd-tizans (or net-native creative entrepreneurs and artisans).

#3 [New] Capitalists Arrived: huge amount of capital was required to buy machines and tools. Thus, resources and labor force were combined by people who had the capital to start a business. In the 1800s, the corporation was born and bank and financiers became important. Today, less capital is required to create a successful business (check out Instagram’s story here). Moreover, money is getting cheaper as more and more no-middlemen-financial institutions have become available (i.e. Zopa, Kiva, Kickstarter, and others) as well as VC’s, angel investors, and a new kind of capitalists –geeks with money or simply geek-vestors-. They have arrived in the business scene willing to fund creativity and exhilarating causes they deeply care about.

#4 Large Markets: as the urban-life-style appeared and life quality standards improved, an avid demand for finished goods rocketed. In the early 20th century, an era of mass market began. Nowadays, as Jeff Jarvis appointed, we are entering into an era of mass of niches. Certainly, this entails a bigger market with a plethora of consumers/producers and a vast number of niches.

#5 Transportation became faster and cheaper: roads, railroad tracks, and canals were built, maintained, and protected. Now, we have better highways and, of course, high-speed Internet connection, along with Skype, Twitter, and more.

#6 A Mobile Society: before, a poor person, who worked hard and saved money could become wealthy one day. Today, that societal rule seems to be pretty much the same, doesn't it?

***

In essence, it is not hard to sustain and believe that a revolution may be about to explode. Now, the question is how to survive, grow and thrive in an economy built on HTML5? [What is HTML5 anyway]. In other words, how can you manage a company, as an investor and member of a board, in a world that is clearly designed by kids and for kids, who are able to talk with people in five different social networks at the same time?

The answer is simple. You can’t.

You can´t manage your company, at least not in the way you used to. However, there are some strategic approaches that you can either adopt or follow the path of the feudal lords: oblivion.

Transform your company into a mini nation, a virtual nation that resembles the spirit and main characteristics of a real one. For example, Brazil, China, and USA are nations and share some common traits:

- A central government

- A unique and identifiable set of traditions and way of life

- A strong feeling of proud and loyalty among people within the nation

In this sense, the top priority of a corporate governance body should be create culture pride as well as virtual homeland, that is, a platform where people belong, live, and prosper.

Why? Because long gone are the days where people formed lines outside factories to beg for a job. Lone gone are the days where people buy a product just because the TV said so. Long gone are the days where a generic mission statement (“to be the first… and maximize the value of shareholders”) produced alignment and optimal financial performance. And, especially, long gone are the days where owners knew a great deal about their businesses.

Let me give you an example. If you are a family man or woman and have kids, chances are that you and your espouse are the “owners” of the house and everything it contains. So, you may have an Ipad at home that clearly belongs to you (that’s what the invoice said). But, who are the ones who enjoy the gadget the most? Who discovers and uses every single feature of the device? Who are the grandmasters of technology? Exactly, your kids (or your little sister, or cousin…)

Therefore, everything seems to be way too complex now. The only guiding compass you can really trust is your purpose. As Steve Jobs said, “You’ve got to find what you love” and stick to it. In this hack, the recipe is to find what you and your corporate board love (if you haven’t figure it out yet) and to make it into a simple yet contagious nationwide raison d'etre.

How?

In order to build your nation, some strategic considerations require your attention:

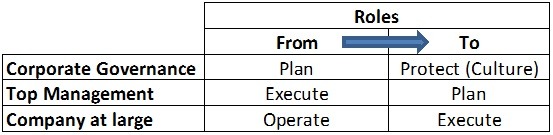

1) Redefine the role of the corporate board, top management, and company at large.

2) Share ownership based on meritocracy.

3) Build your nation as an unleashing platform

1) Redefine the Role of the Corporate Board, Top Management, and Company at Large

It is quite certain that corporate boards have many and diverse roles depending on the type of company, industry, regulations, geographical location, and shareholders composition. Nevertheless, there’s one neural role that requires some revision: setting the strategy.

Traditionally, corporate boards are the ones in charge of setting the agenda for the years to come. This has been a good and beneficial practice in the past, that’s for sure. However, as we move from a knowledge economy to a creative one, its positive effect is being systematically diluted.

It is the moment to trust in your organization and to let them run the strategy for you. Don’t panic. Out there, there are many examples and successful experiences of large manufacturing companies, who reaped the power of self management (refer to: Morning Star story or Semco). Besides, you need time to focus on your new task: to become a corporate body of storytellers and protectors of your nation.

In this sense, the role of the board will slowly drift from planning (set strategy) to focus on the creation and nurture of a strong culture, comprised in two main elements: a purpose (why I’m here? Why we are here? What we want to achieve?), and a series of supporting values. This may even imply a radical redefinition of the business you’re in. In other words, “It is time for your identity crisis”, as Jeff Jarvis wrote in WWGD?.

Here’s a comparative table to illustrate the transition from traditional to newer roles:

2) Share Ownership Based on Meritocracy

Let’s suppose you have come up with an exciting culture, along with an inspiring national anthem. Because of this, everyone is talking about this virtual nation, and your market capitalization seems to take off. Great job! Now what? The second step is to preserve it from hostile invaders as well as to attract skilled and creative pioneers to populate your land and prosper.

A good strategy to do so is by sharing ownership, that is, granting common stocks to those who believe in the cause, not only to those with buying power to acquire a share. In this sense, anyone who has made significant contributions to the company can be recognized as a co-owner of the corporation with voice and voting power proportionally to the number of shares he holds. Remember, grant voice and voting power, not preferred stocks or other options and derivatives. Reserve those instruments to non-believers with money, speculators, and some other types of investors you may need to finance your operations.

For example, if you want to retain your best talent, then, you should better recognize their contributions with ownership, voice, and voting power. They might be in love with your culture, but the thing is, if you don't offer them a genuine and generous chance to share risks as well as capital gains, someone else will. The opportunity costs are just too high. They even can start a business of their own, and in the process... canibalize you (just kidding! Business, in the creative economy, is not necessarily a zero sum game as we should see in the third point).

You'll also need a new kind of investor. I suggest you to pay attention to a particular kind of person: geeks (with money to invest).

A geek may be different from another kind of person, perhaps in the fact that he tends to experience passion more often, at least with the things he likes. An average person who likes Tolkien's Hobbit, for instance, might expect to watch the movie within the second or the third week of its launch. In contrast, a geek who likes the same movie will do his best to watch it first probably in an anticipated especial function.

So, go out and hunt geeks with money! That's the kind of investors you need, especially in your corporate board.

Geek-vestors will help you create and nurture your culture. They will be ok even in reducing dividend payout in order to let the organization grow. In fact, they will be the ones who will suggest that.

If you seek growth, be prepared to sacrifice dividends.

Remember:

Value of a common stock = dividend yield + capital gain yield

Note: If you are an investor, you may include in your portfolio, in one hand, a set of mature companies with attractive dividends payout and, on the other hand, a set of emerging companies you deeply care about and want to see them grow.

3) Build Your Nation as an Unleashing Platform.

As we said before, business is not necessarily a zero sum game, and you can promote win-win partnerships through platforms. This approach would produce some tangible benefits to your corpo-nation, such as:

a) Improve your net profit margin

- More experimentation (R&D) with distributed risks and fewer costs.

- Better brand positioning without PR and advertising costs.

b) Improve total asset turnover (this actually could allow you to significantly reduce your margin and let your company grow faster)

Remember:

ROI =Return on investment

ROI= margin x turnover

Create national pride as well as to Improve ROI, ROE, culture, innovation, and capital gain (growth).

Challenge your corporate aspirations and co-decide what business are you in. Moreover, check these hacks in order to find some inspiration:

Why points trump the hierarchy to reward contribution in knowledge organizations – By Vlatka Hlupic, Jack Bergstrand, Madhusudan Rao, Stefan Blobelt, and Chris Grams

All work can be viewed as service – By Michael Grove

Hacking Executive Compensation with Dynamic Incentive Accounts – By Alex Edmans

You need to register in order to submit a comment.