Hack:

From Zero-Sum to Alignment of Interests

In the Long-Term Capitalism Challenge, this challenge is presented:

How do we eradicate the pervasive zero-sum mentality in business and embed the positive-sum view of stakeholder interdependence into operations at every level?

Here is one possible answer: Enable a direct connection between Enterprise and Investment that allows for an alignment of interests along multiple points of shared value: scale, liquidity and sustainability.

In the Exchange-traded architecture of the Capital Markets, Enterprise and Investment are aligned, indirectly, along a single point of value: the market-clearing price for shares traded over the Exchange. Put another way, in the Capital Market eco-system, both Enterprise and Investment work for the Exchange, and what the Exchange values is transaction volume. In the context of the Public Company, this means Market expectations for rising share prices.

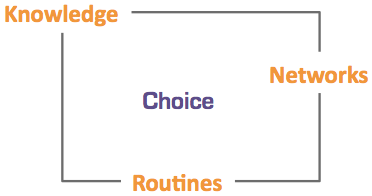

This limits the choices an organization is realistically allowed to make, even if its Investors, in principle, agree with those choices.

If a choice does not support expectations for rising share prices, in the moment, moment-by-moment, the Market mechanisms will punish any organization that tries to make that choice.

Encourage the Institutions that have emerged as the new stewards of our private wealth - Insurance, Endowments, Pensions and Annuities - to connect directly with Enterprise using the proven and familiar architecture of the Institutional Investment Partnership (already standard practice in Real Estate and Project Finance) to align interests along multiple points of shared value: scale, liquidity and sustainability.

Today, these Institutions invest in Enterprise, indirectly, by partnering with Fund Managers to execute trading stragegies over the Exchanges.

Why not have these Institutions invest in Enterprise, directly, by partnering with Fund Managers to direct Investment directly into Enterprise using an investment architecture based on revenue sharing, not share price, that I propose calling the base case cash flow partnership.

- The partnership is for value creation in the commercial markets.

- The base case supports capital formation by programming performance to stabilize investment return expectations.

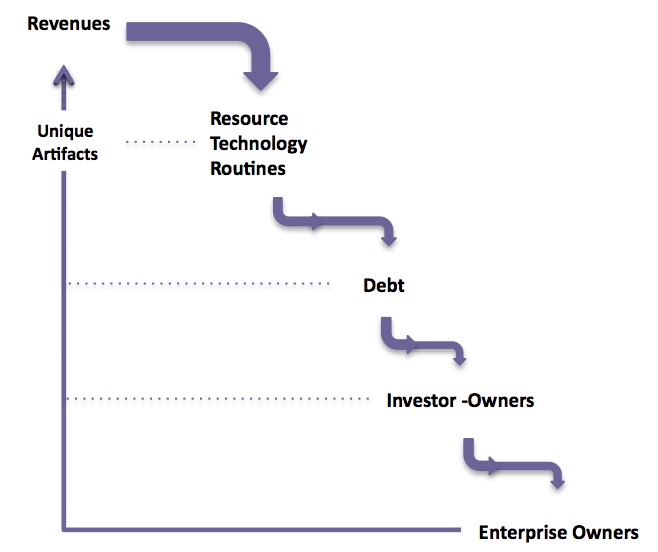

- Cash flow provides returns, to Investment and to Enterprise, based upon their pre-agreed positions in the cash flow waterfall.

Institutional investors invest for the long-term. They value safety of principal and predictable performance. The base case uses contracts and commitments from diverse parties sharing a vested interest in the success of the Enterprise to program commercial performance and stabilize financial return expectations.

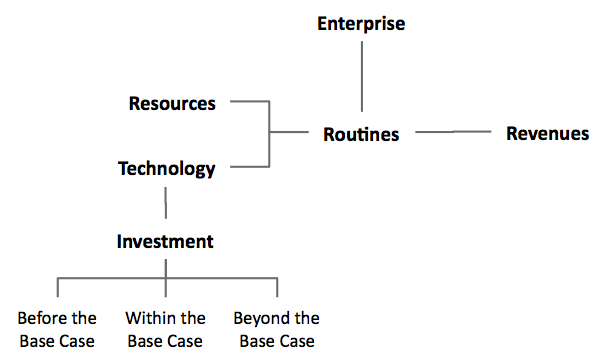

There are three phases to investment in a base case cash flow partnership.

- Before the Base Case, commitments are not yet secured, and performance is not yet programmed. Investment must deal with the uncertainty associated with this work of constructing a stabilized Base Case, and will need to be rewarded with premium returns for participating in this uncertainty

- Within the Base Case, the Enterprise performs on a pre-programmed basis, generating stable, steady cash flows that pay returns of and on Investment. Investment will be priced as appropriate to the degree of predictability actually built into the Base Case.

- Beyond the Base Case, the gloves are off! Investment has been repaid both principal and profit, and its continued interest is residual sharing in additional value that is created by the Enterprise, as the Enterprise determines to be best, at the time, and under the circumstances then prevailing.

Organizations must think of Investment as being associated with specific configurations of technology/assets that are dedicated to performing in a pre-programmed way at least to the limts of the associated contracts and commitments that stabilize the Base Case which provides returns to Investment.

Organizations must use modern technologies for information and communication - computer, the Internet, email, the World Wide Web, etc. - to engage directly with Investment in discussions around a range of interests that affect returns, and return expectations, through participation in a sustainably recurring flow of cash through a pre-agreed cash flow waterfall.

Organizations must pay out profits to Investment currently, as they are earned, in accordance with a pre-agreed sharing formula. If money is needed to support a new Enterprise, new Investment must be raised through a new base case cash flow partnership.

This will better align the ethos of the organization with the natural ebb-and-flow of commercial exchange (instead of the go-go-go of the Capital Markets) and improve its ability to stay focused on the future, and the challenges of tomorrow, rather than getting embedded in the past, reliving the successes of yesterday.

It will also empower alignment of interests between Enterprise and Investment along multiple points of interest that may include replacing short-term goals with longer term sustainability.

- Identify a new business venture that can be structured into a base case partnership.

- Engage with experienced Project Finance Lawyers to build the partnership, property and contract rights that Institutional Investors will accept as stabilizing Investment return expectations

- Reach out to the largest - and most sustainability-minded - Institutions currently invested in the organization and invite them to discuss an alignment of interests as partners in the partnership.

Start small. Then step-and-repeat.

You need to register in order to submit a comment.