Hack:

Innovating Innovation with a Triune Insurance Policy (TIP) Mindset?

With me being an active participant within the MIX community, I am being humbled and honored to see that the theme behind the current MIX challenge (i.e. Make Innovation, an every day, everywhere capability), happens to align perfectly, with the spirit and essence of our firm’s innovation slogan, we had coined couple of years ago (“Make Innovation, an everyday, everyone’s experience like Air and Water”).

Within that spirit, as I regurgitated the three questions, posed by Gary Hamel, further challenging us to test the depth of Innovation competencies within business organizations, I couldn’t contain myself reframing them, in the form of 3E’s. Sure enough, they happen to align perfectly, with the top three management disciplines of the 21st century i.e. leadership, strategy and Innovation - or what we, collectively call as the TRIUNE PURPOSE DISCIPLINES, as shown in the mapping below -

- Educate the Innovation fundamentals effectively-> Innovation Foundation

- Elicit the Capital efficiently (i.e. resources/capabilities) ->Strategy Foundation

- Exercise the Accountability rigor appropriately -> Leadership Foundation

What do we mean?

Let’s face it - when an innovation engagement, fail to produce its intended outcome (or for that matter even when a company misses the opportunity to innovate, and let its competitor to eat their own lunch), one of the questions, that get often asked is -What derailed it? Good Boss, Bad Boss (or) Good strategy, Bad strategy (or) Good Innovation, Bad Innovation? Although, one can build a compelling case, for any one of these three dimensions, the short answer, in our humble opinion is - some combination of the above three disciplines, with varying weight factors, depending upon the situation. In other words, the root causes behind most innovation derailments (whether it is a leadership failure, strategy failure and/or innovation failure); all stem from “the lack of an integrated, collaborative insurance policy” in the dimensions of leadership, strategy and innovation, that is derived from the common foundational purpose seed DNA (Vision, Mission, Values, Codes, BHAG)” - as further affirmed by Prof. Clay Christensen, when he stresses the importance of leadership instinct, within the context of business model innovation, and I quote –

- Breaking an old business model is always going to require leaders to follow their instinct. There will always be persuasive reasons not to take a risk. But if you only do what worked in the past, you will wake up one day and find that you’ve been passed by.

Yet another challenge, we have seen is the lack of an integrated Collaborative approach, to increase the size of the value pie, by creatively overcoming the resource pool constraints of the value equation (as explained in detail in the later sections). The implication is that companies end up competing aggressively, within a limited value pie size (i.e. market segment), with a similar set of “P&S’s and business models with very little differentiation”.

In other words, If we are serious about innovating innovation (i.e. making innovation as the only insurance policy against irrelevance, as eloquently alluded by Gary Hamel), it is time to develop an integrated approach called TRIUNE INSURANCE POLICY (TIP) to address all of these challenges simultaneously!

One might ask, what do we mean by TRIUNE INSURANCE POLICY? Triune insurance policy, in its essence is the substance (strategy dimension) of capabilities hoped for, in the form of expectations (innovation dimension) and evidence of capabilities, not seen (leadership dimension). Sounds like a definition heard during our Sunday school days? Well, Apostle Paul, in his enormous wisdom, perhaps had coined this definition for us 2000 years ago, for a time like this?

In other words, here is how, we see our triune policy solution evolving, in perfect harmony with the faith definition -

- Strategy is the “substance” part of the triune policy, and it is all about establishing niche market positioning or assembling powerful capabilities, to get the “job-to-be done”, with a superior value proposition.

- Innovation is the “capabilities, hoped in the form of expectations” part of the triune policy, and it is all about disrupting the current markets to get the “job-to-be-done”, with an end goal of making innovation, an everyday, everywhere and everyone’s capability.

- Leadership is the “evidence” part of the triune policy, and it is all about creating the culture that facilitates the triune value creation (shareholder + societal+ motivational), in a collaborative manner using Dr. Steve Willis’ Power through Collaboration (PTC) framework.

Put simply, here is how we see the TIP solution equations evolving, within the big picture TIP framing-

- Faith Insurance Policy = Substance + Expectation + Evidence, all under the faith umbrella

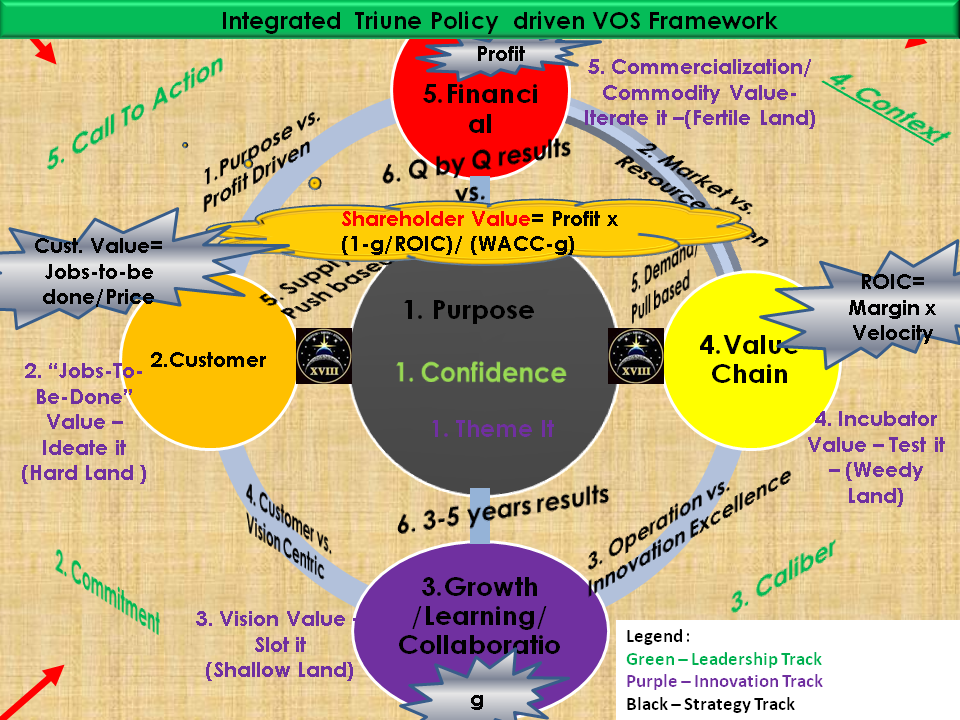

- Triune Insurance Policy =Strategy + Innovation + Leadership, all under the triune policy based Virtual Ocean umbrella, as outlined in the picture below.For more details, please read the attached VOS document in PDF format.

As it turns out, the bulk of the challenge, hindering organizations to make this vision a reality (i.e. innovation, an every day, everywhere capability), happens to stem from the same set of questions posed by Gary Hamel, in his video blog only. In addition, we have identified two more challenges, from the learning’s from our consulting engagements, thus making it five, as listed below -

- Lack of a comprehensive educational training approach, to effectively ground employees on solid Innovation fundamentals.

- Lack of a disciplined approach to elicit Capital, to help innovation engagements to be executed efficiently.

- Lack of a well exercised accountability rigor, to help innovation engagements, to be led appropriately.

- Lack of a creative approach, to increase the size of the value pie (through new market segments that never existed before), especially within the context of the emerging social media driven virtually connected digital world. As it turns out, this challenge happens to be directly related to the key growth lever (g) of the value equation, as explained later.

- Lack of a creative approach, to overcome the resource/capability constraints. As it turns out, this challenge happens to be directly related to another growth lever (ROIC) of the value equation, as explained later.

In other words, If we are serious about innovating innovation (i.e. making innovation as the only insurance policy against irrelevance), it is time to develop an “integrated insurance policy framework called TRIUNE POLICY”, that, not only, makes innovation, relevant for the 21st century, but also, makes it as an every day, everywhere capability, within a triune cultural context!

As synthesized in the summary section, Triune policy, in its essence is the substance (strategy dimension) of capabilities hoped for, in the form of expectations (innovation dimension) and evidence of capabilities, not seen (leadership dimension). In other words -

- Strategy is the “substance” part of the triune policy, and it is all about establishing niche market positioning or assembling powerful capabilities, to get the “job-to-be done”, with a superior value proposition.

- Innovation is the “capabilities, hoped in the form of expectations” part of the triune policy, and it is all about disrupting the current markets, and get the “job-to-be-done”, with an end goal of making innovation, an everyday, everywhere and everyone’s capability.

- Leadership is the “evidence” part of the triune policy, and it is all about creating the culture that facilitates the triune shared vale creation (shareholder + societal+ motivational), to come to life, in a magical way!

Put simply, here is how we see the solution equations evolving, within the big picture solution frame-

- Faith Policy = Substance + Expectation + Evidence, all under the faith umbrella

- Triune Policy =Strategy + Innovation + Leadership, all under the triune policy umbrella

While this sounds like a good framing, in the real world, however, most companies are still not very successful, in reaping the value from innovation engagements, partly because, they are executing innovations with a single dimensional mindset with minimal emphasis on strategy and leadership dimensions. In other words, it is like getting the expectation part right within the faith equation, without the sufficient substance and evidence part, and still expecting God to honor the faith with rewards!

Yet another reason, organizations tend to take this single dimensional approach is, that there are not many, integrated triune policy frameworks, available within the market place, to meet the ever changing innovation challenges of the 21st century world. In other words, the need of the hour is, not only, an integrated triune insurance policy framework(to overcome the first 3 competency challenges), but also, a framework, that inherently helps us, to exploit the power of emerging social media driven, virtually connected, digital world(i.e. the remaining two challenges). This is where; we challenged ourselves with the following two hypotheses –

- What if, if we have a dynamic mechanism available to us, to redraw the traditional industry structure boundaries, as per the emerging trends of the 21st century social media driven virtually connected world, with a “traditional industry structures are irrelevant” mindset?

- What if, if we take the physical resource constraints out of the value equation and replace it with unlimited (infinite?) resource pool, by creatively combining physical and virtual resources with a Virtual Reality Experience (VRE) portfolio mindset, with a “traditional resource constraints are irrelevant” mindset?

As it turns out, these two hypothesis map 1:1 to the two key levers of the value equation i.e. Market Growth (g) and Resources/capabilities (ROIC), within McKinsey’s Zen value equation

- V= Profit x [(1- g/ROIC)/ (WACC-g)]

By altering the two levers within the value equation, we see the following three value management/creation scenarios emerging, which by the way, map 1:1 to the three dimensions of our TIP framework as identified below as well-

- Explore ways to grow value, by “grabbing market share (g)” from competitors, with grow at any cost mindset, by “effectively and efficiently leveraging the limited set of resources/capabilities (ROIC). -> Substance type strategy dimension of TIP

- Explore ways to grow value, by “producing new market (g) segments (that never existed before)” and by “effectively and efficiently leveraging the limited set of resources/capabilities (ROIC)”. In other words, under this scenario, it is all about increasing the size of the overall value pie, with newly created markets

(and P&S’s), using the limited set of resources/capabilities. -> Capability type innovation dimension of TIP. - Explore ways to grow value, not only, by “producing new market (g) segments (that never existed before)”, but also, by leveraging the infinite (i.e. seemingly infinite) set of resources/capabilities (ROIC)”. In other words, under this scenario, it is all about increasing the size of the overall value pie, by increasing both levers simultaneously i.e. with newly created markets (g), and by leveraging seemingly unlimited set of resources/capabilities (ROIC).-> Evidence type leadership dimension of TIP.

With that said, as we inventory all the strategy, innovation and leadership frameworks available within the market place today, by and large, they can be grouped under the popular Red Ocean and/or Blue Ocean categories. As it turns out, the first scenario happens to be the driver behind the Red Ocean category, whereas, the second scenario, happens to be the driver for the Blue Ocean category.

The third scenario, by the way, happens to be the emerging scenario, and so, we have chosen it to be the foundation for our TIP framework, as it, not only, helps us to increase both levers simultaneously (i.e. new market segments with seemingly unlimited resources), but also, it positions us to execute these three management disciplines (leadership, strategy and innovation) simultaneously in a collaborative manner, using Dr. Steve Willis’ Power through Collaboration (PTC) framework - and rightfully so, we have named it as Virtual Ocean.

That being said, let me also reiterate one more important point that, our approach is a superset approach, that is flexible enough to pick and choose the relevant features from both the Red and Blue Ocean categories (depending upon the problem domain and industry), as our experience suggests that “one size does not fit all”, when it comes to selecting innovation and/or strategy frameworks. In other words, our approach is more of a complimentary solution, as opposed to a replacement solution, to Red and Blue Ocean categories.

With that prelude, the question we asked ourselves, to bring these three scenarios to life simultaneously is - What if, if there is a mechanism available for us, to increase the size of the value pie dramatically (infinite?), in both dimensions of market segment (g) and resources/capabilities (ROIC)?

One answer we were able to come up with for this question is, a new mechanism, to enlarge the size of the value pie, by creatively combining virtual and brick and mortar resources, with a Virtual Reality Experience (VRE) Portfolio mindset. This is where, we see ” Social media enabled virtual reality/digital technologies” helping us in a big way, by shifting the focus from “fixed value pie size” to “unlimited value pie size”, as explained in detail, within our Virtual Ocean Strategy(VOS) and Purpose Innovation articles. In other words, when the size of the value pie is enlarged, it is no longer a zero sum game, as there are enough value slices available (even if all the competitors crave for the same type of value slice pie), and so, we all can be still motivated to play together in a collaborative fashion, as we are all rest assured that, there are enough slices available, for everyone.

Without going too much into the detail, for the purposes of this hack, we have reframed our earlier work (http://www.managementexchange.com/story/strategic-planning-purpose-driven-way-using-nature%E2%80%99s-seedal-chain-principle), under the behavior economics driven Motivation, Belief and Action (MBA) dimensions, to make it relevant for the context of this hack.

- Motivation: To make Innovation, every day, everywhere capability, we not only, must take an integrated approach (in leadership, strategy and innovation dimensions), but also, learn to fly faster into the virtual ocean space, in order to, tap the untapped value, by doubling (tripling, quadrupling or even make it to infinity?) the size of the value pie, by creatively combining physical and virtual resources, using our firm’s VOS, VRE, Capitalism Plus, Purpose Innovation and VizPlanet platforms.

- Belief: We are capable of creating a new approach that, not only, help us to formulate/create new market segments (by tearing down the traditional industry structure walls, with a “traditional Industry structure is irrelevant” mindset), but also, to overcome the resource pool constraints of value equation, with a “traditional resource constraints are irrelevant” mindset.

- Action: Balance the five dimensional value cycle i.e. “value-cost-velocity-growth-purpose” using five value stations (4 BSC +purpose).

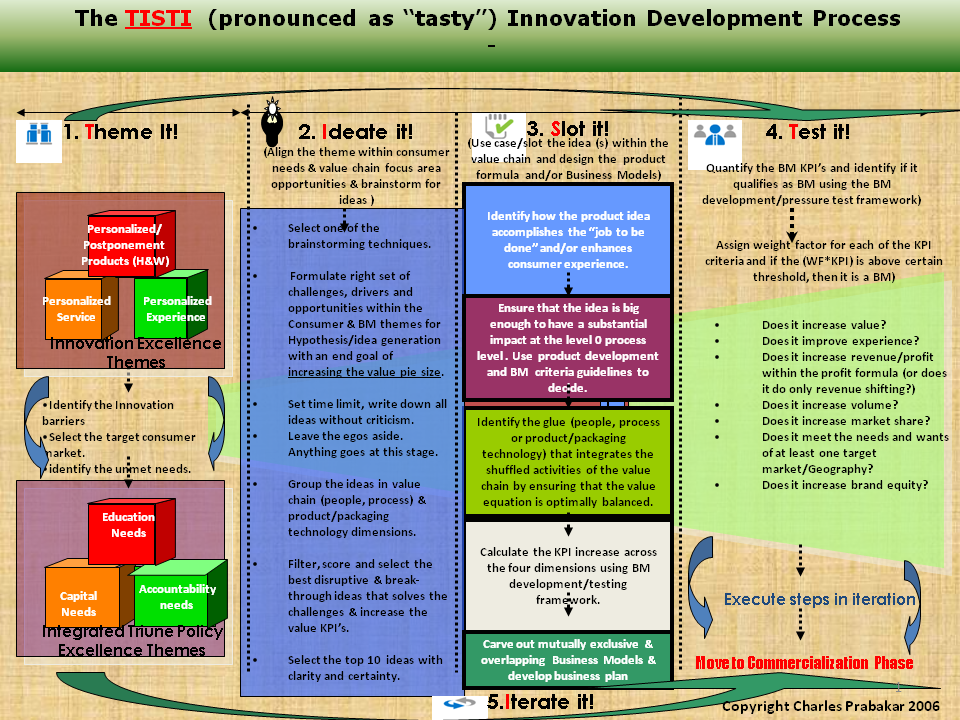

Now that we have repositioned our earlier work within this MBA dimension, let us go little more deeper, into the innovation part of the methodology (within this larger VOS umbrella), specifically addressing some of the innovation challenges, identified in the problem section of this hack, at a granular level, as explained in the schematic below.

Conclusion

Most innovation engagements, fail to produce its intended outcome (or for that matter, even fail to get off the ground), partly because, they are executed with a single dimensional innovation mindset, as opposed to, being executed with an integrated mindset (in the key dimensions of leadership, strategy and innovation). Yet another challenge, we have seen is that most innovation initiatives, try to go after the same old market segments that are already crowded with competitors. The implication is that companies end up competing aggressively, with the similar P&S’s and business models, with very little differentiation. This is where, our integrated approach, has a compelling answer, as it not only, addresses the three competency challenges (i.e. Educate Innovation, Elicit Capital and Exercise Accountability), but also, provides a comprehensive answer, to increase its size of the value pie (multi fold), by exploiting the power of social media driven, virtually connected, 21st century, digital world.

- With the fact our approach, take a holistic, big picture approach (incorporating the foundational tenets of leadership, strategy and innovation), it will inherently help leaders to proactively discern innovation challenges, and apply right type of solution, for the right type of challenge (with varying weight factors among these three disciplines), and avoid the so called “innovation derailments” proactively.

- With Innovation education happen to be the foundational issue within most organizations; our integrated approach will help leaders, to pick and choose the right type of curriculum for the right type of employees, in alignment with the organizational culture.

- With the fact that our integrated approach stems from the foundational Purpose seed (Vision, Mission, Values, Codes, BHAG); purpose themes, get blended into the innovation engagements, thus making it relevant for the whole organization.

- With the fact that our approach is specifically designed to exploit the power of social media driven virtually connected, digital world, it does provide some powerful alternatives, to increase the size of the value pie (multifold), thus making it as an unique approach, in meeting the ever changing innovation challenges of the 21st century world.

- Our approach has a huge opportunity to revolutionize/disrupt many industry sectors, particularly, CPG, Retail, healthcare, Insurance, Financial Services, Media and Hi-Tech industries, as explained in one of our VizPlanet hacks.

- First and foremost, spend time and energy in creating a purpose culture that is conducive enough for developing this triune insurance policy (TIP) mindset within a smaller and yet forward looking organization within the corporation (say strategy, innovation and/or transformation organization within a country perhaps is a good start)

- Hire and train the right type of leaders with this integrated TIP DNA.

- More specifically, addresses the three competency challenges (i.e. Educate Innovation, Elicit Capital and Exercise Accountability) head-on, early in the TIP life cycle.

- Find creative ways to increase its size of the value pie (multi fold), by leveraging both the levers (g and ROIC) of the value equation simultaneously, by exploiting the power of social media driven, virtually connected, 21st century, digital world.

- Take the concept global across all the parts of the organization.

Some really good thoughtful stuff here. I do find your VOS Framework a little complex.

I am also very much in favour of your "superior value proposition" and "increase the size of the value pie". My work is around trying to flesh out what value is and what value means to customers. I would be interested in your comments on my Value work (focus on customer value more than profit): http://www.mixprize.org/hack/focus-customer-value-not-shareholder-profit

- Log in to post comments

Thank you Richard for your compliment! I just quickly glanced at your hack, and I must admit that your hack has some interesting insights as well. More than anything else, the thing that got my attention the most was, our alignment, as it relates to the need for looking at businesses, with a value management lens, as opposed to looking at it with just the traditional “profit only” mindset.

Having said that, like most things in life, a balanced approach (between value and profit), perhaps is a better way to go, as we all have heard the statement in the press that “profit is the mother’s milk of all stocks”. While that is partially true, I might perhaps add a qualifier to that statement, and make it complete i.e. While profit might be the mother’s milk of all stocks, valuation is the guarantee for the future health and wellness of the baby (stock or firm), that grows up by “drinking only that mother’s milk”. And so, it is perhaps fair to hypothesize that – “health of the mother’s milk today will drive the performance of the baby tomorrow”!

With all the press pun aside, the better way to frame this value-profit dilemma perhaps is to first understand the drivers (or levers) that drive the overall profit and value. Needless to say, the top two levers (g and ROIC) of value equation (i.e. McKinsey's Zen of Corporate Finance equation), happens to be the same foundation for our Virtual Ocean Umbrella framework as well (as explained in the hack in detail), and by changing these two levers, it not only, gives us the guarantee, to increase the near term profit, but also, the overall valuation of the business as well. In other words, if I may use the same quote, I often use with some of our clients is – “think with a valuation mindset, but act with a profit heartbeat”!

That being said, yet another reason for this profit-value dilemma is that, value in this context is the “expectation driven value”, and not the “realized value”, which makes dilemma resolution all the more interesting.

In other words, value, in its original definition format, has three parts -

• First, projecting the ability of an entity (firm) to produce a certain cash flow in future

• Then, assigning a risk to the likelihood of realizing that ability to create cash flow

• Followed by answering the question of - how much one is willing to pay (today) for owning the right to that future cash flow prospect?

One implication from this definition is -

Value is purely determined, based on future performance, and not based on historical or present performance (which is profit driven), and so, financially speaking, value, starts as, zero dollars (even if today’s profit is at its best), on ground zero (say today), and then progresses along the “expectation driven value trajectory”, by passing through few value stations (where it gets accelerated/de-accelerated), before reaching its final value.

With this alignment as a prelude, let me see, if I can also try to highlight some of the differences between our approaches, as it relates to this innovating the innovation challenge. If I understand your hack correctly (please correct me if I am missing anything), you have focused on just the customer dimension of value (which I agree 100% that it is an important dimension), whereas, I have taken a cyclical 360 view of value (by equating it with energy management) and added 4 more dimensions (4 BSC perspectives + purpose). In addition, we have also attempted to alter the value flow trajectory, with the top two levers of the value equation (i.e. g and ROIC) in an integrated manner.

Simply put, our firm’s integrated Virtual Ocean Umbrella of frameworks (Strategy + Innovation + Leadership,) - happens to be governed by nature’s top three principles, in three steps -

• As a first step, the purpose seed (Vision, Mission, BHAG, Values and Codes) gets manifested as three top management disciplines of 21st century i.e. Leadership, strategy and innovation, using nature’s energy management principle.

• Then these three transformed disciplines, go through a 3S (seed-season-sequel) journey, before resulting in as a Triune Shared Value (shareholder + societal + motivational) using nature’s seedal chain principle.

• Last, but not the least, this 3S journey, ends up creating 18 macro dilemmas(6 for leadership, 6 for strategy and 6 for Innovation) and many more micro dilemmas( e.g. our profit vs. value dilemma), and gets resolved, by nature’s principle of balancing opposites, as eloquently affirmed by you, in your article as well.

In other words, under VOS cyclical framework, value, starts as, “jobs to be done driven customer value”, and then progresses along the “expectation driven value trajectory”, by passing through few value stations (or perspectives, where it gets accelerated/de-accelerated), before reaching its final financial value. We chose to call those dimensions, as perspectives (or value stations), mostly for better understanding purposes only (i.e. BSC’s 4 perspectives + purpose). However, for all practical purposes, we can go lot more granular as well, with say, 10 or even 15 value stations, within the value trajectory, to analyze the trajectory characteristics at the granular level.

However, a BSC aligned value management model like VOS, in my opinion, gives us a stronger foundation, to develop a big data driven real time Corporate performance Management (CPM) system in the future, wherein, senior leaders, can get an accurate view of their company valuation, based on various events happening, not only within the company, but also, at the macro economy level, as I had explained in one of our firm’s CapitalimPlus articles (http://www.mixprize.org/hack/purpose-driven-capitalismplus-%E2%80%93-rei...)

While I can go on and on, let me stop here for now. Should you see a value in this type of a 360 view of big data driven real time valuation approach, I will be glad to collaborate with you and we can collectively take some of these ideas to the next level. Let me know. Regards, Charles

PS: On a related note, we as a firm are also looking at alternate ways of valuing the firms (and the larger capital markets) and some of the options, we have in mind include, but not limited to are –

1) Weighting System Approach with 5 or 10 or 15 possible value station on top of BSC perspectives

2) Represent the value trajectory with a log-log equation?

3) Progressive ratio approach (between expected and realized values).

4) Energy Management Approach (by equating value to energy one can borrow scientific principles and apply them to business valuation?)

5) Hybrid Approach (Some combination of previous approaches i.e. pick and choose the combination of above approaches, and apply them as per the context).

- Log in to post comments

You need to register in order to submit a comment.