Hack:

Reforming the Performance Management Systems – The Virtual Purpose Equity (VizPity©) Exchange Way!

A recent study by the economists from MIT, UOC and CMU, suggest that financial incentives, no longer are the primary motivational drivers of increasing business performance, especially when it comes to the knowledge driven organizations of the 21st century. The same study also goes on to say that sense of purpose, mastery and autonomy are the top three emerging motivational drivers of the high performance organizations -as masterfully explained by Daniel Pink, in his animated presentation (http://blogs.forrester.com/nigel_fenwick/10-06-09-autonomy_mastery_purpose_motivation_your_it_staff). What does this tell us? The traditional monetary motivation driven “performance causal value chains”, that were designed for the 20th century organizations, do not seem to be working well anymore - and so, the need of the hour is, an alternate, free market capitalism driven, performance causal value chain exchange model called Virtual purpose equity exchange(VizPity© as part of our larger VizPlanet™ Platform) providing the ability for organizations (and its employees) to align, trade, motivate, exchange, enhance, energize and execute their human capitals (the single most important capability of 21st century organizations), with a primary goal of increasing the performance (and value) for all of its stakeholders, much more effectively than their competitors.

Purpose Equity, the primary equity traded within this purpose equity exchange, is made up of three value components(functional value + emotional value + purpose value), whose individual scores are aggregated to form the purpose equity index – thus enabling all the players to actively trade their purpose equities – where every employees, teams, business divisions and even companies can come together and coniniously evaluate and trade each other’s purpose equities throughout the year, against their pre-established objectives, (and against their self evaluated purpose equity scores) on a week by week basis, so that this purpose equity stock exchange, can eventually become the primary performance platform of choice for employees and employers, to hire/fire/promote/retain/exchange/reward everyone in proportion to their composite purpose equity index, at any point in time of the year.

With the fact that human capital seems to be emerging as the single most important capability asset within knowledge value chain driven corporations, there is an increased consensus among the experts that the traditional performance management systems, that were designed for the 20th century, are not working well anymore. This is part of the reason - some experts have even gone to the extent of asking large corporations, to get rid of the year end performance appraisal ceremony, as it has become a subjective exercise, that is designed to play favorites in some organizations. Interestingly enough, insights from the MIT/UOC/CMU study, has reaffirmed this thinking and so, it is time to reframe the performance management problem space(as listed below) to find alternate solutions

- Mechanical type repetitive jobs’ performances have direct correlation to monetary benefits, only when money is the primary motivational factor.

- Cognitive knowledge economy driven jobs have negative correlation to monetary benefits. In other words, current performance causal chains (money->motivation->performance->value) do not seem to work well for knowledge economy driven cognitive jobs.

- While the descent monetary benefits are crucial to drive people to perform at a certain level - after that certain point - purpose driven motivational factors (like sense of purpose, autonomy and mastery), seems to be the deal breakers, especially when it comes to cognitive knowledge economy jobs.

The traditional monetary motivation driven “performance causal value chains”, that were designed for the 20th century organizations, do not seem to be working well anymore - and so, the need of the hour is, an alternate, free market capitalism driven, performance causal value chain exchange model called Virtual purpose equity exchange(VizPity© within our larger VizPlanet™ Platform), providing the ability for organizations (and its employees) to align, trade, motivate, exchange, enhance, energize and execute their human capitals (the single most important capability of 21st organizations) with a primary goal of increasing the value for all of its stakeholders, much more effectively than their competitors.

At a high level, our purpose equity has three components, in the form of three value creating sub equities that are traded, based on their future possibilities and aspirations (like stock equities), and not just based on current monetary compensations!

- Functional value - with its cash and its equivalents driven value possibilities (base pay, bonus, stock options, benefits, etc) that drive business performance (i.e. designed to provide the descent monetary security for the employees).

- Emotional value - with its grades, levels and titles, status etc driven value possibilities driving business performance.

- Purpose value - with its purpose driven value aspirations that are quantified using the following five KPI’s (three KPI’s from the MIT/UOC/CMU study and the remaining two from our research).

- sense of purpose,

- sense of autonomy

- sense of mastery

- sense of belonging

- sense of loyalty

With the fact that “functional and emotional value possibilities” are well understood within the realms of traditional performance value chain models, the “purpose value aspirations” (with its five KPI’s) seem to be the missing link here– and rightfully so, out of these three, purpose value aspirations, is the one that stretches the human capitals (or employees) to trade themselves as the “passionate trading entities” within this purpose equity exchange.

With that said, if CK. Prahalad and Gary Hamel had to write the foreword for our article today, they would say that “creating the purpose equity stretch, a misfit between CA enabling possibilities (functional value + emotional value) and aspirations (purpose value), is the single most important task faced by the 21st century organizations, to increase their Purpose Equities”. In other words, if we had to write a purpose equity stretch equation representing the misfit between these possibilities and aspirations, it would look as follows -

Purpose Equity = Functional value possibilities+ Emotional value possibilities + Purpose value aspirations

For many organizations, "increasing this purpose equity" means just pursuing opportunities that fits their functional and emotional value chain possibilities only. While it is the step in the right direction, there exist another approach in which "stretch" can supplement fit, and stretching this purpose equity to bridge the chasm between organization’s futuristic performance (and thus value) aspirations and current possibilities, in the form of purpose equity goals. This is where the five purpose equity motivational driver KPI’s (stated above) can be leveraged to stretch organization’s current functional & emotional possibilities in the following five basic ways to increase their purpose equities within this VizPity exchange platform.

- Concentrating on these five purpose driven KPI’s as a compliment to the functional and emotional possibilities KPI’s.

- Targeting the high impact initiatives needing purpose equities and staffing those initiatives with the high purpose equity possessing resources, thus increasing business performance.

- Complementing purpose equity driven initiatives with mechanical functional/emotional value based initiatives.

- Supplementing functional and emotional value driven initiatives with high visible purpose value driven initiatives at the employee, team, business division and even at the corporation level.

- Recovering from purpose value initiative missteps as quickly as possible.

How it works?

%20Trading%20Platform.jpg)

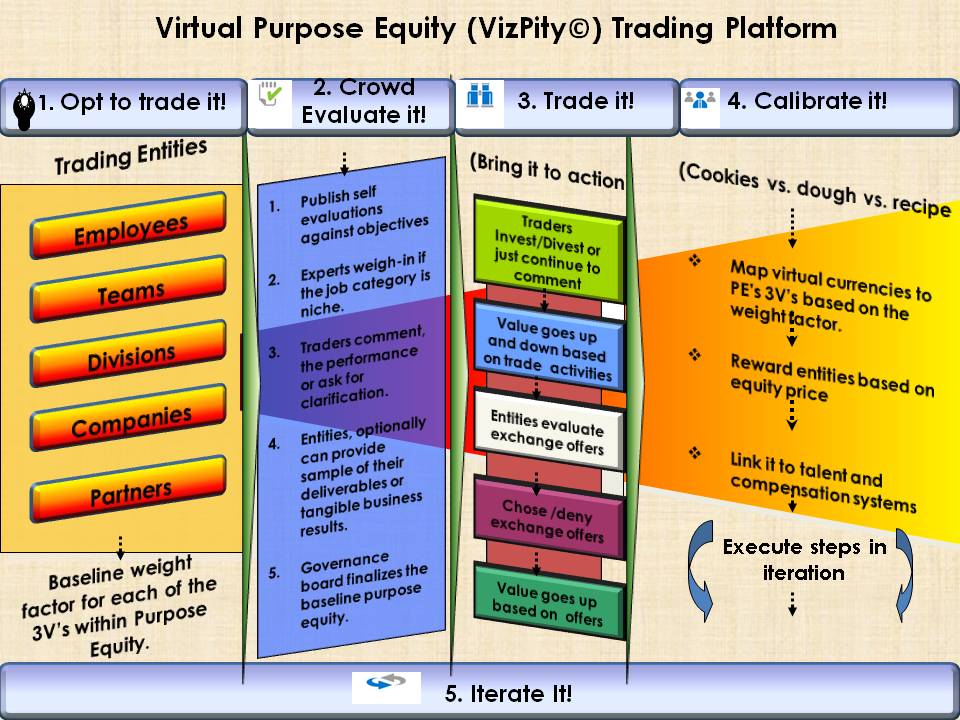

With that said, we hear someone saying - how does this exchange enable the organizations to execute these five steps intuitively? The answer lies in transparency - as those organizations who execute these five steps, transparently, stand a very good chance of increasing their purpose equities, as transparency driven purpose equity activities gets noticed by active traders within this exchange, who then end up driving the value of those equities higher and higher, based on the outcomes from those purpose driven activities. With that said, we have listed the following 10 steps as the “day in the life activities of purpose equity exchange” from operations standpoint as further summarized in the picture above-

- All players have equal access to the exchange and accordingly, they all will be given a certain amount of baseline virtual currencies (perhaps in proportion their current compensation) during registration.

- All entities (employees, teams, divisions and companies) can opt to trade themselves, invest or divest – and/or collaborate through comments (or likes in the terminology of social media), to accurately evaluate each other’s performances. Each entities have the option to remain anonymous in order not to play favorites (i.e. not scratching each other’s back), thus enabling free flow of comments and scores (qualitative and quantitative evaluations) regardless of the grade, title and/or hierarchies of the entities, as further explained in our firm’s trademarked Power through Collaboration (PTC) process.

- Entities cannot invest their dollars on themselves.

- Each entity’s pre-established objectives and self evaluations are initially screened and approved by the overarching purpose equity governance board, just to make sure, they are understandable using an easily understandable language, thus communicating the value of their equities in a best possible manner.

- Approved equities get to the open crowd sourcing evaluation stage – as driven by our PTC process. All entities can evaluate each other and/or invest/divest on equities based on their future possibilities and aspirations, very much like how stocks are traded, based on their future potentials. If a self evaluation of an entity turns out to be too technical and/or too niche, the governance board can ask a team of experts to weigh-in and explain the potential of those niche entities and their future potentials (i.e. possibilities & aspirations), so that the traders can understand their potentials based on the credibility of those experts - and invest on them accordingly.

- After the crowd sourcing evaluation stage, most invested and weighed-in entities are further evaluated by the governance board and approved to enter the trading stage – of course, after the consent of the respective employees, teams, divisions and/or companies as the exchange also provides an avenue for entities to opt out of self trading, as intercompany trading can become little sensitive. This is another reason we have moved the inter company trading to next phase, as lot more collaboration and agreement needs to be established from the standpoint of KPI’s. During the next phase, we will expand the foundational platform across the company and country boundaries.

- As the entities get trade offers, entities can opt to change hands or stay put. Depending upon their decisions, their equities price keep going up or down in the following fashion

- The entity’s original equities keep going high based on invest/divest exchange offers from multiple teams and/or from other entities who are high in the hierarchy.

- The investors get a dividend as a percentage of investment as the entities get actively traded in the exchange.

- The experts/advisors who chimed-in to clarify and/or enhance the performance of the entities will also get royalties based on their comments (or likes).

- Those equities that are not actively traded will be given an opportunity to enhance to improve their equities through training, mentoring and alternate assignments. In other words, the exchange also will be linked to the internal talent management systems in a closed loop manner.

- Those equities that are actively traded are also given career counseling in terms of pursuing their dreams in alignment with their purpose goals and company’s purpose goals etc.

- At the end of the year, the year-end calibration happens – and this is the time all entities, investors and expert advisors are rewarded based on year-end price (which then is translated to purpose equities based on the predetermined mapping between virtual currencies to purpose equity’s three value components (functional value+ emotional value+ purpose value). Depending upon the weight factor among these three components (as agreed by employer and employee), the company will distribute the award to each entities. For example, those employees who have opted higher weight factor for purpose, will get the opportunity to work on high profile purpose driven, highly cognitive assignments as opposed to those who have opted the lower weight factor.

- With a fact there is a big debate happening within the business world, as we speak, whether to get rid of the current “favorite playing, highly subjective” performance management processes, our approach provides an alternate, free market driven, objective performance management approach that is perfectly aligned with company’s strategic objectives, overall performance and above all the business value.

- With a fact it is designed around free market principles, the solution can be easily integrated with any free market principles driven strategic planning systems, more specifically, to a framework like our firm’s Triune purpose framework (PDL©, PTV© and PIP©) driven strategic planning framework (which is being derived from 3 nature’s principles + Kaplan/Norton’s BSC perspectives + our firm’s purpose perspective) – thus paving the way for an end-to-end free market principle driven Enterprise Performance Management System.

- Our approach also helps companies to rethink their internal compensation systems as it can be directly linked to company’s internal performance compensation systems in a causal chain relationship.

- In addition, this approach also can be easily linked to company’s talent management systems facilitating the way for promotion and succession planning.

- Last, but not the least, this model eventually has the potential to revolutionize the recruitment industry, and can become the primary yardstick for hiring the best talent across both company and country boundaries.

- Pitch this new approach with experts, including the leading human capital practitioners and build agreement on the larger idea.

- Take baby steps and implement first within a team and/or division within a large corporation and prove the viability of the VizPity© Platform and measure the success with well defined KPI’s.

- Slowly build the momentum at the company level and make this as the platform of choice for performance management, talent management, succession planning.

- Influence Wall Street and see if the concept can be linked to the stock exchange market in real time?

- Take the concept to global.

As we all know performance of every individual is highly essential as the success of the organization completely depends on it. Performance management is completely to focus on the work of the employees, retro management is being done, and this performance management will developed and develop holistic performance measures would be done.

Performance coaching

- Log in to post comments

Charles Prabakar,

This is a smashing post and I agree with your conclusions. The hack gives a new perspective on the importance of inner motivators and their overriding importance over external ones. Money is an external motivator and is a transitory motivator as well; besides it is a relative one. A sum of money might be great to someone, but little to another person.

I liked your smashing graph and the classification of motivators. The hack gives us a lot to think about.

- Log in to post comments

You need to register in order to submit a comment.