Hack:

Wisdom of Crowds to Empower Beyond Budgeting

The idea of our hack wants to challenge the highly unconscious, but nothing less dominant dogma of heroic leadership, epitomizing the command and control management model. Our offered solution counteracts this dogma, that the ones at the top are the best, know the most and solely making wise decisions.

We don’t think we need heroes anymore now and in the future. The paradigm shift we propose is to abandon heroic leadership for servant leadership. We need leaders and managers who want to serve and support the organization. Servant leaders serve their employees, so that the employees are able and want to contribute their best to the customers and the organization with their capabilities, engagement and passion. In the approach of beyond budgeting/prediction markets leaders are regarded as social architects.

Empowerment and the abandoning of fixed budgets make enterprises more effective. But this kind of planning is always dependent on recent forecasts. Wisdom of Crowds with it's "tool" prediction markets can provide these data and render the Beyond Budgeting approach even more attractive.

Just how happy are you with your business forecasts after the first few months of the year? Do you again need to adjust your planning because your targets do not reflect reality, and are in urgent need of some more financial resources for investment? If you, too, are up against a system of fixed planning and controlling, you are not alone. Many managers perceive classic budgeting as a pointless ritual that no more lives up to the continually fast-changing parameters – economic crisis, new customer demands, increased regulation.

Such a management approach with decentralised leadership and planning without fixed annual budgets (known as Beyond Budgeting) uses relative, self-adjusting goals. The idea behind relative, self-adjusting goals compared to competitors or peers is quite simple and just wants to absorb today's dynamic and competitive conditions. Because it is more important for a company to have sustainably better results than your competitors than to exceed internally bargained, short-term budget targets. That is how it works in many sports, e.g. high-jump, you don't win if you put the target yourself on 2.30 meter but your competitors jump higher, you can not win with such a method of goal setting. In high-jump if you want to win, the goal must be to beat your competitors, that is exactly a self-adjusting, relative goal compared to your competitors. Even though you have to train very hard, maybe along a plan to get better continuously; maybe you even train more and better with this relative goal; the real champions in sports definitely accept this kind of challenge.

To work with self-adjusting, relative goals in the business context you need a reliable and extremely dynamic planning tool. So-called prediction markets act as measures of tapping into the knowledge of employees more effectively. The information technology company Hewlett Packard, for example, uses this instrument to assess the sales figures of their printers, Siemens Austria to estimate the duration of software projects.

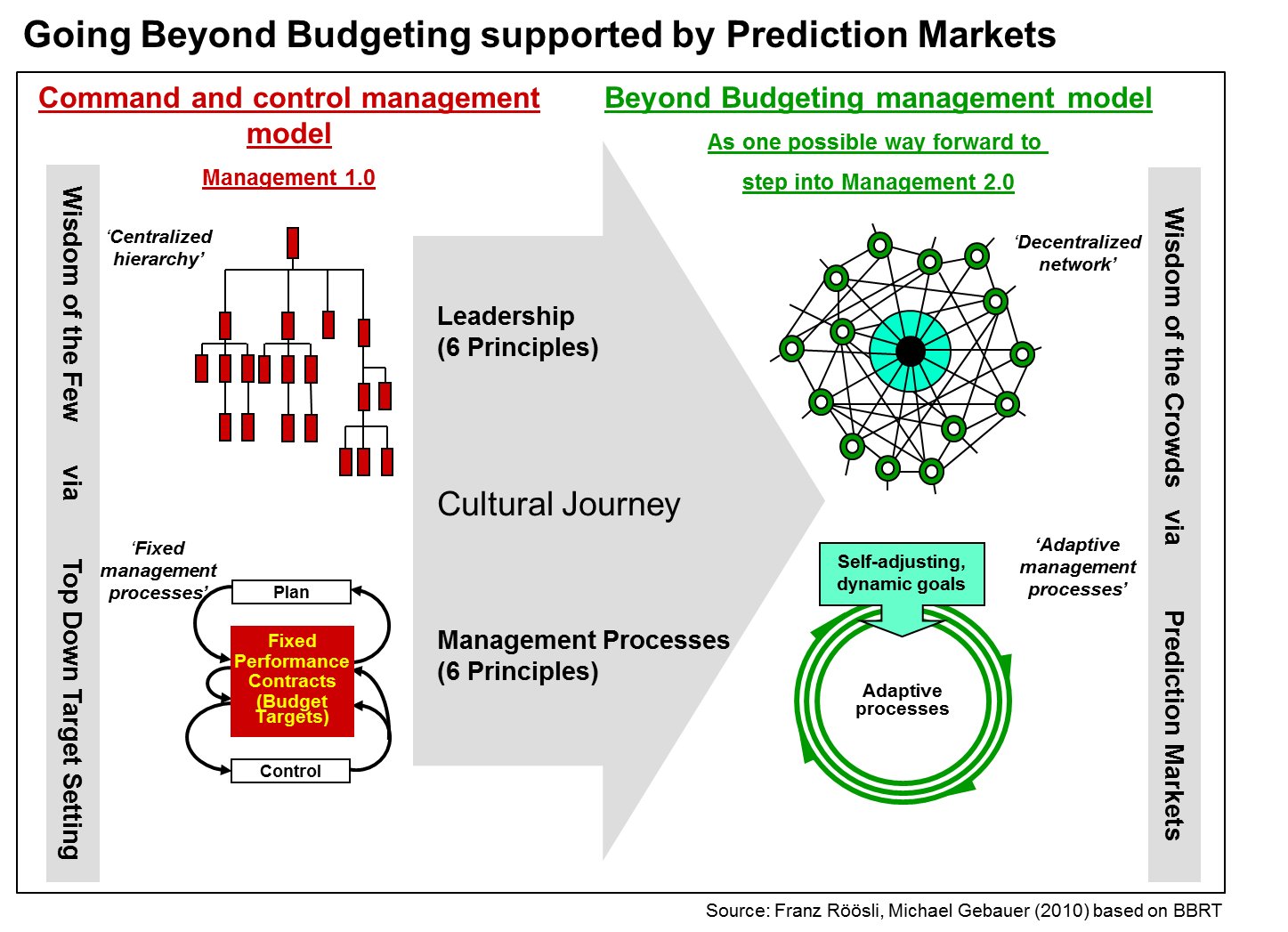

In our view the beyond budgeting approach supported by prediction markets may be a way forward to step into Management 2.0. The figure just below tries to illustrate the contrast between the ‘command and control management model’ or in other words ‘Management 1.0’ and the beyond budgeting management model, regarded as an opportunity to go into ‘Management 2.0’ mode.

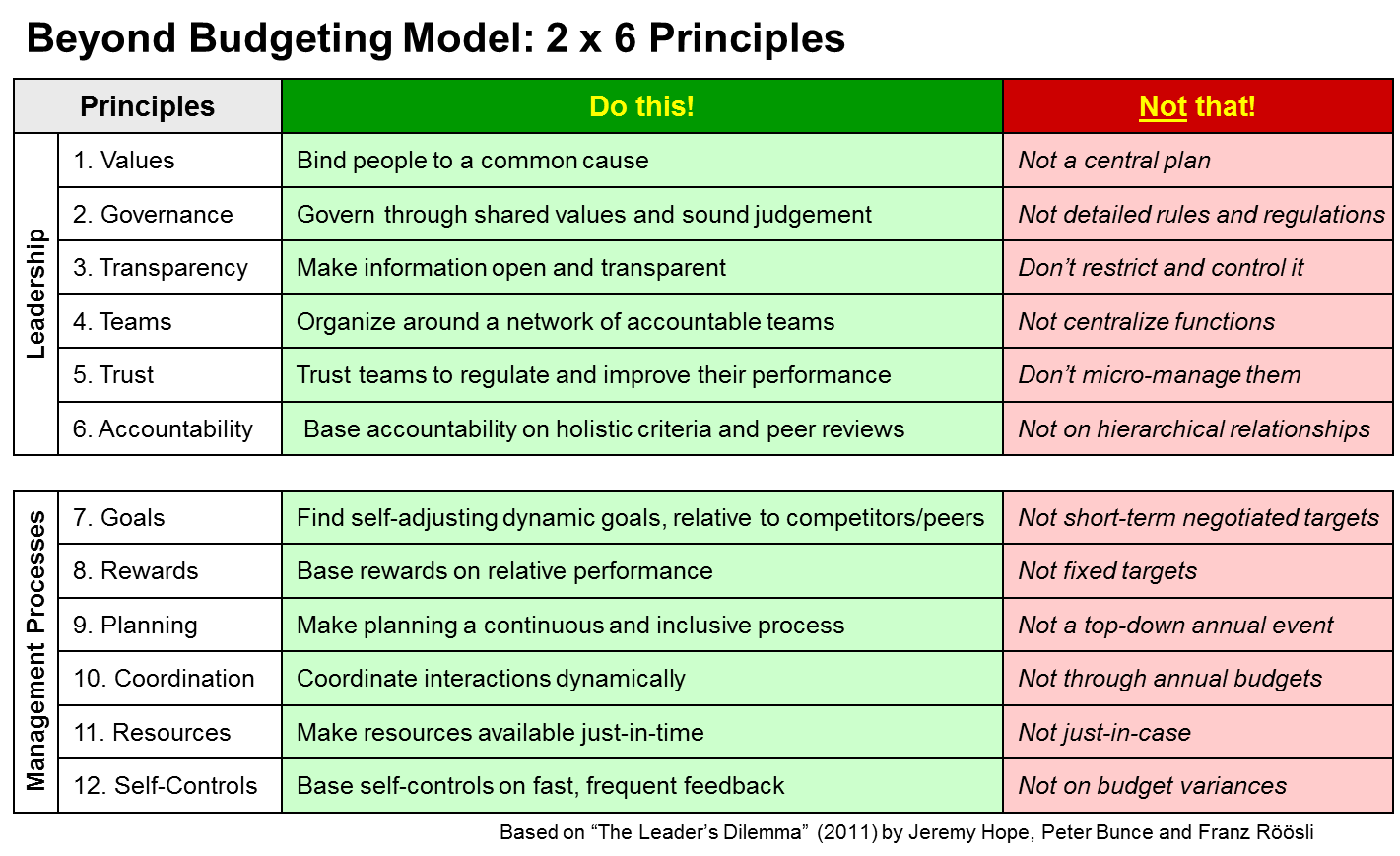

Therefore to change from a format of Management 1.0 to beyond budgeting means to transform the management model. To implement beyond budgeting combined with prediction markets is not a tool project. It is a transformational initiative, a cultural journey. The philosophy of Beyond Budgeting as a holistic, coherent management model with twelve principles - 6 for decentralized leadership/organization and 6 for adaptive management processes:

To illustrate the beyond budgeting model a bit more in detail let’s discover the Svenska Handelsbanken case:

The underlying concept behind the Beyond Budgeting leadership/organization principles is radical decentralisation. The organisation revolves around the customer and no longer around products and shifts away from static hierarchies to a flexible network of highly autonomous units. The consistently high profitability of Nordic bank, Svenska Handelsbanken, is the result of it focusing, for example, on customer satisfaction instead of product volume and market segment targets. There are no centrally organised product campaigns. The bank does not measure the profit or loss of its products, but instead focuses consistently on customer-profitability. Derived from this strong customer orientation, the leadership and organisation is based on empowerment and responsibilities are distributed deeply throughout the organization. Decisions are taken as close as possible to the customer (i.e. in branches), which means they are made quickly, competently and at low cost. Over 50% of Handelsbanken employees have their individual lending authority. Internal suppliers of services have to live up to their customers’ requirements – and not follow some functional hierarchy. As a result, the organisation becomes even more decentralised.

Highly decentralized network-like organisations need appropriate, coherent management processes to support them. Beyond Budgeting with its management process principles in this respect emphasizes adaptability. The fixed performance contracts, which is nothing else than the rigid budget-targets, are abandoned. It is of critical importance not to set fixed targets in form of budgets in advance, against which to measure an employee's performance. In place of them, relative, dynamic goals help the employees themselves to compare and self-control their performance with the benefit of hindsight against competitors in their markets and peers within the bank. Handelsbanken’s prime corporate financial aim is to achieve a higher return on equity than the average for its Nordic (including the UK) competitors. This kind of goal is an example for a relative, dynamic goal, or in other words, a self-adjusting goal. For the past 40 years, it has always succeeded in surpassing this goal. Bonus payments are distributed to employees in the form of profit sharing, based on the actual achievement of this relative goal. No individual incentives for fulfilment of plans exist. No fixed annual plans are made, because, instead of a static budget, planning is a continuous rolling process, which allows dynamic coordination and the use of resources according to need. This management model, in Handelsbanken’s opinion, is the key to its sustained success. Its cost to income ratio has long been under 50 per cent, which is the lowest among Europe’s largest universal banks. As well as the bank consistently has more satisfied business and private customers than the average of its competitors.

The philosophy of Wisdom of the Crowds and Beyond Budgeting are in an ideal fit, both directly addressing the involvement and engagement of the many (instead of the few) and providing dynamic, flexible management processes with fast and up-to-date information (instead of fixed processes and outdated information).

As an example think of a company that is discussing five different products to be developed for future markets. In the old Management 1.0 structure every head of the product idea would start bargaining with the decision maker to get as many resources as possible for his own idea. All five product ideas would get a designated budget. The decision of the allocation of the resources is dependent on the bargaining capabilities of the product heads and the decision making capabilities of one or just a few decision makers, and therefore definitely suboptimal.

Instead you could use the wisdom of the crowds and ask with the help of prediction markets “How many pieces of product x will we sell until …?”, “What average price will we be able to come up with?” and “When will we be able to start marketing the product?” Just invite all your employees to participate in all markets. You will see that “self selection” is the best way to decide who will answer which question: People who are sure to have good information about question A will try to answer this one, people with knowledge in question B will go there. Just let the “experts” themselves decide where to be an expert. They will focus on those questions where they think to become a winner in the prediction market game.

The reliability of the so-called first-generation prediction markets was based on participant's at least elementary understanding of trading. Second-generation prediction markets do not take this knowledge for granted. The "traders" just enter their actual prediction. These new systems look more like a regular poll, although the participants are always able to adjust their opinion. Algorithms in the background simulate buying and selling by every new prediction that is entered of one of the participants, and calculate the overall forecast based on all "trades".

Furthermore you don’t have to think about the best time for a poll. The markets are open 24/7. Let your experts decide when there is the right moment to contribute. Whenever they achieve information that is relevant to one of the questions, they will go to the markets and change their prediction. The only premise to run a prediction market is the quantifiability of the question. So you can forecast "hard facts" like turnover, pieces sold, or prices reached. You can also forecast operating figures like ROI, produced pieces per hour, or warranty cases per 1.000 produced products.

You can even run a prediction market as a kind of a seismograph e.g. for customer satisfaction. If you use a figure or a grade as the result of your analysis, just ask your staff "what - do you think - will be the result of our next customer satisfaction analysis?" This "market" always gives you insight in the collective opinion of your staff. And, the market reacts immediately on your management decisions. Whenever a management decision has impact on the customer satisfaction, you will see that in moving forecasts for the analysis - positive as well as negative.

Your employees may participate in the prediction markets because there could be a chance to win a price. Or just to gain reputation by being a better forecaster than their peer group. But most of all they will participate because their part of the decision making in the company. Their opinion is finally asked for. So you get a rolling forecast that is always as actual as all the information that is available within the decentralized network. Your employees may participate in the prediction markets because there could be a chance to win a price. Or just to gain reputation by being a better forecaster than their peer group. But most of all they will participate because their part of the decision making in the company. Their opinion is finally asked for.

Both approaches combined allow for a better satisfaction of the demands of the clients and thus the creation of a transparent and flexible enterprise. A perfect example for this suggestion does not exist to date. Pioneers like the financial services provider Svenska Handelsbanken, technology and synthetics specialist W. L. Gore, air carrier Southwest Airlines, construction tools supplier Hilti or the internet concern Google, IT specialist Hewlett Packard (HP), engineering firm Siemens and technology enterprise Hoffmann + Krippner, focus on either Beyond Budgeting or on information markets. We are not completely satisfied with this solution, and, with our proposal, plan to go one step further and to provide an important new approach.

Beyond budgets

An adaptable organisation, increased customer proximity and employees thinking as entrepreneurs, cannot be decreed by the management. Instead, the companies should part with traditional hierarchical management systems, as postulated by Gary Hamel in his article “Mission: Management 2.0” (see Harvard Business Manager, April 2009). The abandonment of budgets is only a symbol for a fundamentally different understanding of leadership requiring much more individual responsibility from managers and employees.

W. L. Gore, the technology and synthetics specialist mainly renowned for its famous Gore-Tex material used in functional clothing, shows, for example, the significance of a consequential implementation of this approach. The US company has largely done away with hierarchies and formal titles and whoever wants to promote a project must convince his colleagues to support him. Together they are responsible for the success of the undertaking. Top managers are not superiors but so-called natural leaders and sponsors of the projects they support with their advice. For someone to take over the role as executive he needs the trust and advocacy of his colleagues. Fixed budgets and directly linked remuneration do not exist. Everyone obtains a predefined percentage of their salary in the form of company shares. This, too, increases the necessary group dynamic which helps promote individual ideas and projects that contribute to the corporate success and the fulfilment of customers’ demands.

Reliable information

The members of such a networking organisation, of course, do not act independently. They also have to know of customer demand for their products, allowing them to purchase the right amount of goods for production and marketing. Beyond Budgeting does not imply an end to planning, but planning with other means and targets.

But from where do the necessary and, more importantly, reliable data originate? They are provided by prediction markets as shown by the example of Hoffmann+Krippner. The medium-sized technology enterprise from the German Odenwald region produces membrane keyboards that also function in damp or dusty environments. The management has created a prediction market to enable a quick reaction to changes and to evaluate price trends and sales volumes. In this market, the employees trade with virtual shares representing certain expectations about prices. The share certificate A, for example, can reflect the expectation that the new keyboard for dental practices will reach a higher price than expected; share certificate B represents the view that the prices will be lower. According to the expectations in the development of prices, the employee will buy or sell share certificates A or B. Should many of them assume that the proposed prices are too difficult to implement, the value of share A will fall and the market value of share B will rise.

In this way, the management of Hoffmann + Krippner can quickly perceive how the staff assesses the price trends. These forecasts are amazingly reliable because the prediction markets pool the knowledge and collective intelligence of all the parties involved remarkably well.

Combined force

Where rigid periodical budgets have been given up managers and staff have constantly to adapt their planning. Every plan is only as good as the information on which it is based. The more people contribute their knowledge, the better. But classic instruments and procedures fail to function in a rolling planning process. Therefore, prediction markets are an ideal complement to Beyond Budgeting because they can provide fresh daily forecasts with little effort. At the same time, these markets reinforce the individual responsibility of the workforce because they realise that its knowledge is in great demand and that their opinions matter. This, in turn, boosts the Beyond Budgeting approach based on individual initiative and entrepreneurial action instead of hierarchical management.

Instead of the fixed plans for one year, bargained as budgets in the budgeting process, in a Beyond Budgeting context planning becomes dynamic, e.g. to plan every quarter of a year always for the next five quarters ahead. And the information that goes into this rolling plans are based and supported by the know-how of the many through prediction markets on whatever crucial planning figures it is needed, e.g. market share, revenue development, cost development, project duration etc. And whenever it is needed and whoever requires it.

As a result this kind of planning addresses three interrelated, fundamental requirements in today’s conditions:

- It is dynamic. You plan in a rolling mode (e.g. every quarter or event driven) and you don’t’ plan against a ‘wall’, the wall of end of year. Instead, you continuously plan with a constant time horizon in front of you, e.g. five quarters of a year. As an analogy you have stable headlights to move forward (in contrast to ever shrinking headlights within a traditional budgeting context moving against the year end wall, with an ever shrinking time horizon in form of the imposed budgets.

- The quality of planning data is high because it is an inclusive process by involving the intelligence of the many through prediction markets.

- It is unbiased, because nobody is incentivized on fulfillment of plans ('no carrots in front of the mouth').

In addition, the prediction markets increase the transparency within an enterprise because all partners involved are in possession of the same information and there is no longer distinction between different levels in the company.

In this way, the markets also help to increase customer orientation. Should some of the virtual shares represent the outcome of the next study on customer satisfaction; this will have a self-enhancing effect. The placing of such shares shows the employees the importance of customer satisfaction. They will increasingly and more intensively deal with the question of what customers think and want. It is only in this way, that from their point of view can they buy or sell the appropriate shares. Like this, the knowledge of customers can be enhanced - a prerequisite for fulfilling their requirements.

The combination of Beyond Budgeting and the information market approach opens up encouraging possibilities of making an enterprise an engaging place to work for and more adaptable, and sustainably successful. Precursors that profit from this management innovation are now in great demand.

To start with beyond budgeting combined with prediction markets you don’t have to start on company level. It is possible to initiate a transformation towards the beyond budgeting principles in every organizational unit, with a management team of that unit which is truly willing to do it and to engage actively. Size of the organizational unit does not matter. The most important factor is to apply it consequently within the unit. Consequently especially means: coherently with a holistic, full vision in terms of the transformation. Just to pick and mix parts of the concepts which are most attractive does not work, as we have experienced already with the beyond budgeting model. You would build an incoherent system, which would not be viable, as an analogy you may take the saying‘you can’t be half pregnant’.

To possible higher levels, of course, you still deliver what is demanded. This is absolutely possible in a beyond budgeting/prediction markets context of your own organizational unit. In other words: Upwards you report classically (command and control) downwards or maybe better within the organizational unit you apply beyond budgeting/prediction markets.

For example one avenue you could consider is setting up a "management experiment," with an experimental unit and a control group (which could be a similar unit not exposed to beyond budgeting/prediction markets). You could then observe and judge differences in terms of engagement and satisfaction of participants, customer enthusiasm, quality of decisions, innovation ratio—and surely draw some pretty stark conclusions. Being successful in an organizational unit with such an experiment, making further experiences and adjust for improvements down the road, it will be the fundament for scaling the philosophy company-wide. So these are the steps:

- Figure out your Key Performance Indicators

- Stop all complex Budgeting Processes

- Implement Prediction Markets on KPIs

- Use the date of your wise crowd for rolling forecasts

- Become much more flexible and therefore competitive

Using engagement and wisdom of employees in order to create an inclusive, adaptable and effectively informed company instead of managing a company with (out-dated) fixed budgets like the hack tells, is an original and highly promising approach. It is time to systematically empower employees, involve their wisdom in the organization and go beyond budgeting and rigid objectives – the hack smartly reflects a combination of two highly innovative approaches (information markets and beyond budgeting) which leads to an unprecedented, emerging opportunity to experiment to start the transformation from a mechanistic, budgeting based command and control organization to a human centred, adaptive living system approach.

- Log in to post comments

A neat combination of two ideas, that makes sense. It seems to me that prediction markets are essentially intended to be ways of accessing employees' honest views, sufficiently to make better decisions. I wonder what the conditions are for this to succeed? When is a prediction market the best method? Whose voices don't get heard, and does that matter?

It also makes me think about other uses for prediction markets, in place of (or in combination with) other methods of canvassing opinion such as employee surveys, suggestion schemes, social media...

- Log in to post comments

Thank you for your comment with your questions. We have tried to answer them together with the questions by Michele Zanini (especially answer to question 1) , see our comment by July 12th.

Many regards

Franz and Michael

- Log in to post comments

This article is an excellent introduction to how to move away from the traditional "command and control" way of managing to an "adapt and endure" approach whereby power and responsibility is devolved down to the front line units. Experience is showing that organizations that do this have much higher customer satisfaction and sustainable profitability over the long term. The fear is losing control, but this control is largely illusionary. The approach outlined here provide much better forward looking information enabling a better understanding of the business. This is a direction that the Beyond Budgeting movement has been developing for the past 13 years and fully endorses the work of Gary Hamel.

- Log in to post comments

Michael and Franz, thanks for sharing this great hack. I really like the fact that it embeds prediction markets firmly into a 21st-century budgeting process, substantially increasing the odds that such markets will have a deep and enduring impact on the way a company plans and allocates resources.

The hack left me inspired but also very keen to understand in more detail how the combination of beyond budgeting and information markets would work in practice. I, and I bet many other MIXers, would find very helpful to get your specific thoughts on two fronts:

1. The "solution" itself--could you provide a hypothetical example of how your hack could work in a company--say one that has neither beyond budgeting nor prediction markets?

2. The "first steps"--could you provide some additional advice to fellow management innovators who are interested in trying out this solution (e.g., how could one start experimenting with the core aspects of your hack in a way that makes the case, gathers helpful feedback, and enables it to scale company-wide)?

thanks again--look forward to your input on this

Michele

- Log in to post comments

We try to answer them in this comment along the two questions of Michele, including the answers to Jonathan's comment.

We also have amended the hack itself based on your questions.

Question 1:

The "solution" itself--could you provide a hypothetical example of how your hack could work in a company--say one that has neither beyond budgeting nor prediction markets?

Our answer to question 1:

As we don’t have any data on the assumed company, other than it has not moved to Beyond Budgeting, nor prediction markets, to answer Michele Zanini’s question we try to provide a concrete comparison between a Management 1.0 company and a beyond budgeting/prediction markets company:

As an example think of a company that is discussing five different products to be developed for future markets. In the old Management 1.0 structure every head of the product idea would start bargaining with the decision maker to get as many resources as possible for his own idea. All five product ideas would get a designated budget. The decision of the allocation of the resources is dependent on the bargaining capabilities of the product heads and the decision making capabilities of one or just a few decision makers, and therefore definitely suboptimal.

Instead you could use the wisdom of the crowds and ask with the help of prediction markets “How many pieces of product x will we sell until …?”, “What average price will we be able to come up with?” and “When will we be able to start marketing the product?” Just invite all your employees to participate in all markets. You will see that “self selection” is the best way to decide who will answer which question: People who are sure to have good information about question A will try to answer this one, people with knowledge in question B will go there. Just let the “experts” themselves decide where to be an expert. They will focus on those questions where they think to become a winner in the prediction market game.

Furthermore you don’t have to think about the best time for a poll. The markets are open 24/7. Let your experts decide when there is the right moment to contribute. Whenever they achieve information that is relevant to one of the questions, they will go to the markets and change their prediction. So you get a rolling forecast that is always as up-to-date as all the information that is available within the decentralized network. Your employees may participate in the prediction markets because there could be a chance to win a price. Or just to gain reputation by being a better forecaster than their peer group. But most of all they will participate because their part of the decision making in the company. Their opinion is finally asked for.

Question 2:

The "first steps"--could you provide some additional advice to fellow management innovators who are interested in trying out this solution (e.g., how could one start experimenting with the core aspects of your hack in a way that makes the case, gathers helpful feedback, and enables it to scale company-wide)?

Our answer to question 2:

To start with beyond budgeting combined with prediction markets you don’t have to start on company level. It is possible to initiate a transformation towards the beyond budgeting principles in every organizational unit, with a management team of that unit which is truly willing to do it and to engage actively. Size of the organizational unit does not matter. The most important factor is to apply it consequently within the unit. Consequently especially means: coherently with a holistic, full vision in terms of the transformation. Just to pick and mix parts of the concepts which are most attractive does not work, as we have experienced already with the beyond budgeting model. You would build an incoherent system, which would not be viable, as an analogy you may take the saying‘you can’t be half pregnant’.

To possible higher levels, of course, you still deliver what is demanded. This is absolutely possible in a beyond budgeting/prediction markets context of your own organizational unit. In other words: Upwards you report classically (command and control) downwards or maybe better within the organizational unit you apply beyond budgeting/prediction markets.

For example one avenue you could consider is setting up a "management experiment," with an experimental unit and a control group (which could be a similar unit not exposed to beyond budgeting/information markets). You could then observe and judge differences in terms of engagement and satisfaction of participants, customer enthusiasm, quality of decisions, innovation ratio—and surely draw some pretty stark conclusions. Being successful in an organizational unit with such an experiment, making further experiences and adjust for improvements down the road, it will be the fundament for scaling the philosophy company-wide.

Thanks again for the really well raised questions; it has sharpened also our thoughts about our proposed idea in the hack and hopefully our answers are helpful for the understanding of the beyond budgeting/prediction markets approach.

Further thougths and comments of any MIX'ers would be loved to further develop the idea interactively.

Franz and Michael

- Log in to post comments

Franz, thank you for sharing this great hack.

Let me add some thoughts from my point of view, seeing organizations as living organisms.

Every organism depends on its interactions with its environment. To have a sensory system, that gives us information about what is happening outside is crucial to survive and to direct our energy and actions. In the human body we get continuously millions of informations from our peripheral organs. These informations are always unbiased. They give us informations about the REALITY "out there". This information will initiate our movements and through continuous feedback processes we adjust our actions.

You see there are many analogies to living organisms in the concepts of Beyond Budgeting and the Wisdom of Crowds. But there is something to be added : all informations aren't worth anything, if the "head" / leadership / management is not able or willing to FEEL and accept, what is happening "out there" - this ignorance seems to be one of the biggest problems in our companies and actual world ....

Kindly,

Michael

- Log in to post comments

Franz, thank you for sharing this great hack.

Let me add some thoughts from my point of view, seeing organizations as living organisms.

Every organism depends on its interactions with its environment. To have a sensory system, that gives us information about what is happening outside is crucial to survive and to direct our energy and actions. In the human body we get continuously millions of informations from our peripheral organs. These informations are always unbiased. They give us informations about the REALITY "out there". This information will initiate our movements and through continuous feedback processes we adjust our actions.

You see there are many analogies to living organisms in the concepts of Beyond Budgeting and the Wisdom of Crowds. But there is something to be added : all informations aren't worth anything, if the "head" / leadership / management is not able or willing to FEEL and accept, what is happening "out there" - this ignorance seems to be one of the biggest problems in our companies and actual world ....

Kindly,

Michael

- Log in to post comments

Michael, thank you for your interesting insights!

Your thoughts are leading us to an important barrier concerning such kind of a management innovation as we propose in our hack that we need to address here and also include in the hack itself:

Let’s put it bluntly, one of the biggest barriers to go ‘beyond budgeting supported by prediction markets’ often are the self-interests of (top) leaders/managers of an organization. They are responsible for and in charge of the current management philosophy. That given, they have the power and control in the organization, they get the fat bonuses, they construct company reality (e.g. what is good and what is wrong). So they have very big vested interests to maintain the current management model. This is a classical legacy problem.

Beyond budgeting with its decentralization of power and prediction markets with its new transparency and therefore reality about the world may cause a perception of going against this vested interests: The leaders/managers fear to lose power and control, to lose their influence on the bonus system (beyond budgeting operates without incentives) and they fear to have to change themselves. In other words fear, greed and complacency are real challenges to be taken seriously at the front end of such a transformation of a management model.

Following this line of thought, there is a circularity problem in the issue: The ones (leaders/managers) that are able to decide for such a management innovation like beyond budgeting/prediction markets are the ones that have the least interest to do so, because of fear, greed and complacency. Self-explanatory that these vested interests are not disclosed, they are tabooed and covered with ‘rationalized’ justifications like the culture is not ready, we have not the right people or it is too big a risk. Such kind of ‘rationalized’ reasons are then the ‘case for not to change’.

The good news is that management innovation, e.g. beyond budgeting/prediction markets have not to be started at company level. They can be initiated at any organizational unit, where the energy and willingness is there to go for it. Important is not size of the unit, but leaders/managers who lead the initiative with conviction and wholeheartedly. And last but not least, not all (top) leaders/managers stick to vested self-interests and build up barriers for profound management innovation.

Franz and Michael

- Log in to post comments

- Log in to post comments

Thanks for your comment. It is a crucially important input concerning human nature assumptions you made:

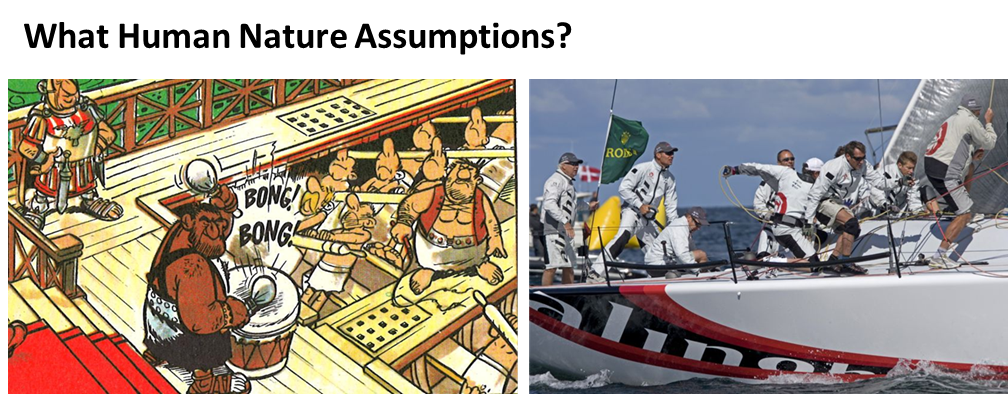

The sociologist Douglas McGregor already 1960 proposed his famous X-Y theory in his book 'The Human Side of Enterprise'. It is a simple and undeniably black and white framework about human nature assumptions in corporate life, yet in our view one helpful way to address and discuss this issue. In a nutshell theory X –assumptions state that people are inherently lazy, not creative and would work only if you force and incentivize them. Theory Y goes for the opposite: People are intrinsically motivated to work, are creative and assume responsibility.

It is not the subject here to judge if people are generally X or Y or a combination of both. Maybe as human beings, we all have “good” and “bad” sides. But we think this is not the relevant question - in fact we are convinced it does not really matter. What matters for an organization is what kind of people and behavior it attracts and gets based on its human nature assumptions. Because the way managers lead and manage a company is always a result of human nature assumptions. It goes without saying that this is the case independently if these assumptions are conscious or paradigmatically unconscious. And the way a company is led and managed always attracts equivalent people and triggers corresponding behavior. It should also be noted that this is a highly cultural issue: The predominant human nature assumptions in any organization heavily determine company culture as one of the most important aspects.

So, if you want to lead your organization coherently, it’s time to think explicitly about human nature assumptions and to make a conscious decision what kind of people and behavior you need in order to ensure that your organization will prosper in the future, e.g. theory X or theory Y. Derived from this decision it is important to design and apply a coherent leadership model. In today’s complex and dynamic world, the so called “creativity age” by Gary Hamel, we certainly think theory Y is way more competitive and viable on the business side than theory X and more human and engaging on the social side. If you opt for theory Y, we recommend beyond budgeting/prediction markets as a leadership philosophy and management model that is aligned and coherent with theory Y. In our thinking theory Y and beyond budgeting/prediction markets add up to a systemic fit to create the requirements for robust viability in the “creativity age” we’ve been heading into.

To summarize our comment in a few words: You always have the employees in your organization, which you (or the organization) deserve. Or let’s put it a bit more provoking: A fish rots from the head down.

Franz Röösli and Michael Gebauer

- Log in to post comments

Hi Franz

Thanks for this interesting hack. This "biological" view of an organization is more adequate than the "mechanical". A network is less vulnerable than a chain, because there are "multiple ways to Rome" in a network. This could be part of an effective risk and knowledge management too. New forms of meetings and communication are needed.

It would be very interesting to develop appropriate management systems for this purpose.

- Log in to post comments

Dear Stefan

With your analogy (the comparison of a network and a chain) you are providing a powerful reasoning why networks handle in a better way today’s prevailing complexity than chains (top-down hierarchies). Networks are more flexible and more creative for appropriate solutions than linear chains of command, where ‘the right to be right’ is monopolized at the top.

Going such a way like beyond budgeting/prediction markets alters the mode of many things in an organization, like meetings and communication as you stated in your comment. Importantly to note is, that there is no recipe or strict protocol how the new forms of collaboration look like, it’s the result of process that is not uni-directional driven from the top, in this way the process is to a certain degree, result-open. Not an easy task for managers with a ‘mecanistic’ view about management and organizations; an option and a potential for entrepreneurs.

Franz and Michael

- Log in to post comments

Hi Franz

Thanks for publishing this very interesting article.

To me your view of next generation management methods and analogies to biological principles sounds very convincing. One main challenge might be how to start the migration path if I am not the CEO of company I am working for. Are there avenues to stimulate the change successfully from middle management or other non-CEO positions ?

Best regards

Volker

- Log in to post comments

in addition to our feedback below to your comment, see also the answer to Aljoscha we have posted on 5th September concerning goals. We do believe to discuss about the methdology of goal setting could be a fruitful way to intitate transformation on company level and also on every organizational unit within the company.

Franz and Michael

- Log in to post comments

Hi Volker

We agree with you that it is a big challenge to start a beyond budgeting/prediction markets initiative not being at the top level of an organization. Our thoughts for initiating such an initiative are as follows in brief:

To start with beyond budgeting combined with prediction markets you don’t have to start on company level. It is possible to initiate a transformation towards the beyond budgeting principles in every organizational unit, with a management team of that unit which is truly willing to do it and to engage actively. Size of the organizational unit does not matter. The most important factor is to apply it consequently within the unit. Consequently especially means: coherently with a holistic, full vision in terms of the transformation. Just to pick and mix parts of the concepts which are most attractive does not work, as we have experienced already with the beyond budgeting model. You would build an incoherent system, which would not be viable, as an analogy you may take the saying‘you can’t be half pregnant’.

Find some more description in our hack under ‘First Steps’.

Franz and Michael

- Log in to post comments

Dear Franz

Thank you for your clear and very important comment from August 2 concerning the basic assumptions about human nature and its interrelation with organizational structures.

Let me add some thoughts about the “Human Side of Enterprise” and its impact on leadership, organizational structure and the “Beyond Budgeting” Model as well as the urgent need for a conscious and clear decision making, involving the picture of the human being we have on our mind.

First let me make a short comment about “good” or “bad” sides in human nature – one of my competence issues, since I have worked as a psychiatrist and psychotherapist as well as in leadership coaching for many years. Yes, there is a lot of destructive potential in human behaviour. And it is absolutely crucial that we can identify and work actively on these personality traits, and not deny them – also in ourselves! But if we want to humanize our organizations we should never accept any active of passive manifestations of destructive behaviour! As rigid – in my opinion- we have to be whilst dealing with destructive behaviour, as rigid we should also be in our conviction, that destructiveness per se is not a normal human behaviour. It is caused by inhuman, “sick” and in many aspects insane social organizational structures. From modern scientific research we know that Darwin was wrong in many of his conclusions about human nature. Today we now that as human beings we have a strong social determination (this isn’t really new, is it? …) To survive, but also to enable active, self-directed and innovative behaviour (in fact, just a part of our survival patterns as human beings), we must be able to interact with others and to build secure, reliable and quite long-term bonding!

Daniel Pink has many very important statements in his book DRIVE (see also the Videos in MIX TV) on the question of human nature. What he describes as Type-I behaviour (quoting intrinsic motivation), reaches farther than Mc Gregors Type Y. Daniel Pink’s “Motivation 3.0” builds on three basic human drives: - Autonomy - Mastery and - Purpose. But these drives, and this is the first point in this comment I really want to stress, are very vulnerable and much more dependent on the kind of supportiveness they encounter, than we usually want to admit.

The second issue I want to point out, is that we must understand, that (concerning intrinsic motivation, engagement and active, self-directed behaviour) there is a on-off principle : if personal engagement is not met by a supportive environment – that is by supportive relationships! – it will shut down immediately and completely. On the other hand, if engagement is met with a supportive manner and if the organizational structures and leadership principles enable autonomous and self-directed action, mastery and purpose will flourish. That’s how Organizational Energy is enhanced.

And that is why it is crucial to make clear decisions concerning our assumptions about human nature on the top management level. From there, all other decisions on leadership development as well as on the organizational and management structures will develop clearly, easily and powerfully. Even change-processes will gain completely different dynamics. “Heroic” leadership is now obsolete – but it will take much more responsibility on behalf of each individual - of each of us!

- Log in to post comments

Dear Michael

Many thanks for your substantial and elaborate illustrations. Your considerations well suit our thinking about human nature.

Particularly we appreciate your raised aspect about the on-off principle. It does even more stress the importance of the decision about human nature assumptions and the subsequent consequences.

- Log in to post comments

Dear Franz

Excellent article - thank you for sharing this hack.

Best regards

Dominik

- Log in to post comments

Dear Micheal,

Excellent monitoring and elaborate conclusions. That's the way of new thinking we all need.

Best regards

Jürgen

- Log in to post comments

Dear Franz and Michael

Great hack and very interesting discussion.

Beyond Budgeting Organisation is a very forward looking, elegant and promising idea to combine entrepreneurial thinking / behaviour with company wide knowledge management and poses therefore a highly dynamic concept to overcome "command and control" philosophy and overly bureaucratic structures which suffocates often initiative and market focused actions.

Beyond Budgeting could set a solution for many companies to better use their internal and external resources, Know How and potential by staying closer connected to employees, clients and changes in a globalized market place.

On a every day basis, I see 3 challenges for all parties in an beyond budgeting organisation which should therefore always be monitored and must be steadily enforced/ensured

1) transparent, lean, quality focused organisational processes….and the awareness that quality always depends on clear, complete, open and respectful communication within an organisation

2) Entrepreneurial, responsible acting upon information, together with all relevant parties . Therefore not only hearing and acting on what one likes to hear but accept inconvenient truths as well and see them as an opportunity not a threat.

3) Making employees to responsible entrepreneurs and giving them the right mix of autonomy, mastery and purpose drivers within a personal support structure. (as Michael stressed), not allowing the human habit of forming dominant groups to enforce ones party self / group interest.

If this can be achieved Beyond budgeting poses a great opportunity to put the true entrepreneurial agenda back in an organisation vs. the pure managerial short term approach which dominates today. It combines the two where it makes sense and leaves out the rest.

In my opinion this poses a roadmap for the future for business today. Hope there are more companies to implement and more to read about this subject in the future. It will be interesting to follow up.

- Log in to post comments

Dear Marcel

Thank you for sharing your well-grounded insights to our hack. We agree to your three points. Beyond Budgeting combined with Prediction Markets is an approach that encompasses the aims you explain in your stated points, e.g. compare principle 3. Transparency, 4. Teams or 6. Accountability in the table in the hack. To get there (Beyond Budgeting/Prediction Markets) is not an easy task and to stay there either; wholehearted engagement from all members of the company is needed. So your three conditions your raise could be taken as a help to appraise progress during the journey to go Beyond Budgeting/Prediction Markets and also as an appraisal support to deepen the philosophy in the culture and to continue on it.

Franz and Michael

- Log in to post comments

Dear Michael, dear Franz,

Excellent development of the hack!

Thank you very much for sharing the sound material on

- the implementation of the two concepts Beyond Budgeting and Prediction Markets in a combined way.

- the enriching discussion about human nature assumptions finding the right leadership/management approach.

- the outstanding idea of self-adjusting goals in a self-organizing system.

All together Beyond Budgeting combined with Prediction Markets build up to a viable, holistic approach that is in contrast to traditional command and control management.

Very best,

Katja

- Log in to post comments

Dear Franz, Dear Michael,

very interesting proposal.

I like the idea of employees being more involved in the company's decisions and goal settings just because of the fact that nowadays the workforce often is not able to identify itself with what the management decides and wants to accomplish. And once there's no identification, there's no commitment, as well. But employees HAVE to be passionate and committed in order to achieve a company's goals more effectively and efficiently. Therefore more involvement is a step in the right direction.

I also like the idea that projects could be based on an employee's idea and his ability to convince his colleagues to execute this idea. This would be a great opportunity for EVERY employee to step out of his "normal" role and evolve to a leader.

Since I have an IT background I know the importance of having good information in order to be able to make good decisions. One of your proposed principles is to make information more open and transparent. That also makes totally sense to me.

One thing I cannot agree with at the moment is the idea of having relative and dynamic goals. How am I able to commit myself to reach a goal when it changes all the time? How can I monitor the progress of a dynamic goal?

And how are companies able to reach their full potential if they only set relative goals like, for example, being better than their competitors?

I'd love to hear your opinion on that.

Very best,

Aljoscha

- Log in to post comments

Dear Aljoscha

Thank you for your supportive comments and the important question about relative goals.

At first it is not easy to imagine relative, self-adjusting goals, because we are so accustomed to fixed targets in corporate world (mostly derived from budgeting). The idea behind relative goals compared to competitors or peers is quite simple and just wants to absorb today's dynamic and competitive conditions. Because it is more important for a company to have better results than your competitors at the end of the day than to exceed internally bargained budget targets. That is how it works in many sports, e.g. high-jump, you don't win if you put the target yourself on 2.30 meter but your competitors jump higher, you can not win with such a method of goal setting. In high-jump if you want to win, the goal must be to beat your competitors, that is exactly a self-adjusting, relative goal compared to your competitors. Even though you have to train very hard, maybe along a plan to get better continuously; maybe you even train more and better with this relative goal; the real champions in sports definitely accept this kind of challenge. So this sport metaphor may help to understand what relative goals really mean in a highly competitive environment. In fact, such kind of top goals increase variability of acting upon them and therefore support freedom to act of intrinsic motivated people who want not to be micromanaged by narrow budget targets. By the way there are some companies applying exactly this way of goal setting being sustainably successful, for example Svenska Handelsbanken, this case is also mentioned in our hack.

We just want to offer an alternative thinking to the almost monopolistic classical way of budget target setting and invite to think about another approach of company goals: Could we benefit from dynamic goals or are budget targets the only right way? Are relative goals possible in our company? How could a self-adjusting goal look like in our company?

Franz and Michael

- Log in to post comments

Great video. It succinctly and eloquently explains the essence of Beyond Budgeting and the wisdom of crowds to help produce "less wrong" forecasts.

- Log in to post comments

Peter

Thank you for your feedback on the video, we are pleased to hear that.

We like your term "less wrong forecasts", because it tells an important aspect: It is not possible to see the future and never will be, even with the best models and tools. And it is absolutely not what we claim with Beyond Budgeting/Prediction Markets. Having said this, the name Prediction Markets is a bit tricky and misleading for what it stands for, however that is the known name for it. But of course future is unpredictable, so with our combined concept of Beyond Budgeting/Prediction Markets we do not aim for clairvoyance but for creativity and adaptability of the organization through democratized and flexible management processes supported by the highly adaptive concept of prediction markets.

In today's dynamic world, we can only anticipate what is most likely to happen through continuously thinking forward and therefore be prepared to act collaboratively and intelligently to whatever emerges out there. Thus, in a complex and unpredictable world the only kind of organization that makes sense is an adaptive organization using its full creative potential. Or speaking with Michael Fradette and Steve Michaud: "You can't predict the future, but you can be ready for whatever it brings. We must create a dynamic business design that can capitalize on the unpredictable." This is what we would like to offer with our hack.

Franz and Michael

- Log in to post comments

Franz and Michael

Yes, your hack is a very sound and promising offer as a way forward to free employees from their strait jackets in corporate world, combining values, concepts and tools in a consistent and practical manner. I will take it forward in my business context of my new company..

Roland

- Log in to post comments

Dear Franz & Michael

Thanks for your feedback and the 2 videos. Great to see how the discussion progresses.

The videos explain the concept of Beyond Budgeting & wisdom of crowds in a comprehensible, clear and eloquent, fun way. Well done.

Look forward to read more about Beyond Budgeting in the coming month.

Marcel

- Log in to post comments

Franz & Michael,

Very interesting take on management challenges and how to circumvent, and in many instances, solve, them using the power of numbers and decentralized power.

I would like to add a couple of thoughts with regards to the power in numbers concept. Apart from the challenges of 'vested interests' and 'human nature' that are already stated, have you considered the probability of employees in the "lower" rungs, so to speak, falling victim to heuristics and biases such as information overload and 'groupthink'? The reason I ask this is because in any modern company, employees are usually required to have a specialized set of skills and knowledge for them to use at the job efficiently. If a company decides to decentralize the decision-making power, or management power in general, consequently allowing, or rather, forcing, those who have never before had to take disparate issues into concern before making a decision (the hallmark of management), and coercing them to do so, might have several unforeseen consequences that could have a ripple effect throughout the organization.

I am just trying to play the devil's advocate here in order to make your 'hack' water-tight. Overall I think your hack is a thought-provoking piece that managers should give serious consideration to. It is high time the management sector across all industries catch up with the rest of the world in terms of (apparent) decentralization of power.

VC Arun

- Log in to post comments

We've got a similar take on hero leadership to servant leadership.

We call it the movement from leader-follower to leader-leader.

You may be interested in leader-leader.com/blog

In a nutshell — since the advent of farming 10,000 years ago mankind’s work has been physical and the organizational and leadership framework optimized for controlling physical work is hierarchical. There are leaders and there are followers.

Now, work is cognitive but we have 10,000 years of leader-follower in our cultural heritage [Think Achilles, Beowulf, Master and Commander]. What’s needed is fundamentally treating people differently, as leaders. The images of what “leadership” means, however, holds us back.

- Log in to post comments

You need to register in order to submit a comment.